The Advantage of Payroll Posting Accounts in Microsoft Dynamics GP

Payroll posting accounts in Microsoft Dynamics GP allows for very granular control over the General Ledger accounts that are used when processing payroll checks. Wages, taxes, deductions, and benefits all have their own setup for determining which accounts will be used, and within each of those, you can break down the posting by the department and position of the employee.

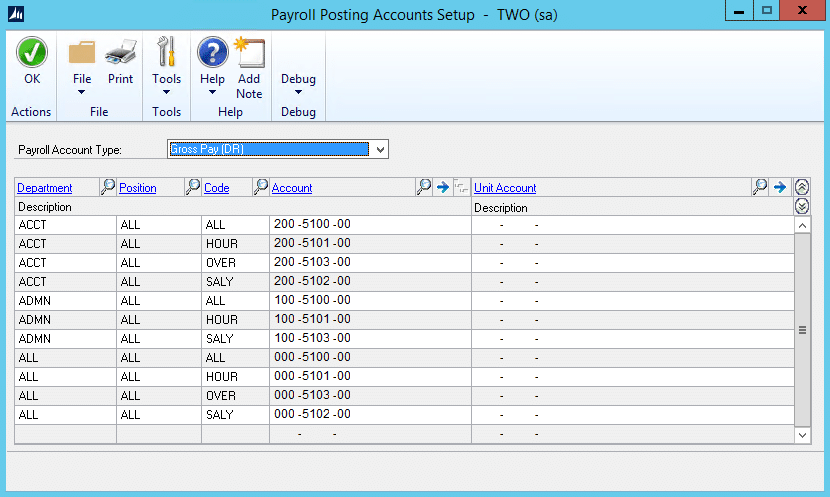

The Payroll Posting Accounts Setup window (Microsoft Dynamics GP > Tools > Setup > Posting > Payroll Accounts) is broken down based on the type of payroll transaction that is being processed. The following types are available:

- Gross Pay (DR)

- Federal Tax Withholding (CR)

- State Tax Withholding (CR)

- Local Tax Withholding (CR)

- Deduction Withholding (CR)

- Employer’s Tax Expense (DR)

- Benefits Expense (DR)

- Benefits Payable (CR)

- Taxable Benefits Expense (DR)

- Taxable Benefits Payable (CR)

- SUTA Payable (CR)*

- FUTA Payable (CR)*

- W/Comp Tax Expense (DR)*

- W/Comp Tax Payable (CR)*

*These accounts are used when posting the SUTA, FUTA, or Worker’s Comp taxes in the Period End Routines window, rather than during normal Payroll Computer Checks or Manual Checks.

Each transaction type will post either a debit or a credit, as noted in the transaction type options. For Benefits, we have control over both the Expense and the Payable side of the transaction – If we choose to set these as the same account, the benefit will not post to the GL at all, as GP will summarize the distributions and they will wash out to be zero.

Within each transaction type, we can add lines to allow for a more detailed segregation of payroll posting. Each line contains a potential combination of Department, Position, and Code (Pay code, Deduction, Benefit, or tax type) that could apply to a payroll transaction.

Dynamics GP uses “ALL” to represent a wildcard for that line. This means that it doesn’t matter the value of the specific dimension, it works for this line.

The default setup for most transaction types is to have a line for “ALL ALL ALL.” This line is the “catch-all” line, such that if GP is unable to match up the Department, Position, and Code to a more specific line, it will use this one. If we do not need to break down the specific transaction type based on the employee’s Department or Position or Code, then all we need is “ALL ALL ALL.”

To add a new line to the Payroll Posting Accounts Setup, just click anywhere on the next blank line. The default values will be “ALL ALL ALL,” but we can fill in the line with the desired values for Department Position and Code. Leave the value of “ALL” for any dimension that we do not need to match specifically. Then enter the Account that we want to use for this combination of values.

We can also post the values to a Unit Account, but this functionality is not commonly used with Payroll Posting Accounts.

Continue adding lines to the Payroll Posting Accounts until we have covered the possible combinations where we want to use different accounts.

The hierarchy used by Dynamics GP when determining the posting account to use can cause some confusion. Dynamics GP will always look to match specific values before using the “ALL” wildcard, and will match starting with Department, then Position, then Code.

For example, we have set up lines in the Gross Pay (DR) account type for “ADMN ALL ALL” and “ALL ALL HOUR” (where ADMN is a Department and HOUR is a Pay code). If an employee in Department 01 is paid using the HOUR pay code, GP will use the line for “ADMN ALL ALL” rather than “ALL ALL HOUR” because it prioritizes the match on the Department before the pay code.

This means if we want to have different posting accounts based on the employees Department AND Paycode, we would need to setup Payroll Posting Account lines for each possible Department and Paycode combination (using ALL as the Position value). It is still a best practice to use the Wildcard for each Department so that as new codes are added into the system if we forget to update the Payroll Posting Accounts Setup we can still easily identify which Department the posting came from.

Here are a few things to keep in mind as we are setting up Payroll Posting Accounts:

- A specific value always matches before ALL.

- If we are breaking down values for a specific Department or Position, be sure to include an “ALL” line for the Code so that we have something in place if GP cannot match the specified value.

- If we add a line and use an account that has already been used in the Payroll Posting Account setup, GP will provide a warning. This is informational and will not prevent we from using that account again, but we may want to review and make sure we are not doubling up on Accounts when it is not expected.

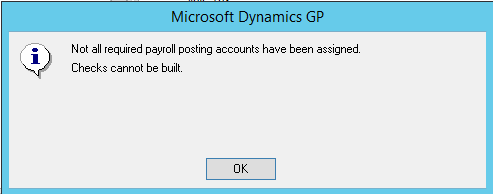

- Each transaction type needs to have an “ALL ALL ALL” line. This is required, and if it is not populated, we will receive errors during the Build and Calculate process of Payroll checks.

“Not all required payroll posting accounts have been assigned. Checks cannot be built”

- To delete a line, right-click the line and choose “Delete Row.”

If you'd like to learn more about payroll and Dynamics GP, let us know!

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.