How to Reconcile Payments from a Bank Statement to Microsoft Dynamics GP

The question of “What is the correct way to reconcile items from my bank statement?” is common. In Dynamics GP, there are multiple ways to add lines to the bank reconciliation, and they are all correct from an accounting standpoint. The questions that you must ask are:

- What am I trying to accomplish?

- How much time do I want to spend on this?

- What level of traceability do I want to have?”

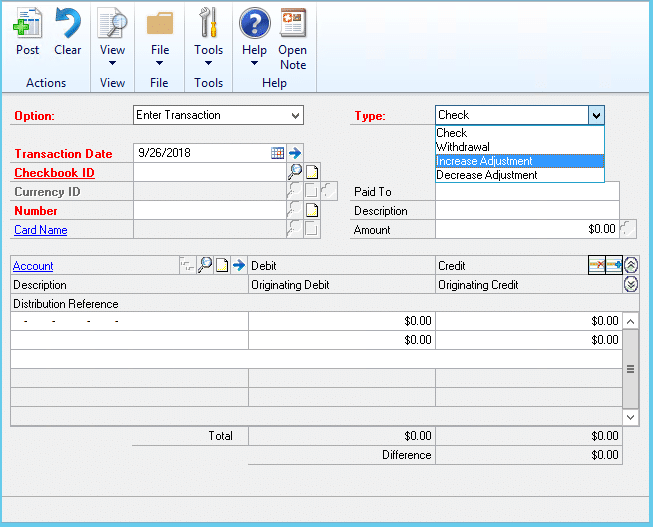

1. The easiest way to reconcile is to simply use the bank transactions increase/decrease adjustment (Financial -> Transactions -> Bank Transactions).

- Pros: Fast and easy

- Cons: Cannot search who/what will not show up at year-end for tax reporting, not directly associated with any customer/vendor, not reported on the subledger

