Planning for a Painless Bank Reconciliation in Dynamics 365 Finance and Operations

One of my favorite features available with Advanced bank functionality is the automation of the reconciliation process. To get the most from this feature, good matching rules are essential. Therefore, if you anticipate using Microsoft Dynamics 365 for Finance and Operations Advanced bank reconciliation process, then you will want to pay attention to a couple of important configurations.

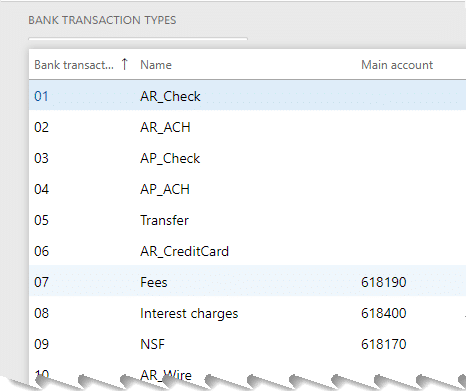

1 - Bank transaction types

Bank transaction types are a way to assign bank and ledger activity. They are vital to mapping transactions recorded in the operating system for comparison and matching to bank file transactions.

This configuration is located at Cash and bank management/Setup/Bank transaction types. A partial sample list is shown next in Figure 1.

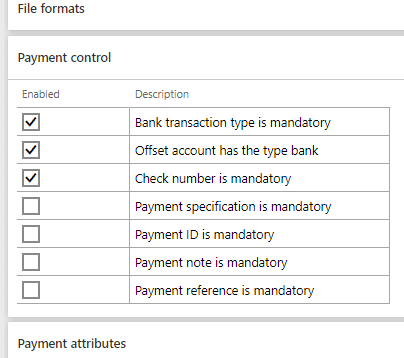

2 - Methods of payment

are defined for both accounts payable and accounts receivable. Those configurations are established at Accounts payable/Payment setup/Methods of payment and Accounts receivable/Payment setup/Methods of payment respectively.

For each Method of payment, there should be a Bank transaction type assigned on the General fast tab. For example, if the method is Check and the description is AP check payments then the Bank transaction type should be 03 based on the list above.

The Payment control fast tab is also important to review. It has settings that ensure data consistency in support of matching system and external bank transactions. Following our example for an AP check payment, the following controls should be enabled as depicted in Figure 2.

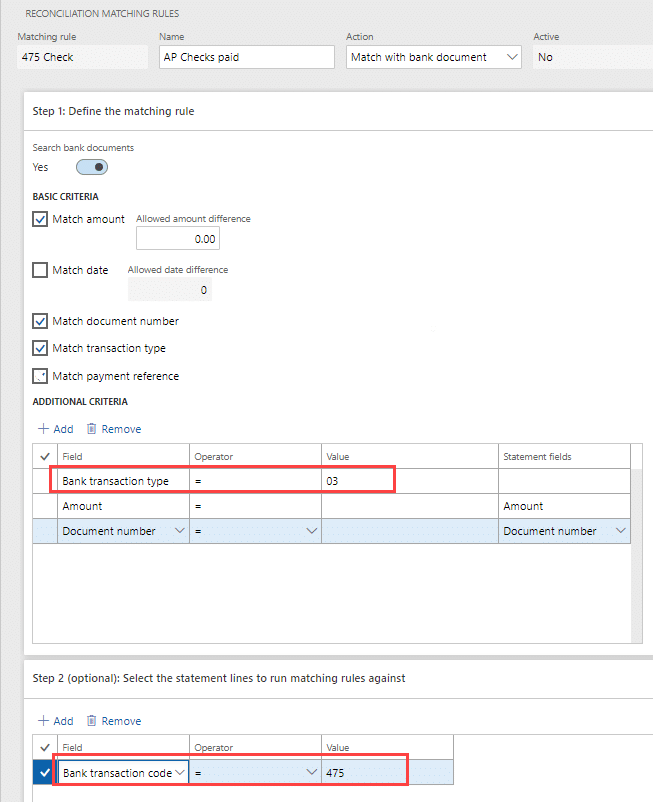

The data configuration comes together when working with Reconciliation matching rules. When I create matching rules, I prefer to create them specifically with a 1:1 relationship between the codes. The following example (Figure 3) is a simple match for an AP check. There are many different settings and values that are used in reaching a higher matching ratio. Higher matching ratio = less manual review!

There are a number of other steps in setting up advanced bank reconciliation. We have skipped those in the interest of focusing on data relationships. If you would like to learn more about Advanced bank features, please reach out to the Stoneridge team!

As always, please test any new or updated business processes in an environment designated for testing before implementing in a live production environment.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.