Cash Flow Statements and Forecasts in Business Central

Cash Flow Statement:

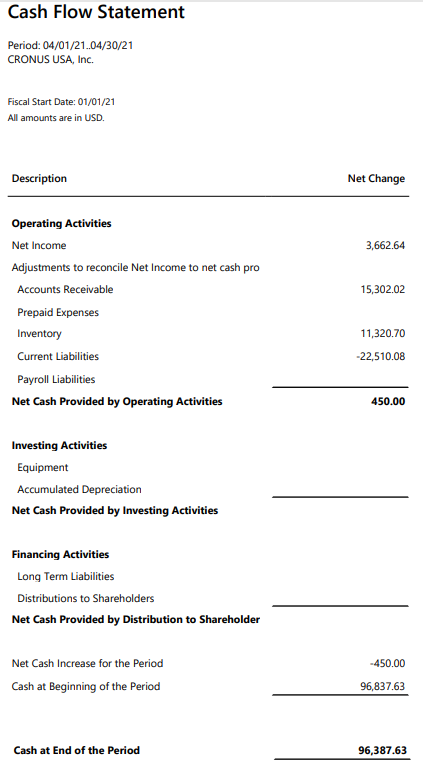

In Business Central, you will find the Cash Flow Statement is one of the Account Schedules. This is out of the box and requires little additional setup. The statement is the historical data for a specific period of time.

Since it is historical data, it will use the General Ledger Entries to calculate the values.

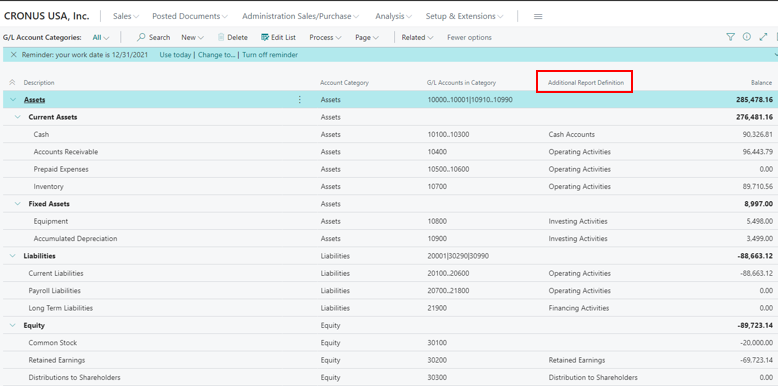

The additional setup will include assigning the additional report definitions (your activities) on the G/L Account Categories page. The values can be assigned to multiple categories and rolled up on the Cash Flow Statement. This is similar to using the G/L Account Subcategories to roll up accounts on the Balance Sheet and Income Statement.

The Cash Flow Statement is made up of three sections:

- Operating Activities at the top – and that includes the Cash receipts and cash payments due to operating activities – such as AR, AP, Inventory, and Prepaid Accounts

- Investing Activities in the middle section – are your Fixed Assets, this includes acquisition costs, accumulated depreciation for the period, and any sale/disposal of asset

- Financing Activities the final section – this is your Cash investments and borrowings. It includes your long-term liabilities and distributions to shareholders

The bottom will show the net cash and beginning cash for the period to arrive at your Cash at End of the Period.

The Cash Flow Statement is an important resource for companies to see historical transactions and can be used to help create the Cash Flow Forecast. And with all Account Schedules, the Cash Flow Statement can be built specifically for your needs.

Cash Flow Forecast:

The Cash Flow Forecast is the financial position of a company at a specific period of time. It is looking into the future vs looking at historical transactions. It does require setup to use the out of box functionality.

The Assisted Setup wizard is the fastest way to setup the Cash Flow Forecast. Go to Assisted Setup and select the Configure the Cash Flow Forecast Chart

