How to Find Invoices Paid by Check in Microsoft Dynamics AX 2012

Have you ever needed to find invoices paid by check in Microsoft Dynamics AX? There are times when a vendor calls you up and asks if payment has been sent for specific invoices. Dynamics AX 2012 offers two different forms that you can quickly view from the vendor record that allows you to search both on vendor invoices and check number.

Finding invoices paid by check

Scenario 1:

A vendor calls and has not received payment. As the Accounts payable clerk, you need to quickly look up the vendor information and identify the invoice in question to verify if payment has been sent or now. To do this, you can go into the vendor transactions inquiry

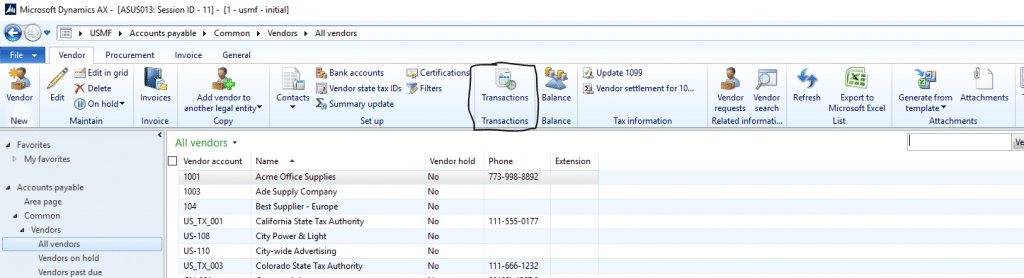

1. Navigate to Accounts payable > Common > Vendors > All vendors.

2. Search the vendor in question and then from the action pane, select Transactions

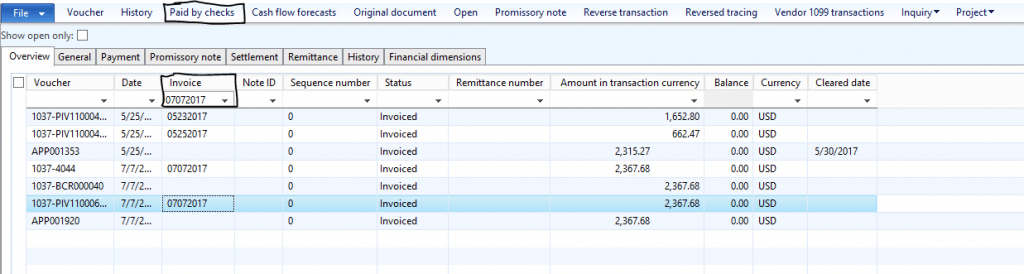

3. In the Transactions form, type ctrl+G to filter. Type in the invoice number in question.

