Overview of Overhead Codes and Groups in Key2Act Service Management

You can use overhead details and overhead groups for Service Management labor transactions. Overhead detail codes and overhead groups in Key2Act Service Management can be created from Job Cost or Service Management and are shared between the applications. Once overhead detail codes and overhead groups are created, they are used to create labor rate groups in Service Management.

Overhead is the indirect, job-related cost your company incurs in the process of doing business. Examples of overhead costs are workmen’s compensation and benefits earned by hourly employees. Overhead may also include items such as administrative salaries, rent expense, and other indirect expenses incurred in a Service Call. Service allows you to recognize the overhead cost of labor by creating overhead detail codes and assigning those codes to overhead groups. The overhead groups are associated with position/department codes, which are associated with employees. The employee and job are entered in the payroll transaction. After a transaction is posted, the overhead is applied to the job.

Overhead Groups and Detail Codes Setup

Overview of Overhead detail codes

Overhead detail codes define how overhead amounts are calculated based on payroll costs. You can recognize indirect labor costs, not typically set up as cost codes on an hourly or piecework basis, as overhead. These costs are added to posted amounts for the detail and are not identified separately on customer invoices.

- For example, a technician may work three hours on a service call at $41.25 per hour. The billing rate of $100 would be calculated automatically for the customer’s invoice. The pay rate per hour is $25 with overhead at 25%, plus fixed overhead at $15 per hour, resulting in a total cost per hour of 41.25. The total cost to the service invoice is $123.75Calculating actual labor costs

- Formula Amount

- Pay rate per hour $25 $25.00

- Overhead percentage 25 x 25% $6.25

- Fixed overhead per hour $10 $10.00

- Total cost per hour pay rate + overhead% + fix overhead $41.25

- Total cost to invoice $41.25 x 3 $123.75

- You could also use the code GEN for the description “General Overhead” and 25% as the portion.

- You could use the abbreviation code BEN for the description “Benefit” and use $10.00 for the fixed portion.

- The payroll transaction posts in Service and then in the general ledger, provided the accounts are the default general ledger accounts as

- a debit to WIP-Labor of $123.75,

- a credit to the Wages Payable account of $75.00

- a credit to the Overhead Offset account of $48.75.

The Wages Payable and Overhead Offset posting accounts default by division from the Revenue and Exp Account Setup window. The methods for calculating overhead are flexible. You can allocate overhead on a cost-per-unit basis to a labor cost code or as a percentage of cost, or a combination of both. You must set up detail codes for overhead in Job Cost whether you apply overhead to your jobs. To do so, create an overhead detail code for zero percent or zero dollars per unit.

Note: If you have unposted payroll transactions (for either Microsoft Dynamics GP Payroll or Time Track), do not change overhead detail codes (or create new codes and assign them to affected overhead accounts) until all unposted transactions are posted. Otherwise, posting these transactions could result in unbalanced general ledger entries. Contact Stoneridge Software for assistance.

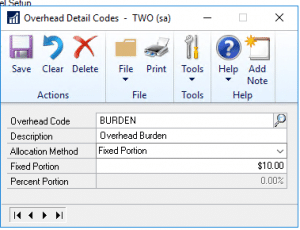

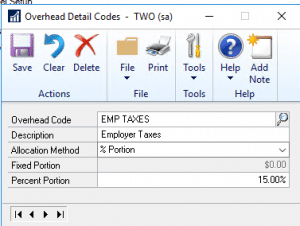

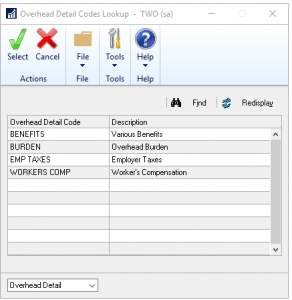

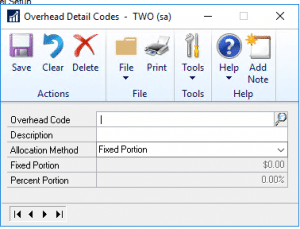

Step 1: Create overhead detail codes.