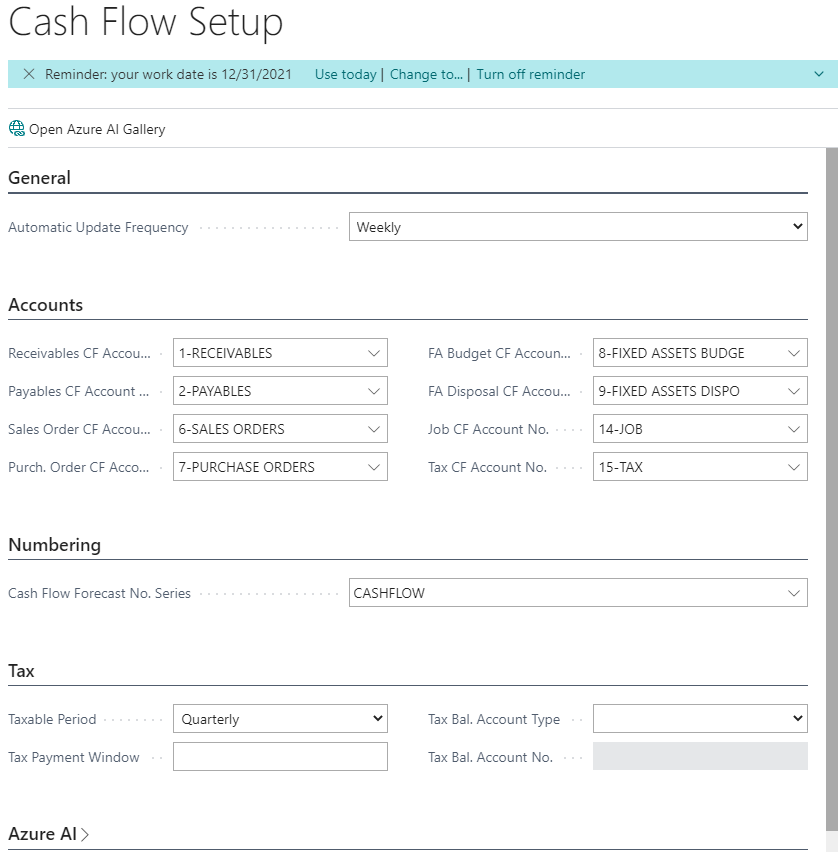

It will walk you through a few questions regarding the Cash Accounts, how often you would like to update the cash flow forecast, and whether to enable Azure AI if using Azure machine learning, finally information regarding when and who taxes are paid and that's it you are done.

The assisted setup will create the Chart of Cash Flow Accounts, a default Cash Flow Forecast card, along with assigning the account number to the Cash Flow Setup page.

Based on the details provided in the assisted setup wizard, the Cash Flow Setup page will have the default values.

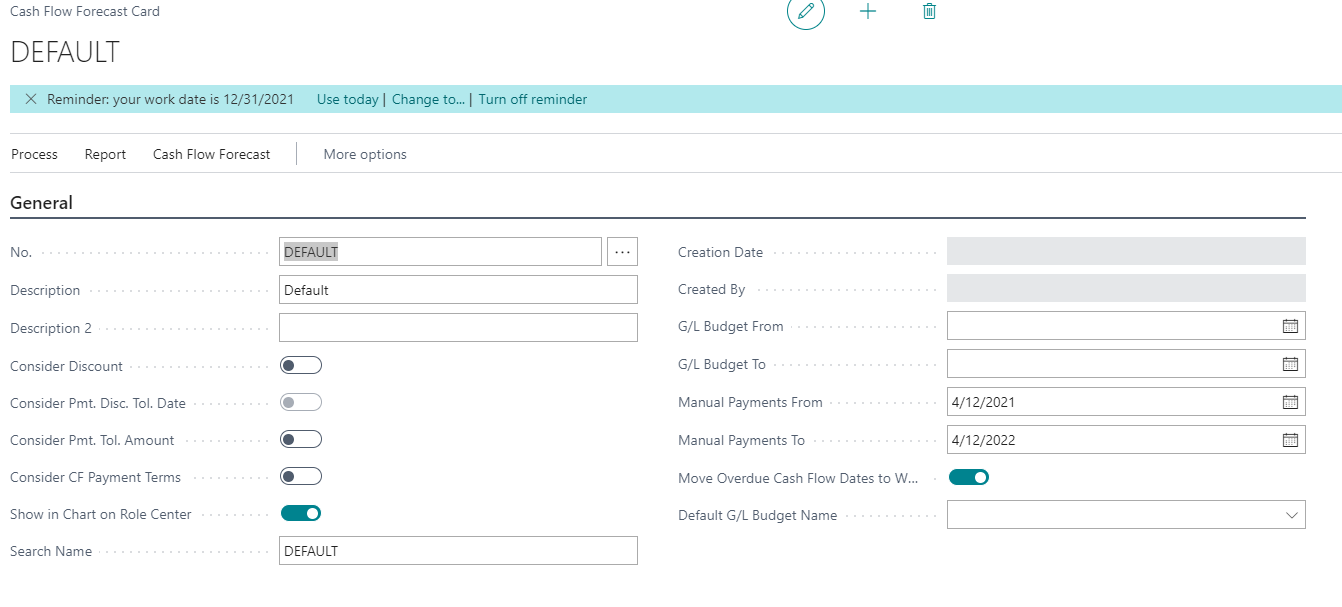

In BC, you have the options of having multiple Cash Flow Forecast cards - this allows you to have different views of cash flow based on different settings. Example, you might have the desire to run a cash flow forecast with considering CF Payment Terms or maybe even discounts and one that doesn't consider those items.

