Cash Flow Statement Overview and Creating a Cash Flow Forecast in Dynamics 365 Business Central

- While the Income Statement and Balance Sheet are anchored to accrual-based accounting for measuring performance and financial position, the Cash Flow Statement (required by GAAP) is used to complete the picture by helping to explain a company’s performance in generating cash.

- Cash flows = Cash receipts and Cash payments

- The Cash Flow Statement records receipts and disbursements classified according to the entity’s major activities: Operating, Investing and Financing (net cash inflows/outflows for each activity).

Purposes:

- To predict future cash flows

- To evaluate management decisions

- To determine the ability to pay dividends to stockholders and interest and principal to creditors

- To show the relationship of net income to changes in the business’s cash.

Comparisons:

- The Balance Sheet = the cash balance at the end of a period (“As of xx/xx/xxxx”)

- The Income Statement = revenue, expenses and net income (Beginning to End)

- The Cash Flow Statement = Cash receipts and cash payments in a period; used to identify where money came from and how it was spent; identifies the causes for the change in the cash balance (Beginning to End)

Notes:

- The largest cash inflow from Operations is the collection of cash.

- Cash also means “cash equivalents” (highly successful short-term investments)

- One thing to watch out for among finance activities is whether the business is borrowing heavily; excessive borrowing has been the downfall of many companies.

- According to FASB, interest and dividends are including in operating income because they affect net income.

- Shareholder dividends fall under “Financing Activity” because they go to owner’s equity.

Two Ways to present Cash Flow Statement:

- Direct Method (FASB-preferred)

- Indirect Method

Preparation of Cash Flow Statement Steps:

- Identify all activities in the business that increased and decreased cash.

- Classify each increase and decrease as either an operating, investment or a financing activity.

- Identify the cash effect of each transaction.

Finally …

- Cash flows from operating activities are listed first because they are the largest and most important source of cash for a business.

- Cash vs. AR – Only cash receipts count and are reported.

- Dividends received are included in operating activities (Note: Dividends paid are included in financing activities).

- The beginning and ending balances are not required on a Cash Flow Statement by FASB because they’re reported on the Balance Sheet; only required to show cash changes during a period.

Dynamics 365 Business Central – Steps to create Cash Flow Forecast:

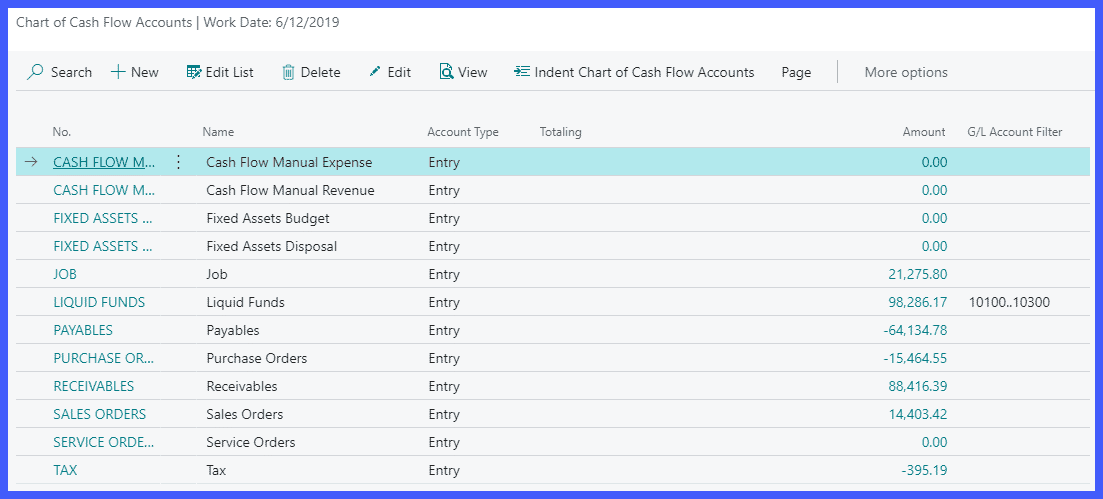

1. Create the Chart of Cash Flow Accounts.

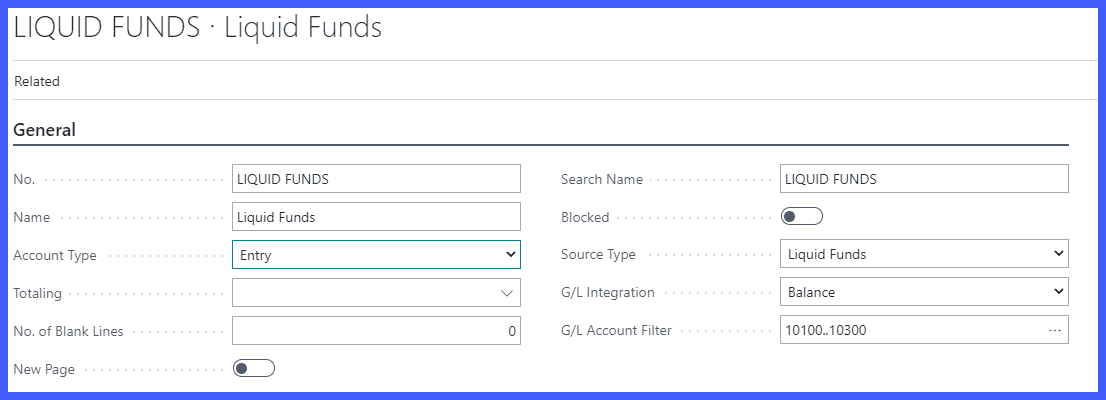

Each ‘Account Card’ can be mapped to G/L accounts or Budgets:

- Account Type -> Specifies the purpose of the CF account (“Entry” is the default). Options include: Entry, Heading, Total, Begin-Total and End-Total.

- Source Type -> Examples include Liquid Funds, AR, AP, Purchase Orders, GL Budget …

- G/L Integration -> Specifies if the cash flow has integration with the general ledger. Options include Balance, Budget or Both.

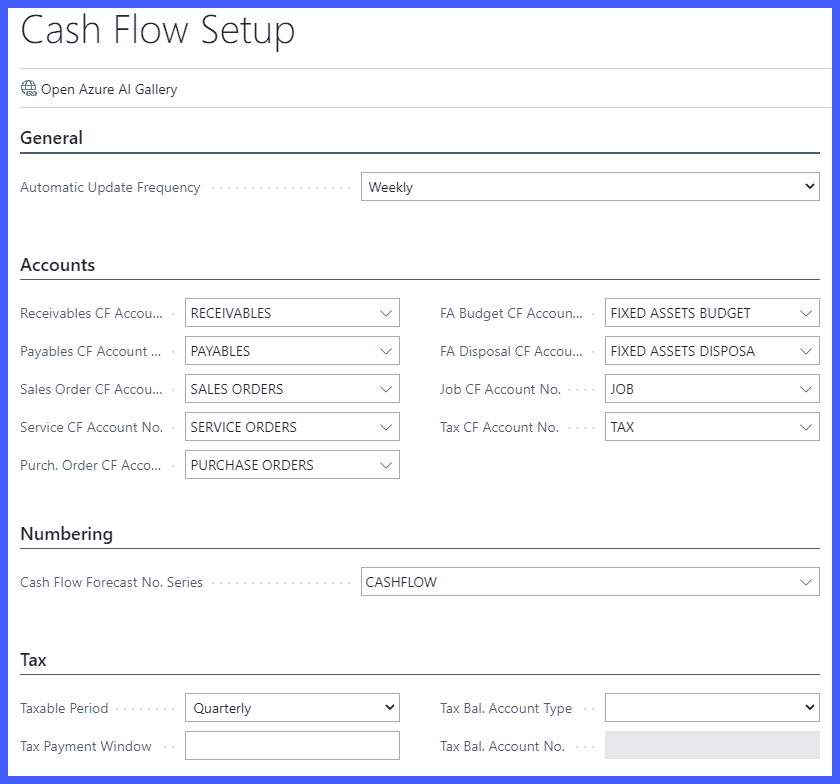

2. Cash Flow Setup – This process can be done manually or using the wizard in the Assisted Setup (which creates a generic COA). The fields are as follows:

- Automatic Update Frequency -> Specifies the automatic update frequency of the cash flow forecast in the Job Queue.

- Accounts -> Default these fields from the Chart of Cash Flow Accounts.

- Numbering -> Create and assign a Cash Flow Forecast No. Series to be used for the forecasts.

