Inventory to General Ledger Reconcile Report in NAV 2013

*This post was written for Dynamics NAV but the content directly applies to Dynamics 365 for Financials, which is the cloud product based on Dynamics NAV. You may notice some slight differences in the screenshots, but the information and steps are directly applicable to Dynamics 365 for Financials.

I am often asked to explain the difference between NAV Inventory Valuation and NAV Inventory to General Ledger Reconcile reports. The Inventory Valuation report provides a snapshot of your company’s overall on-hand inventory value. However, it can’t be used to tie back directly to individual GL accounts if you’ve enabled the “expected cost posting” feature and/or disabled the “automatic cost posting” feature within NAV.

When “Expected Cost Posting” is enabled, your company’s on-hand inventory value will be spread between “interim” and “actual” inventory GL accounts. For example, purchased inventory that has been received, but not yet invoiced will be sitting in an interim inventory account whereas invoiced material will be represented in your inventory account. The NAV Inventory Valuation report simply combines interim and actual costs into one summarized figure, thus you lose the ability to reconcile to individual interim or actual inventory GL accounts.

If “Automatic Cost Posting” is disabled (which is rare), there will be inventory value unaccounted for in your general ledger until the “Post Inventory Cost to GL” batch job is run. The Inventory Valuation report makes no distinction between inventory value that has or hasn’t been posted to the GL.

In a nutshell, the purpose of the Inventory to GL Reconcile report is to provide visibility in regards to:

- What portion of an item’s value is made up of expected vs. actual cost?

- What portion of an item’s value has/hasn’t been posted to the G/L?

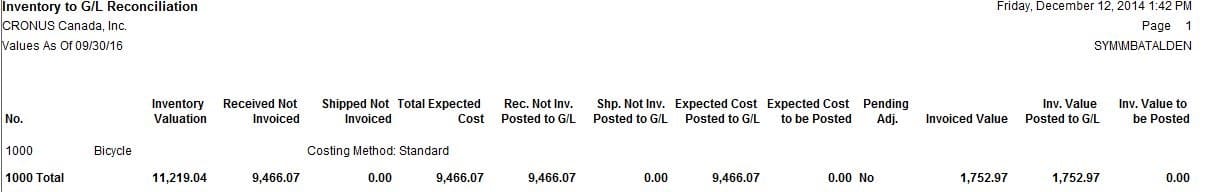

The report’s thirteen column layout can be a bit daunting initially. However, a brief explanation as to what each of the columns actually represents can shed light on the report’s usefulness. Assuming that your organization has the “Automatic Cost Posting” feature enabled, the six columns of the report dedicated to showing whether inventory value has or has not yet been posted to the GL are irrelevant. That leaves us with seven primary columns to consider:

- No.

- – Displays the item’s number.

- Inventory Valuation

- – Represents the item’s total inventory value excluding WIP. The figure includes both expected and actual (invoiced) cost. This column will tie to the inventory valuation figure shown in the “Inventory Valuation” report.

- Received Not Invoiced

- – As its name implies, this figure represents value of inventory that has been received, but has not yet been invoiced. Also, the figure represents value of on hand production output that has not yet been finished.

- Shipped Not Invoiced

- – This figure should tie to the “Interim COGS” account and represents the value of inventory that has been shipped, but not yet invoiced.

- Total Expected Cost

- – This is a summary of the two previous columns and represents the value in the “interim inventory” inventory account(s).

- Pending Adj.

- – This columns tells you whether or not NAV is waiting for the “Adjust Cost – Item Entries” process to be run for this item.

- Invoiced Value

- – This figure represents the value of inventory that has actual (invoiced) cost. It represents the value in the “inventory” GL account(s).

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.