Other flexibility that you have based on the Cash Flow Forecast card:

- Consider payment discount tolerance dates and amount – determines if you use the due date or payment tolerance date.

- G/L Budget From/To – allows you to specify the dates to use the budget entries.

- Move Overdue Cash Flow to Work Date – this allows the values to be reported in the correct period vs a prior period.

- Manual Payments From/To - you can record revenue or expense amounts for a specific date, for a length of time

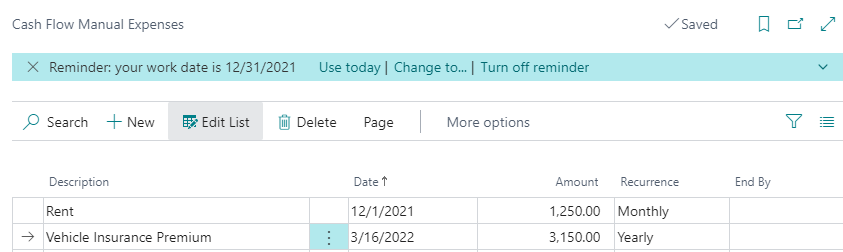

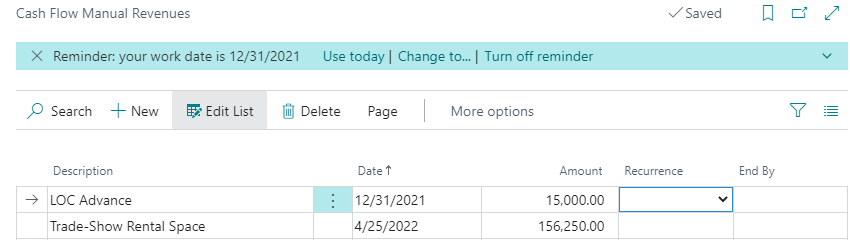

You have the flexibility of adding revenue and expenses by using the Cash Flow Manual Expenses/Revenues. The entries can be recurring or a one-time entry. The Cash Flow Statement can be helpful with determining what to include in the manual entries. You can look back at the historical information to see what has been posted.

The manual expenses and revenues are amounts that aren’t entered into BC either as an order or a posted invoice. This includes things such as: monthly rent, purchasing equipment, revenue from an event, and an advance on a line of credit just to name a few.

When posting a manual entry, you are only recording the entry to the cash flow ledger entries and not the general ledger entries.