- Tax -> How often tax is paid, Payment Window and tax account information

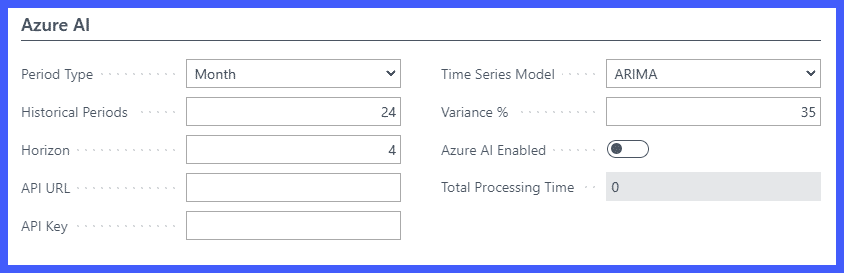

- Azure AI -> This feature uses Cortana to predict future cash flow movement. This function uses historical and current data + future orders, etc. to generate predications. If there is not a lot of data to work with, the algorithm will return errors. (This is quite involved -> https://gallery.azure.ai/Experiment/Forecasting-Model-for-Microsoft-Dynamics-365-Business-Central)

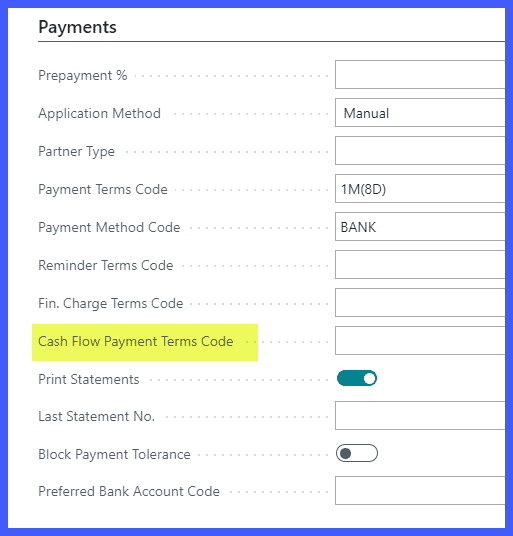

3. Customer/Vendor Cards:

- On the ‘Payments’ tab of both cards is a field called, “Cash Flow Payment Terms Code”. This field is what the system will use to predict cash flows (when the customer actually pays or you actually pay vendors) vs. Payment Terms Code (set terms). To figure out what the actual payment time frame is, go to Statistics for the customer/vendor.

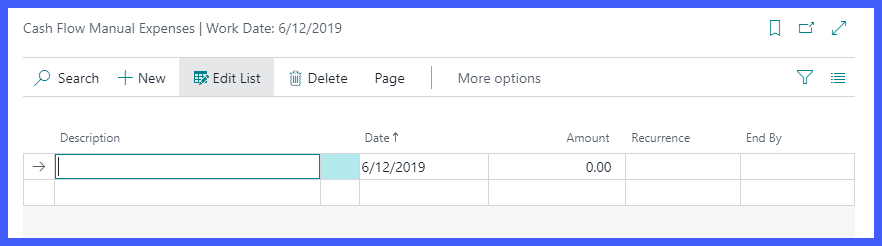

4. Cash Flow Manual Revenues/Manual Expenses:

- This is used to record amounts that have not yet been posted. Included in this could be rentals, financial assets, or investments; personnel, running and finance costs.

- These entries are set up like a recurring journal.