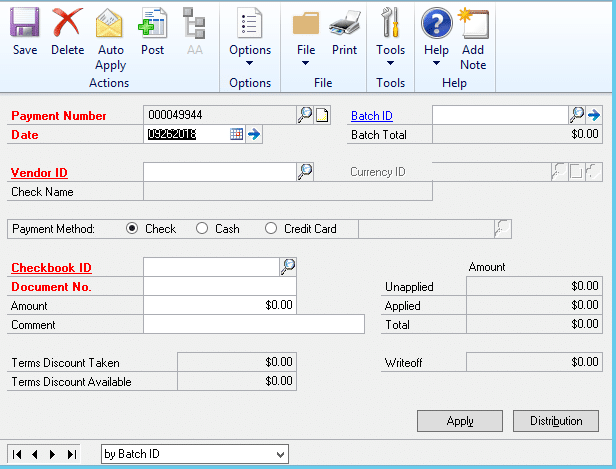

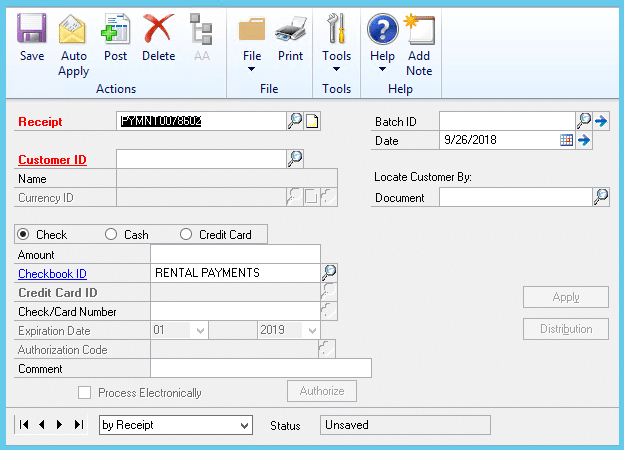

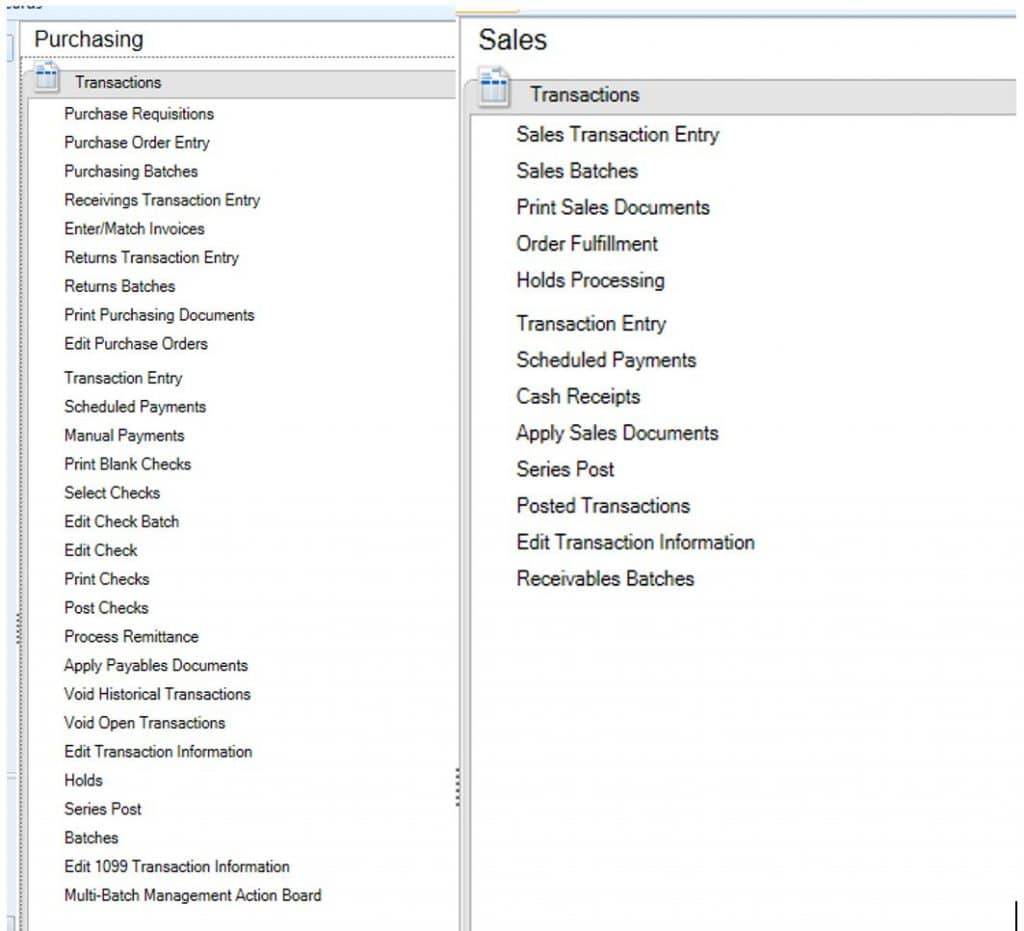

2. Creating Manual Payments/Receipts takes a little bit longer, but is probably the most effective (Purchasing -> Transactions -> Manual Payments or Sales -> Transactions -> Cash Receipts).

- Pros: Transactions are linked to a vendor/customer and can be applied directly to open items or enter Distribution accounts is no open items exist, can increase search capabilities, is attached to vendor/customer accounts

- Cons: Takes more time than a simple adjustment

3. Enter in customer/vendor invoices to recreate the invoicing/payment or invoicing/cash receipt process (Purchasing -> Transactions or Sales -> Transactions)

- Pros: Meets all internal controls/company practices, creates traceability for searching and year-end reporting

- Cons: Time consuming and possibly “extra/unnecessary” work

All three methods will show you how to reconcile payments from a bank statement to Microsoft Dynamics GP. However, in order to be able to track and run reports, reconciling at levels 2 or 3 is necessary.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.