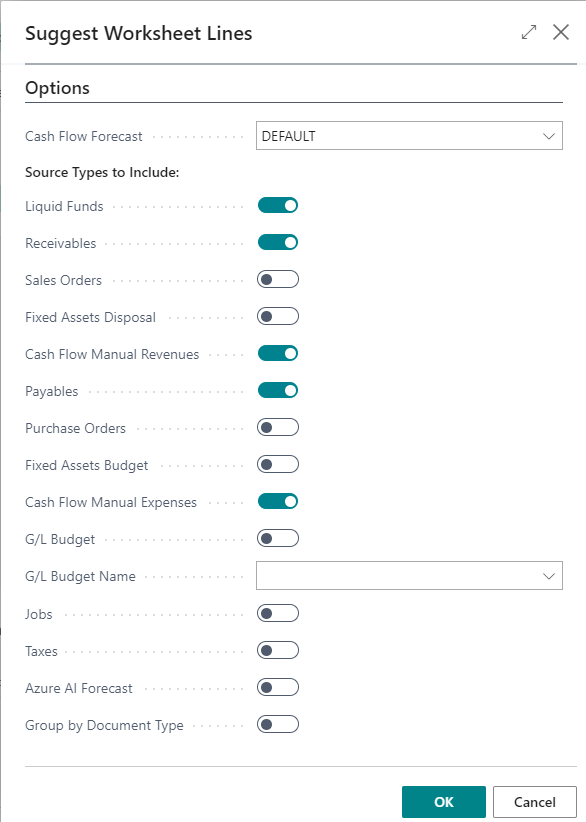

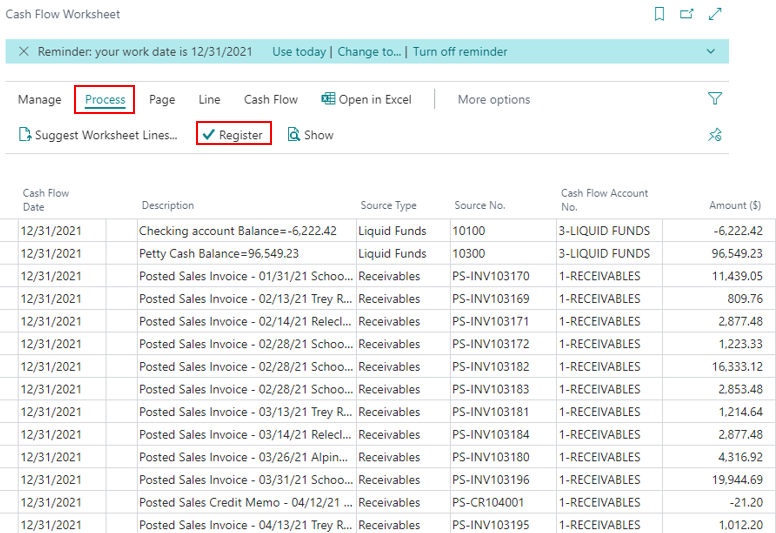

To update the Cash Flow Forecast reports, from the Cash Flow Forecast Card, run the suggest worksheet lines to update the cash flow forecast. Go to Process -> Cash Flow Worksheet -> Process -> Suggest Worksheet Lines. This process will create cash flow ledger entries that are used on various reports.

You will need to select the Cash Flow Forecast along with the options on which source types to include.

The Cash Flow Forecast considers various source types:

- Liquid Funds – G/L Cash Accounts identified on the Chart of Cash Flows - these are based on the data you added to the assisted setup wizard

- Receivables – which are your posted sales invoices/credit memos that are due according to payment terms

- Sales Orders – total including tax from the sales order list

- Cash Flow Manual Revenues – you can manually enter expected revenues that aren’t captured from Receivables or Sales Orders

- Payables – which are your posted purchase invoices/credit memos that are due according to payment terms

- Purchase Orders – total including tax from the purchase order list

- Cash Flow Manual Expenses – you can manually enter expected expenses that aren’t captured from Payables or Purchase Orders

- Just to name a few more - service orders, jobs, fixed assets, and taxes.

Once the Suggest Worksheet Lines is completed, the worksheet will populate with lines that met the criteria. You can easily update the amount if you have a need, delete lines such as Orders that aren’t expected to be invoiced, or adjust the date if you know payment will be coming later – the cash flow worksheet is flexible and editable before registering the lines. Once you are satisfied with the suggested lines, go to Process -> Register. This will create the cash flow ledger entry lines used in reports.

What happens if you register lines and decide to exclude or include source types that were originally included or left out? Run the Suggest Worksheet Lines again and register the desired lines - this will create new Cash Flow Ledger Entries. This will override the original lines so don’t run with just the changes, make sure you run the complete desired source types.