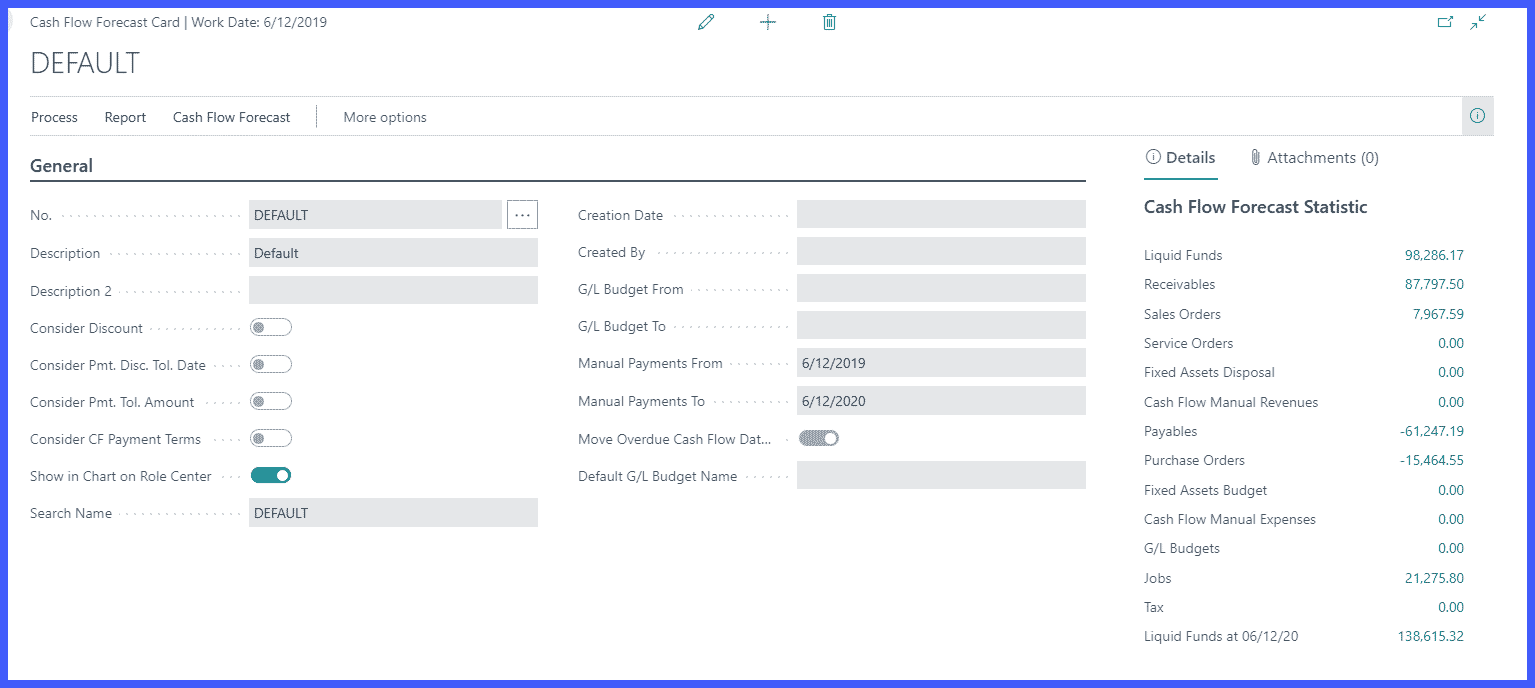

5. Create Cash Flow Forecast Card (and Statistics):

- Multiple cash flow forecasts can be created.

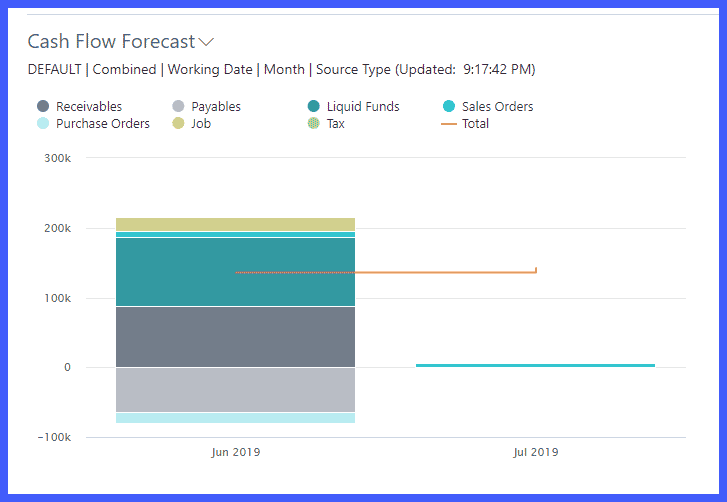

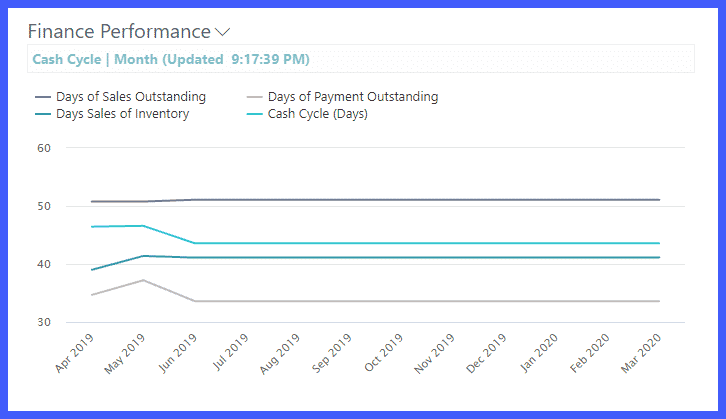

- The settings on the card determine what the forecast will include or omit. Examples include discounts, payment tolerances, CF Payment Terms (if applicable); you can opt to show the chart in the Role Center (presuming Profile permits).