4. Highlight the Invoice line and select Paid by checks.

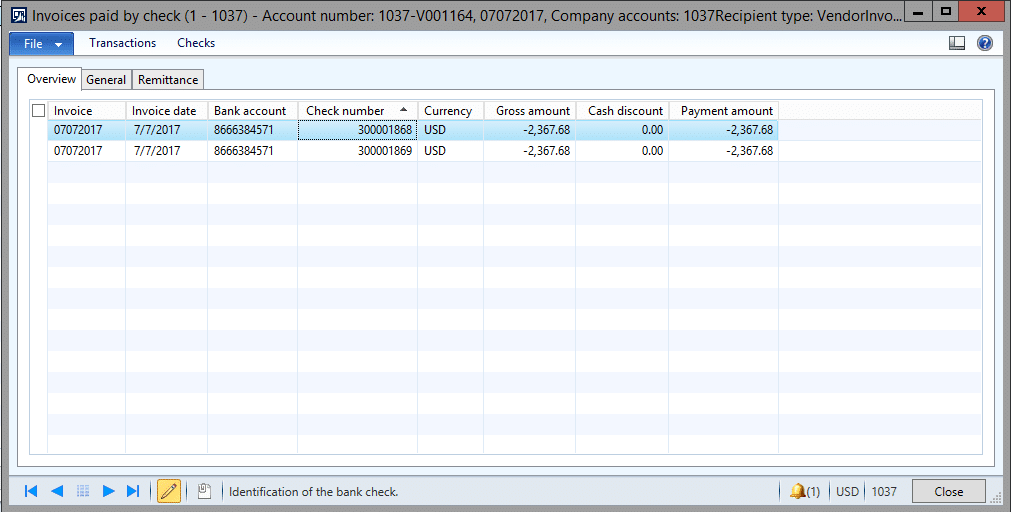

5. The Invoices paid by check form opens and displays all checks that were issued to pay for the invoice identified.

Finding invoices paid by check

Scenario 2:

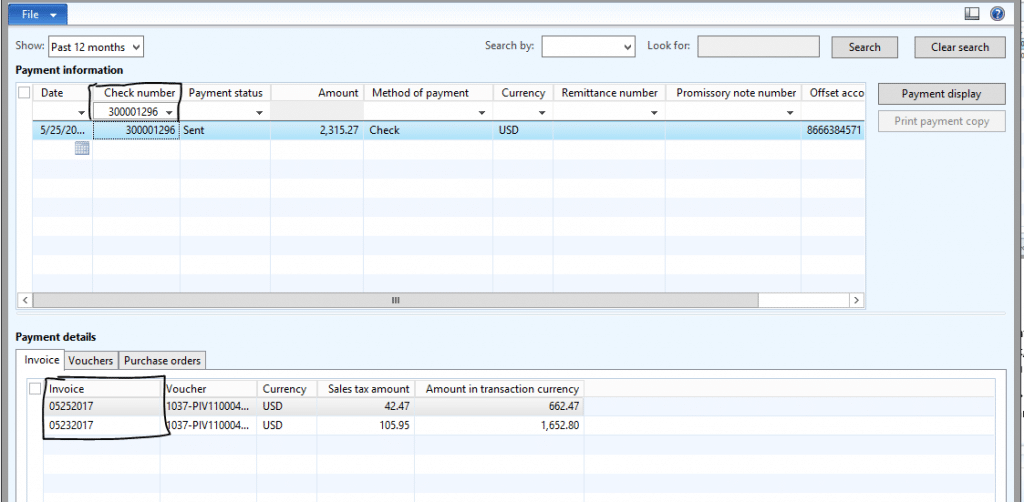

A vendor calls and has received payment but is unsure of the invoices that were settled via this payment. As the Accounts payable clerk, you need to quickly look up the check number and drill back into the settled invoices. To do this, you can go into the vendor payment history form.

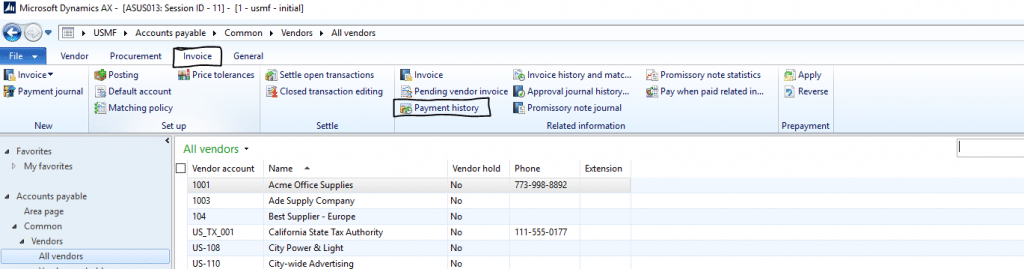

1. Navigate to Accounts payable > Common > Vendors > All vendors.

2. Search the vendor in question and then from the action pane, select Invoice > Payment history.

3. In the Payment history form, type Ctrl+G to filter. Type in the check number provided by the vendor.

4. Once filtered, you can see the invoices that were settled via this payment.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.