Setting Up 1099 Software Vendor Information in Dynamics AX 2012

There is a multitude of 1099's processed in January. Here is the basic information you need to know in order to set up 1099 software vendor information in Dynamics AX 2012. One of the fields required by the Internal Revenue Service when filing 1099 information electronically is information regarding who the software vendor is that wrote your 1099 file creation software.

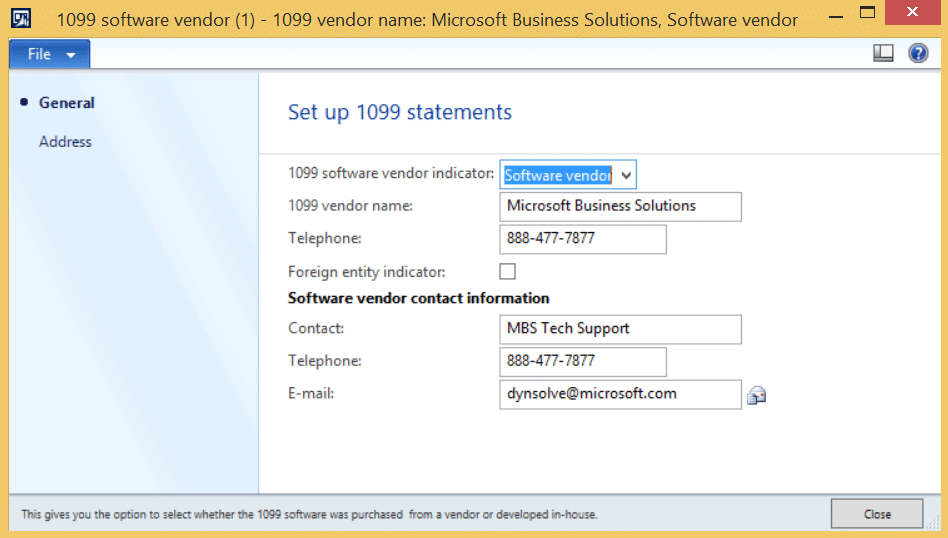

The specific fields required for the 1099 software vendor information include:

- Whether the 1099 filing software was built in-house or by a software vendor (Unless you aren’t using the filing from Dynamics AX, in which case, you can quit reading this blog post, you would always choose Software vendor.)

- The 1099 software vendor name

- Telephone number of the software vendor

- Name, phone and email of the contact person/team of the software vendor

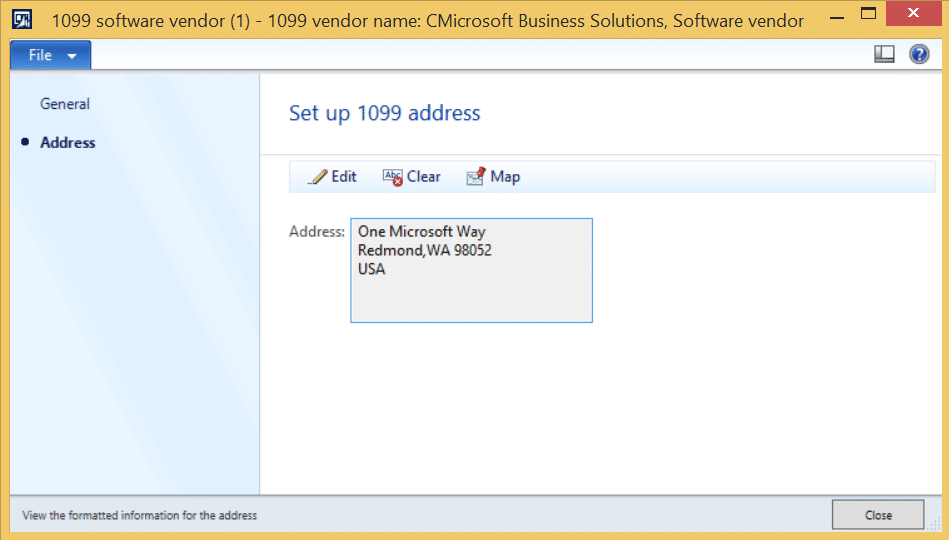

- Address of the software vendor

This information can be entered when creating legal entities (Organization administration > Setup > Organization > Legal entities), on the Tax 1099 fast tab, using the 1099 Software vendor button. It’s optional, but if you haven’t entered this information ahead of time, when you try to file, Dynamics AX will force you to enter it at that time.

When recently setting this up for a new client, I had some difficulty figuring out what to set these values to, so I reached out to my friends at Microsoft on the Dynamics AX product team for assistance. Their recommendation for populating these fields was as follows:

So this January, or whenever you need to populate this information, now you know what to set these field values to.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.