Setting Up a Commission Basis in Red Maple for Dynamics AX

Red Maple is an ISV product that can be used to configure commissions in Dynamics AX. The following post will cover how to set up a commission basis in the Red Maple product. The commission basis is the underlying currency amount that is subject to a commission. An example of a commission basis is the sales price of a sales order line. The sales price constitutes revenue which can be the basis for a commission. Another example is the margin of a sales line, which is the sales price less the cost. In each case, the basis you define is used in the commission calculation. Once a basis is determined, this is then assigned to the commission agreement so Dynamics AX knows how to calculate a commission for a sales rep.

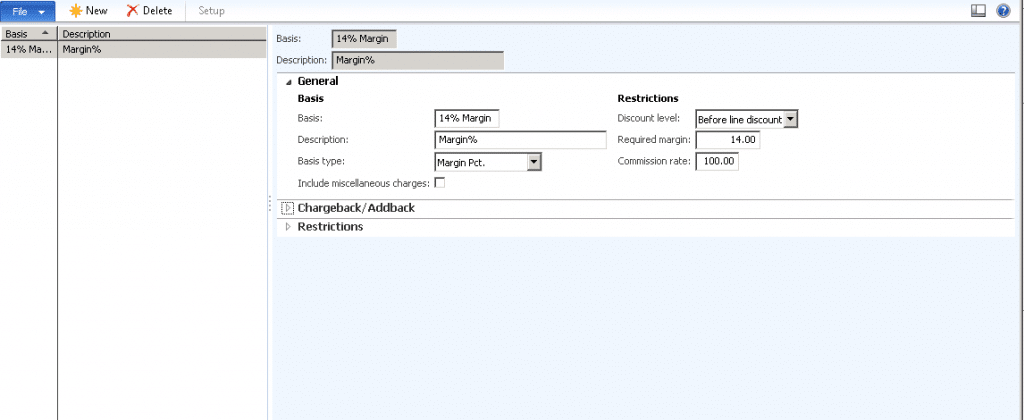

Sales and marketing > Setup > Commissions > Calculations > Basis

General tab

1. Press ctrl+N to create a new entry.

2. Enter a basis and description.

3. Select a basis type. You can choose from the following:

• Revenue – This is the sales price multiplied by the quantity sold.

• Margin – This is the difference between the revenue and the cost of the same item.

• Weighted Margin – This basis is the cost of the item at the time of the transaction plus any additional costs.

• Quantity – The quantity of the line. The unit of measure is taken from the order line.

• Margin Pct – A percentage amount of the revenue of an order subtracted by the cost, divided by the price.

• Discount Pct – A percentage amount of the revenue less the discount divided by the price.

4. Select a discount level. From the drop-down list, you have the following options:

• Before line discount – Revenue (if used) is calculated based on the sales price before any discount is take.

• After line discount – Revenue (if used) is calculated based on the sales price after any discount is taken.

• After total discount – Revenue (if used) is calculate based on a distributed basis across all lines on an order after any discount taken

5. Required Margin – Enter the required minimum margin, if applicable, that must be met before a commission is eligible to be calculated. This criteria can also be accomplished through a commission schedule. An example for this could be that your sales reps need to reach a 10% margin on a single sales line before a commission can be paid. If the margin is below 10%, a commission will not get calculated for that sales line.

6. Commission Rate – Enter the rate used to calculate commission of this basis. If the entire basis should be used for calculation, set this amount to 100%. There are times when certain items or customers are not 100% commissionable. For example, you are selling a new product line and an agreement has been set that the sales reps will only receive commission on 90% of the margin. You would want to specify the value of 90 in this field.

7. Select the Include miscellaneous charges checkbox to include miscellaneous charges in the basis calculation.

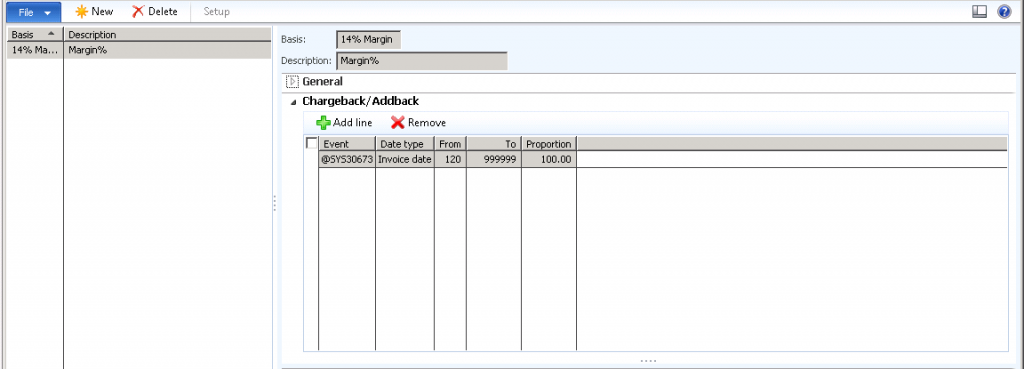

Chargeback/Addback tab

If your company has a policy that commission can get taken back after it has already been calculated you can set that up in this section. An example could be that your company can reverse a commission that has been paid if the customer invoice has not been paid after 120 days from the sale.

1. Press ctrl+N or click Add line to add a detail line.

2. Select the appropriate event:

• Past Due

• Settlement

3. Select the appropriate date type:

• Invoice date

• Due date

4. Enter the From day and To day for this detail line.

5. In the Proportion field, enter the percentage of the commission that should be charged back to the sales person once the detail line criteria is met. If a percentage, this would be a whole percentage amount (20 = 20%). If amount, enter the currency amount per unit. To allow a full chargeback on commissions, enter a value of 100.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.