Fixing the Tax Data Version Error Following Dynamics AX 2012 Payroll Tax Update KB 3156738

After applying the Dynamics AX 2012 Tax update, released in April 2016 (KB 3156738), a client was not seeing their Tax data version in the Human Resources shared parameters form. They were receiving the following errors when trying to run the "Update tax data":

- An error occurred accessing the tax engine. Please check your installation.

- Microsoft Dynamics any type cannot be marshaled to CLR Object.

Cause of Payroll Tax Data Version Error:

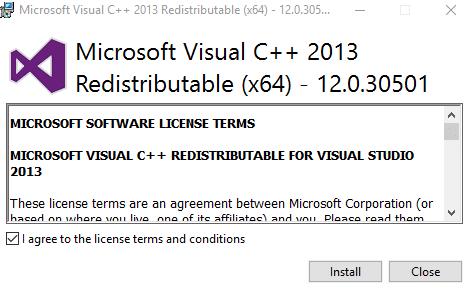

Missing the prerequisite ( Microsoft Visual C++ 2013 Redistributable Package on all machines running an AOS)

as detailed in the Payroll KB3156738 guide. Here is what is listed on page 3 of the guide -

Prerequisites - Updated for 2016-R05 and later

IMPORTANT: This tax update is an incremental tax update and requires that the latest baseline tax update be applied prior to applying this update. Please go to CustomerSource to download the latest baseline update and apply the database portion prior to installing this update.

· Dynamics AX 2012 R2 - Tax engine base code version: 1.0.1.70 (2014-R8 tax update)

· Dynamics AX 2012 R3 - Tax engine base code version: 1.0.1.67 (Initial release of R3)

· NEW! Installation of the Microsoft Visual C++ 2013 Redistributable Package on all machines running an AOS

· o

· NEW! Installation of the Microsoft .NET 4.0 Framework on all machines running an AOS

· o http://www.microsoft.com/en-us/download/details.aspx?id=17718

You can verify you have this installed on the AOS server by going to Control Panel> Programs and Features. Then verify that Microsoft Visual C++ 2013 Redistributable (x64) - 12.0.30501 is installed on your 32-bit server.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.