Microsoft Dynamics GP Year-End Payroll Checklist

When the weather outside gets frightful, completing your year-end payroll shouldn't be. With Microsoft Dynamics GP, closing out payroll can be completed in just a few steps. Prior to starting closing procedures, the following actions should be implemented:

- Make sure you have a complete backup of the databases, including Dynamics and all company databases.

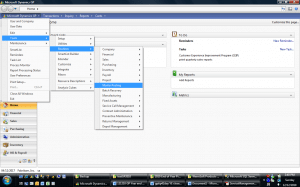

- Post all batches - (Microsoft Dynamics GP >Tools > Routines > Master Posting)

- Check and clear Batch Recovery – (Microsoft Dynamics GP > Tools > Routines > Batch Recovery)

- Make sure you close the last period or month of fiscal or calendar year.

After your information is backed up, you can start your close. To perform the year-end closing procedures, follow these steps:

- Verify that you have installed the latest 2014 payroll tax update

- Complete all pay runs for the current year.

- Complete all month-end, period-end, or quarter-end procedures for the current year.

- Make a backup of the original file.

- Install the Year-End Update.

- Create the Year-End file.

- Make a backup of the new file.

- Verify W-2 and 1099-R statement information.

- Print the W-2 statements and the W-3 Transmittal form.

- Print the 1099-R forms and the 1096 Transmittal form.

- (Optional) Create the W-2 Electronic file.

- (Optional) Archive inactive employee Human Resources information.

- Set up fiscal periods for 2015.

- (Optional) Close fiscal periods for the payroll series for 2014.

- Install the payroll tax update for 2015.

For full details and additional information on the Microsoft Dynamics GP Year-End Payroll Checklist, please contact Stoneridge Software.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.