- The forecast can also include GL Budget numbers within a specified date range.

- There is an option called, “Move Overdue Cash Flow Dates to Work Date”. If this slider is on, any overdue transactions will become as of the Work Date.

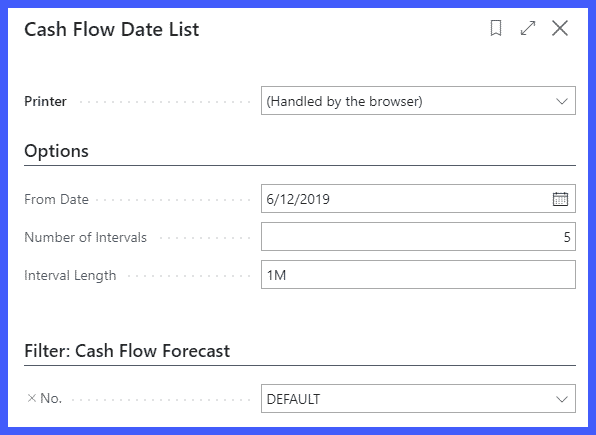

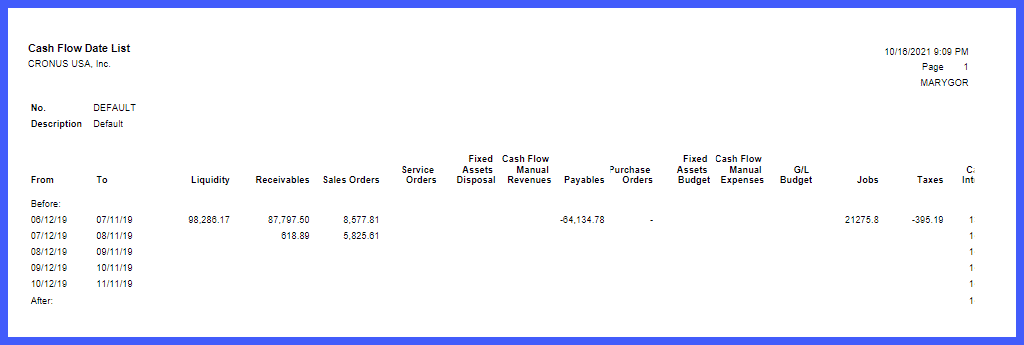

- Run the Cash Flow Date List report by interval (Ex: 5 months) to see the cash outlook:

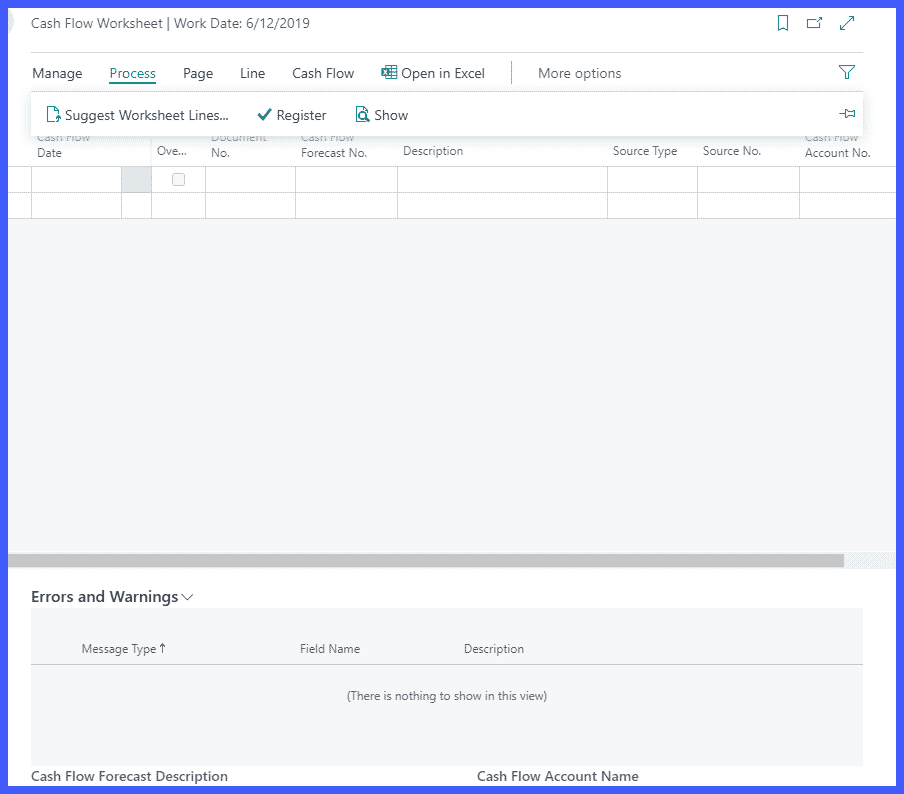

6. Run the Cash Flow Worksheet:

- When this is run, the existing cash flow forecast is cleared and replaced with the new information.

