1099 Form Changes for 2013 and Dynamics AX 2012

The United States Government has made changes to the 1099 forms for 2013 1099 reporting. A description of the form changes is listed below:

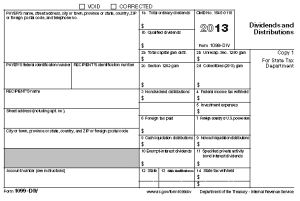

1099-DIV:

1. RECIPIENT’s name box is smaller vertically

2. Street address has been moved up due to RECIPIENT’s name box being larger.

3. City, State and ZIP Code box is larger vertically.

4. The location for the Account number and 2nd TIN not. boxes moved below blank box.

5. Blank box has moved above Account number and 2nd TIN Not.

6. Boxes 12 through 14 allow for a second data entry. (Size hasn’t changed though)

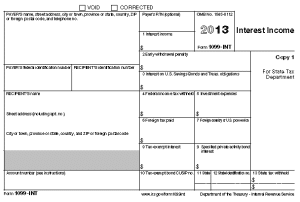

1099-INT:

1. 1099-INT changed from a 3 per page format to a 2 per page format for 2013. This has shifted all boxes.

2. Boxes 11 through 13 allow for a second data entry.

3. A blank box has been added above the Account number/2nd TIN not.

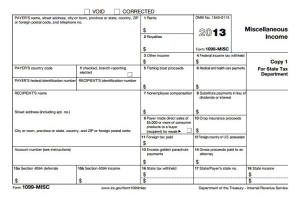

1099-MISC:

1. RECIPIENT’s name box is smaller vertically

2. Street address has been moved up due to RECIPIENT’s name box being larger.

3. City, State and ZIP Code box is larger vertically.

4. Box 11 is now used to report the foreign tax paid on payments reported on Form 1099-MISC. Box 12 is used to enter the name of the foreign country or U. S. possession for which the foreign tax was paid

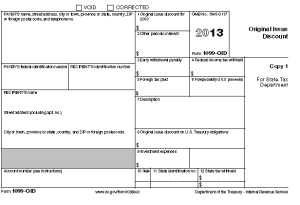

1099-OID:

1. Box 5 is used to enter any foreign tax paid on OID. Box 6 is used to enter the name of the foreign country or U. S. possession for which the foreign tax was paid.

2. 1099-OID changed from a 3 per page format to a 2 per page format for 2013. This has shifted all boxes.

3. Boxes 10 through 12 allow for a second data entry. (Size hasn’t changed though)

Microsoft has released a hotfix KB to accommodate the government changes to these 1099 forms via hotfix KB # 2918317. To obtain this hotfix KB #2918317, visit the following Microsoft Web Site:

https://support.microsoft.com/hotfix/KBHotfix.aspx?kbnum=2918317

It will be important that this hotfix is installed to ensure that the 1099's that you print out of Dynamics AX 2012 to the preprinted 1099-MISC, 1099-DIV, 1099-INT-, and 1099-OID forms align to the respective boxes on the form.

If you need any help, please reach out to contact us.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.