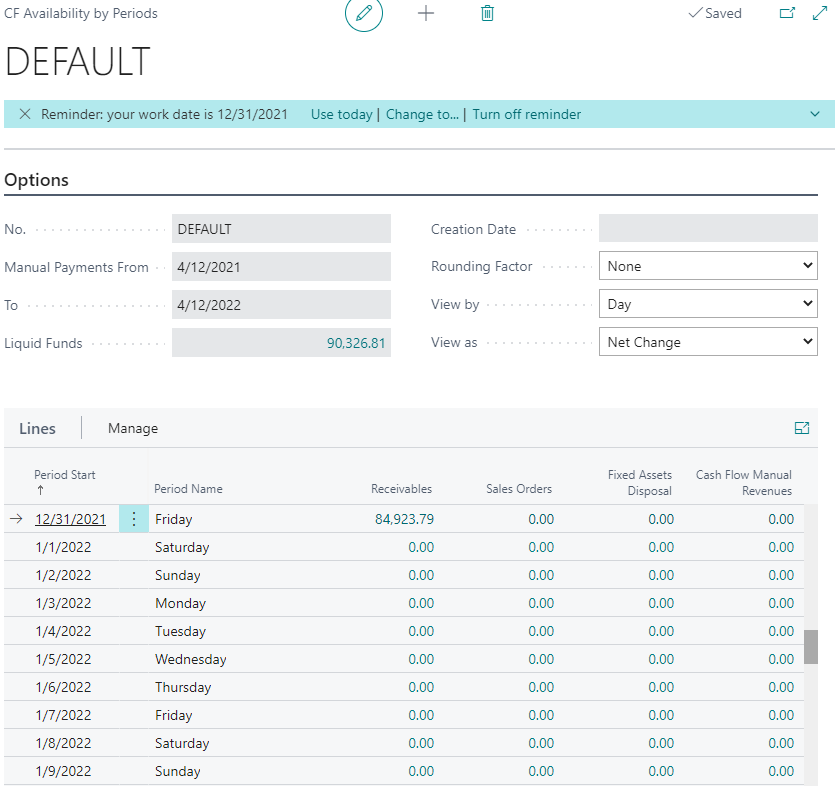

One of the reports is the Cash Flow Availability by Periods report - it is a matrix view within BC that allows you to drill into the Cash Flow Ledger Entries.

From the Cash Flow Forecast card, go to Related -> Cash Flow Forecast -> CF Availability by Periods.

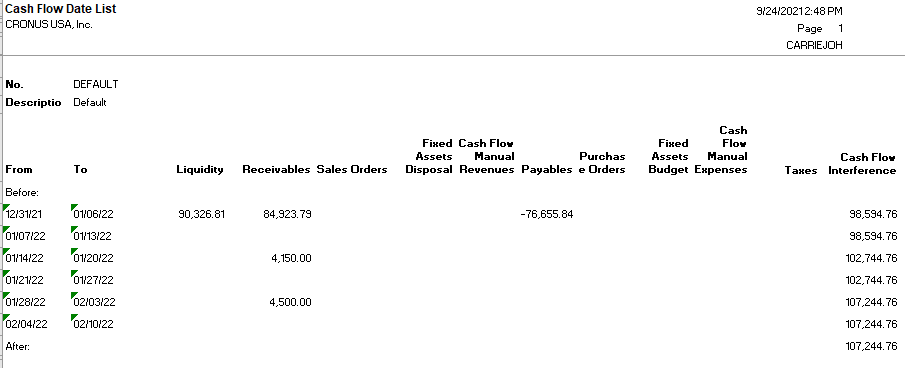

Another analysis view is the Cash Flow Date List report. It is a report that you can run and send to PDF, Word Document, Or Excel, Print, or Preview to the screen.

From the Cash Flow Forecast card, go to Report -> Cash Flow Date List (or search Cash Flow Date List. You will be required to select a start date, number of intervals, and the length of the intervals. The report will return the values based on the Cash Flow Ledger Entries that were registered in the Cash Flow Worksheet. If you want to look at your cash forecast by week for 6 weeks to see where you are best suited to pay down some debt or make some purchases, you can easily see that data.

The data shown on the Cash Flow Date List report is the same data shown on the Cash Flow Availability by Periods - with the source type of Liquid Funds, Receivables, Sales Orders, CF Manual Revenues, POs, and CF Manual Expenses. This report is able to be printed vs the cash flow availability by period is a matrix within BC that can be drilled into

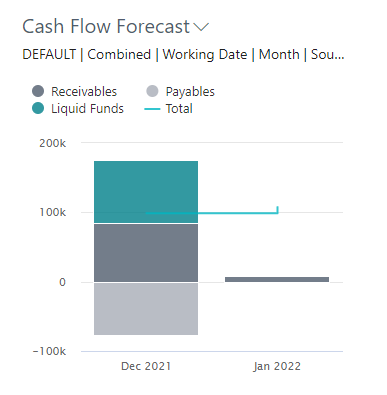

The final analysis to display that is out of the box in BC is the Cash Flow on the Role Center. This is found in the Business Assistance section of the role center - based on the role assigned to the user will determine whether or not you can see it. It is the cash flow data from the account schedules – make sure the posting accounts are updated to desired G/L Accounts.

Since the account schedules are based on actual data vs forecasted data, the values are calculated using the General Ledger Entries and not the Cash Flow Ledger Entries. You are able to drill into the amounts to see the GL Entries associated with each section.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.