Moving to the Cloud? Are You Prepared to Account for Implementation Costs Under the FASB’s New Guidance?

You’ve heard about this thing called the “cloud” and have decided to take the leap from utilizing your own internal server infrastructure to that of a cloud service provider. As part of the migration, you will likely incur implementation and set up costs. How are you planning to account for these? Have you thought about which costs should be capitalized and what to expense?

Under current guidance, costs associated with cloud computing service contracts that don’t contain a software license are generally expensed as incurred. However, this is about to change. Under recently issued guidance (ASU 2018-15), implementation costs related to cloud computing arrangements classified as service contracts are to be accounted for under ASC 350-40 [1], the same guidance that is applied to both internal use software arrangements and hosting arrangements that include a software license.

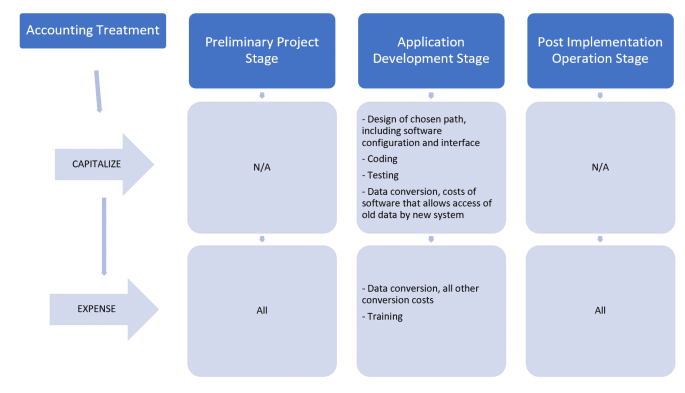

This guidance classifies implementation costs into three main buckets; preliminary project stage, application development stage, and post-implementation operation stage. Certain costs in the application development stage (such as design, coding, testing and data conversion from old system) are generally capitalized. As a result, you will no longer expense these cost categories and will instead capitalize and amortize them over the term of the arrangement. Amortization expense should be presented in the same income statement line item as the cloud computing service contract expense (not with depreciation or amortization expense related to property, plant and equipment and intangible assets). Capitalized costs must also be evaluated for impairment. Implementation expenses incurred in the preliminary project stage and post-implementation operation stages, as well as the underlying cloud subscription fee, will continue to be expensed as incurred.

Effective Dates

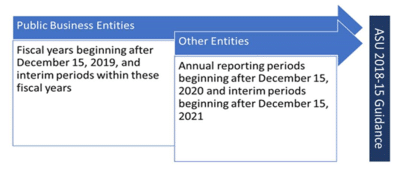

These changes are effective for 2020 financial statements of public business entities and 2021 financial statements for all other entities. Early adoption is permitted.

Customers can adopt prospectively or retrospectively. Prospective adoption would apply to implementation costs incurred after the adoption date. For ongoing projects, costs incurred prior to adoption should be expensed as incurred. Retrospective adoption would apply to costs incurred in all periods presented. If you have any other questions, reach out to us at Stoneridge Software.

[1] Accounting Standards Update No. 2018-15, Intangibles – Goodwill and Other – Internal-Use Software (Subtopic 350-40); Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Service Arrangement That is a Service Contract.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.