Understanding Worker Payment Issuance in Microsoft Dynamics AX R2

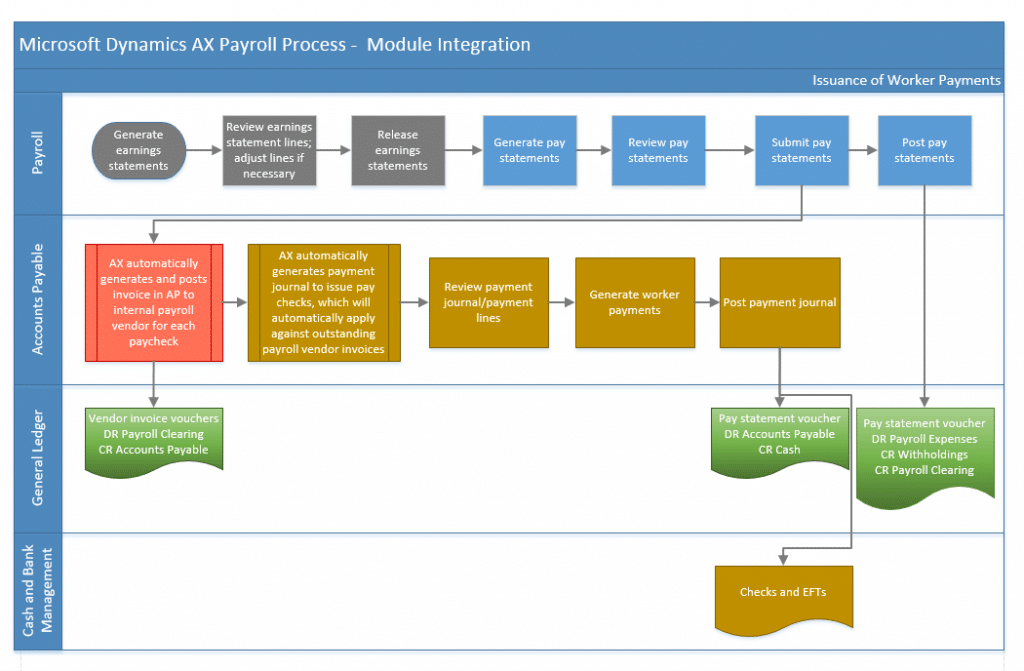

Microsoft Dynamics AX R2 brought with it a re-write of the payroll functionality. While there is much about the functionality that I like, one thing I continue to find confusing is the integration of payroll to the other modules. Payroll payments to workers are processed through the Accounts Payable module, and when we implemented AX payroll internally a year and a half ago, there was not documentation available that laid out how each step of the payroll process affected the other modules. So I’ve prepared a flow chart that lays out the steps for issuing a worker payment, along with the resulting transaction or document for each step when appropriate.

AX MODULES

Each swim lane represents a separate module within Dynamics AX. The process to issue a payroll payment to a worker affects AX modules in the following ways:

PAYROLL is the module which calculates worker earnings and net checks, and accumulates year-to-date totals for each worker’s financial information. The payroll module sends transactions to both the accounts payable and the general ledger modules.

ACCOUNTS PAYABLE is used to issue the worker payments. The accounts payable module prints the checks or generates the electronic file for transmission to the bank and sends transactions to the general ledger and cash & bank management modules.

GENERAL LEDGER is the module used to accumulate financial information from all other module. In regards to the payroll payments, the general ledger is the end of the process – the module receives financial information from payroll and accounts payable. It does not update any other modules.

CASH AND BANK MANAGEMENT is the module used to track and reconcile transactions made to bank accounts. For purposes of the payroll process, cash and bank management receives transactions from accounts payable and does not update other modules.

AX TRANSACTIONS

Each color in the diagram indicates processes for a specific transaction type in AX. The AX transaction types associated with the payroll process include:

EARNINGS STATEMENTS (grey) are used to accumulate gross earnings to be paid to each worker. Earnings statements includes earnings lines, which each represent a specific earning to be paid to the worker. Earnings lines might represent hours or other units to be paid, or flat dollar amounts.

- a. Generate earnings statements is an AX process in which an earnings statement is generated for each employee, containing default earnings lines for the employee if AX is configured to automatically generate salaries or default hours. If AX is not configured to automatically generate earnings, then this step generates an empty earnings statement. Earnings statements do not ever post to other modules within AX.