- Similar to the Planning Worksheet, the lines are generated, reviewed and can be edited or deleted.

- Once the worksheet is complete, click “Register” and the forecast will be updated.

- As noted earlier, if there is not enough data and AI is enabled, ‘Errors and Warnings’ will appear. If AI is not enabled, this section will remain blank.

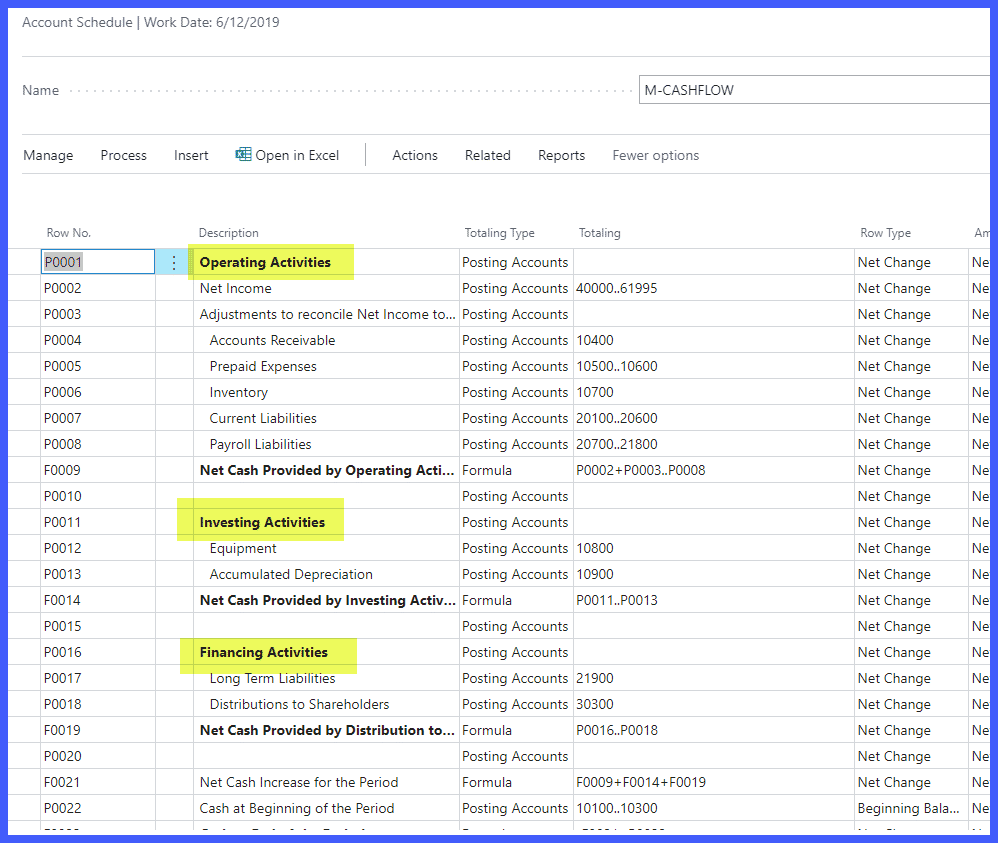

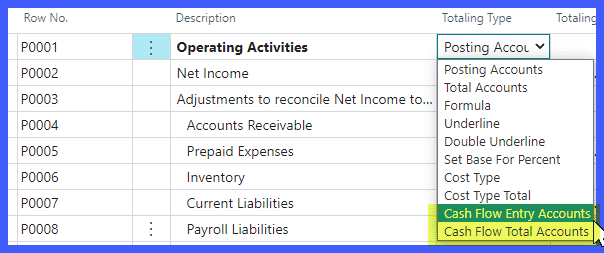

7. Account Schedules:

- BC comes with a standard Cash Flow account schedule: M-CASHFLOW (Broken down by Operating Activities, Investing Activities and Financing Activities).

- This can be used as a template and updated with a user’s Cash Flow COA to build a Cash Flow Statement:

- BC also comes with standard Cash Flow account schedule data for the charts: I_CACYCLE and I_CASHFLOW

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.