2020 Year-End Close Resources for Microsoft Dynamics GP Users

Year-End is upon us again, and now is the time for Dynamics GP users to make plans to install the year-end update and close out the year. The GP Year-End update is now available. All prior patches are included in the release. The year-end update includes payroll form changes and updates for ACA reporting, form 1095-C. Additionally, there are fixes for:

- Template issue with recent Office Update

- Fixed Asset Luxury Auto Depreciation Changes

- Payroll Box 14 open for all pay types to report COVID pay on W2’s

- Payables 1096 form updated for 1099 NEC amounts.

The U.S. 2020 Year-end Update contains software changes to allow you to comply with 2020 filing requirements as well as the most recent fixes for Dynamics GP and other quality report fixes related to the payroll year-end. The update is all-inclusive and includes all prior service packs and hotfixes.

For Microsoft Dynamics GP 2018 customers if you install the 2020 year-end update, you will have all the features noted in the October 2020 release.

Changes to the Payables Forms

There are three payables form changes to be aware of this year:

-

- 1099-MISC form changes.

- 1099-NEC form (new).

- 1096 form modified to include NEC amounts.

The new 1099 NEC form for the 2020 tax year is the most significant change. This form now includes Non-Employee Compensation, which had been included in the 1099 MISC form previously.

Dynamics GP Payroll Users

If you’re running payroll from Dynamics GP, there are specific changes that impact payroll directly:

- Payroll form changes

- Payroll Wages for FFCRA report on W-2 Box 14

- Updates for ACA reporting, form 1095-C

- New ACA codes

- Plan start month is required

- Employee age printing on the form

- New Line 17 Zip Code

Reporting FFCRA wages on the W-2: New functionality added with Year-End Update

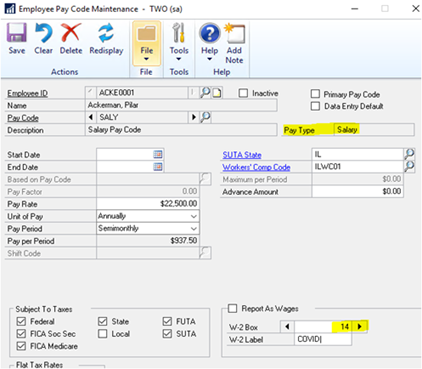

The Dynamics GP Year-End Update added functionality that requires specific pay codes to be reported on the W-2. Once the year-end update is installed, you can enter labels for Box 14 on all pay code pay types to report COVID/FFCRA (Families First Coronavirus Response Act) pay.

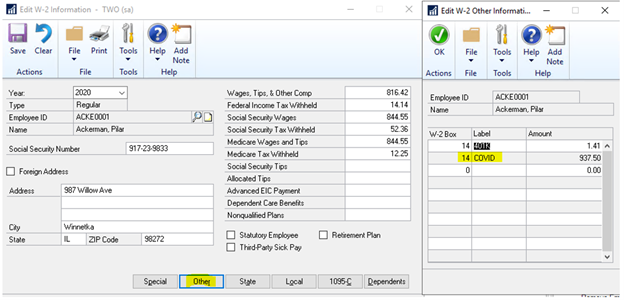

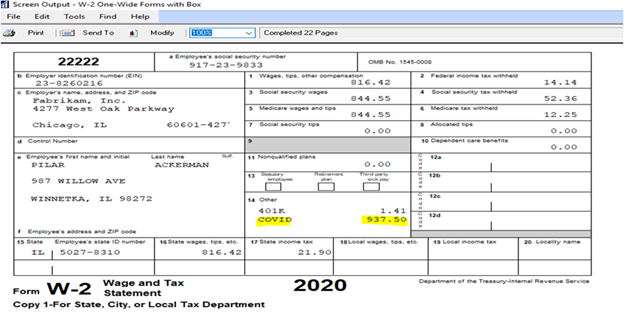

You need to separately report Qualified Sick Leave Wages and Qualified Family Leave Wages paid under FFCRA on 2020 Forms W-2, Box 14, or on a separate statement.

In the screen shot below COVID is an example label, but should not be used as your label. This is available for ALL pay types not just Salary.

Once you install the update, go to the Setup of your COVID pay codes and properly put the Box 14 label on each code. When prompted to roll down to all employees choose YES.

When you create the year end wage file it will report correctly on the W-2. If you do not install the year end update, you could edit each employees W-2 manually to enter this amount in Box 14.

If you have completed your year-end close without making this update, you’ll need to remove the year-end close, make the change, roll back tax tables to 2020, close again, and then update taxes back to 2021.

***NOTICE***

Mainstream Support for Microsoft Dynamics GP 2015 ended on 4/14/2020 which means you no longer receive tax and year-end updates.

Have Stoneridge Help With Your Year-End Close

Does your team need assistance with year-end close? Stoneridge can assist you. Just schedule now!

If you would like the GP team to complete your year-end close, contact us today.

Our calendar typically fills up quickly – make sure to contact us as soon as possible to ensure you are scheduled for the date and time of your choosing.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.