- b. Review earnings statements lines is a manual process in which the payroll professional can review the automatically generated earnings statement lines, and add or modify lines as necessary.

- c. Release earnings statements is an AX process, and is the equivalent of approving earnings lines for payment to employees. It does not result in additional transactions within AX, as it only updates the status of the lines on the earnings statements to indicate they are okay to be paid.

PAY STATEMENTS (blue) are used to calculate the net payment due to each worker. Pay statements include the earnings line from the associated earnings statements as well as lines for each of the taxes and benefits to be withheld. The pay statement uses these earnings lines, tax lines and benefit lines to calculate the net payment due to the worker.

- a. Generate pay statements is an AX process in which released earnings lines for the specified period are used to generate a pay statement for each employee, which includes the earnings lines, tax withholding lines, benefit expense and withholding lines, and net check amount. The generation of pay statements does not result in transactions to other modules.

- b. Review pay statements is a manual process in which the payroll professional can review the net payment calculations, and modify tax or benefit lines as appropriate. This step does not result in additional transactions within AX. At this point, a payroll professional can still delete the pay statement, as well as the associated earnings statement, without affecting any other modules.

- c. Submit pay statements is an AX process which is the equivalent of approving the pay statement for issuance to the employees. This step results in the posting of an accounts payable invoice, as well as generation of a payment journal containing unposted accounts payable payments to offset the posted accounts payable invoice. It is important to note, that once this step is performed, pay statements can no longer be simply deleted without affecting other modules. Submitted pay statements cannot be deleted – they must reversed.

- d. Post pay statements is an AX process in which the financial information on the pay statements updates the year to date totals for workers within the payroll module and posts the related financial information to the general ledger. This step results in a journal entry to the general ledger for the pay run expenses and withholdings. This step DOES NOT result in any transactions in the accounts payable or cash & bank management modules.

ACCOUNTS PAYABLE INVOICES (orange) are the first transaction used to process the net payments to the workers. This is an automatic step performed by AX when the pay statement is submitted for payment, and the invoice itself is never visible to payroll professional through the payroll module, although it can be viewed through the accounts payable module. The step results in the posting of an open accounts payable invoice to the master payroll vendor, as well as posting to the general ledger of the journal entry associated to the invoice.

ACCOUNTS PAYABLE PAYMENTS (gold) are used to generate payments to workers, either as checks or as files for electronic payment transmission. Generation of unposted payment lines is an automatic step performed by AX when the pay statements are submitted for payment, and results in the creation of an open payment journal, with a single line for each payment to be made.

- a. Review payment journal/payment lines is a manual process in which the payroll professional can review the payment journal prior to generating the payments, and does not result in the recording of any additional transactions within AX.

- b. Generate worker payments is an AX process in which the payments to the workers are generated either as checks or to a file for transmission to the bank. This step does not result in the recording of additional transaction in AX, although the payment lines will be updated to the Sent status, and will be updated to include the check or electronic payment number.

- c. Post payment journal is an AX process in which the payment journal containing worker payment lines is posted. This results in several additional transactions – the payroll vendor’s open invoice will be fully applied, checks and EFT payments will update the bank account in the cash & bank management module, and the associated journal entries will be recorded to the general ledger.

GENERAL LEDGER JOURNAL ENTRIES (green) update the general ledger. All transactions posted to the general ledger worker payments are posted automatically as the result of steps in the payment issuance process, and do not require any manual intervention.

- a. Pay statement vouchers post to the general ledger to record the various expenses and withholding for payroll payments. The offset on these entries for the net payment amount is a credit to the payroll clearing account, not a cash account. They are generated automatically during the Post pay statements step.

- b. Vendor invoice vouchers post to the general ledger to record the accounts payable invoice to the payroll vendor. These journal entries always contain only a debit to the payroll clearing account and a credit to accounts payable. They are generated automatically during the Submit pay statements step.

- c. Pay statement vouchers post to the general ledger to record the cash payments to the workers. These journal entries always contain only a debit to accounts payable and a credit to cash. They are automatically generated during the Submit pay statements step, and posted during the Post payment journal step.

Additional information about the payroll process in AX can be found by searching the Stoneridge Software blog for ‘AX Payroll’.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.