Overhead detail codes define how overhead amounts are calculated based on payroll costs. You can recognize indirect labor costs. These costs are added to posted amounts for the details and are not identified separately on customer invoices.

1. Choose Microsoft Dynamics GP > Service Management > Setup> Invoice Setup > Labor Rates > Overhead Detail Code.

2. Complete the following fields, as necessary.

- Overhead Code, Description - Enter a name and description for the code.

- Allocation Method - From the drop-down list, assign a method of calculating overhead for the detail code.

- Fixed Portion - Allows you to allocate overhead for payroll transactions on a cost-per-unit basis. you could add $10.00 per hour.

- Percent Portion - Allows you to allocate overhead for payroll transactions on a percentage basis. You Could Add 15% of the wages.

3. Choose Save.

Note: If you modify the overhead detail codes in the future, posted transactions will not be affected.

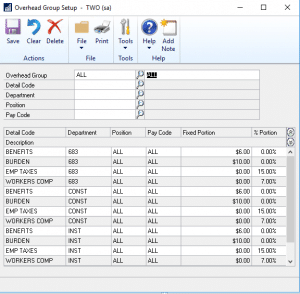

How to create overhead groups.

Overhead group codes organize overhead detail codes logically according to departments, positions, and pay codes. For example, assume you set up detail codes for hourly workmen’s compensation overhead and hourly driving time to a site. You combine these details under a group code named Hour and specify that the code applies to technicians assigned to the installation department. Each detail code represents an indirect cost. You could enter the percentage of wages incurred on each of the details and use the appropriate amounts to calculate and track overhead costs on Job Cost payroll transactions assigned to the installation group code. Grouping detail codes allows you to use both percentages and fixed amounts when calculating specific overhead amounts. To post payroll transactions, you must set up at least one overhead group. Even if your company does not assign overhead costs to jobs, you must create an overhead detail code for zero percent or zero dollars per unit. You then assign the code to overhead group codes for each job department/position combination.

1. Choose Microsoft Dynamics GP > Tools > Service Management > Invoice Setup > Labor Rates > Overhead Group Setup.

2. Complete the following fields, as necessary.

- Overhead Group, Description - Use the Tab key to move from the name to the description.

- Department, Position, Pay Code - You can enter All in each of these fields.

- Note: Facilitating setup by using All Since the number of combinations of department, position, and pay code for a given overhead group code can become quite large, you can facilitate the setup by entering the word All in any of those fields. For example, if all departments, all positions, and all pay codes have a general overhead detail code, All could be used with each of those items. If a specific combination of department, position, and pay code has a unique detail code, that combination will be used along with any All combinations for the overhead group that match the same criteria. For example, if the administration department, CEO position, and salary pay code combination had a special bonus overhead detail code, and the All departments, CEO position, and All pay codes combination also had a bonus overhead detail code, both detail codes would be used.

- Detail Code - Use the lookup to select the detail code.

3. Choose Save.

Note: Overhead groups should be set up with different combinations of department, position, and pay code. For example, the combination of SRV, ENG, and HOUR should not appear in more than one overhead group.

Facilitating setup by using All

Since the number of combinations of department, position, and pay code for a given overhead group code can become quite large, you can facilitate the setup by entering the word All in any of those fields. For example, if all departments, all positions, and all pay codes have a general overhead detail code, all could be used with each of those items. If a specific combination of department, position, and pay code has a unique detail code, that combination will be used along with any All combinations for the overhead group that match the same criteria. For example, if the administration department, CEO position, and salary pay code combination had a special bonus overhead detail code, and the All departments, CEO position, and All pay codes combination also had a bonus overhead detail code, both detail codes would be used.

Check out our other two blog posts on How to Create Labor Rates in Key2Act Service Management & Creating Labor Rates Based on Pay Code and Position in Key2Act Service Management.

For additional information on managing labor codes in Signature, please reach out to the team at Stoneridge Software. Our Dynamics GP team includes some of the top Key2Act experts in the country.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.