Balancing Financial Dimension Field in AX 2012 R3

In the past, I worked on an implementation for a company that had a line of business slightly different than the rest of their organization. My initial instinct was to utilize the Business Unit financial dimension and split the company into two Business Units. Through further discussions with the client I gathered the requirement that they needed to be able to produce a balance sheet for this line of business, so basically a balance sheet by financial dimension. I wasn’t sure how to make this work until I discovered the Balancing financial dimension field in the Ledger form in AX.

Here’s how it works:

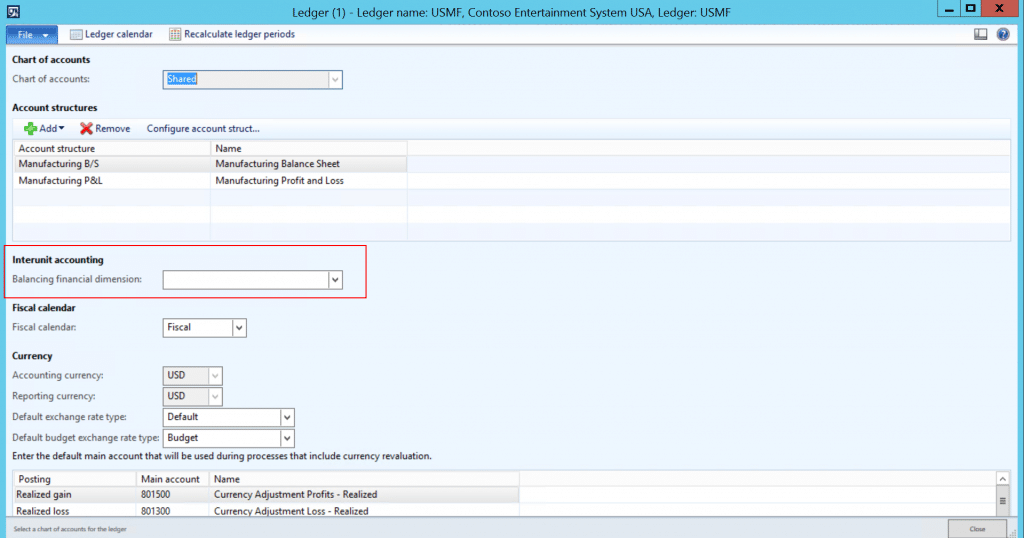

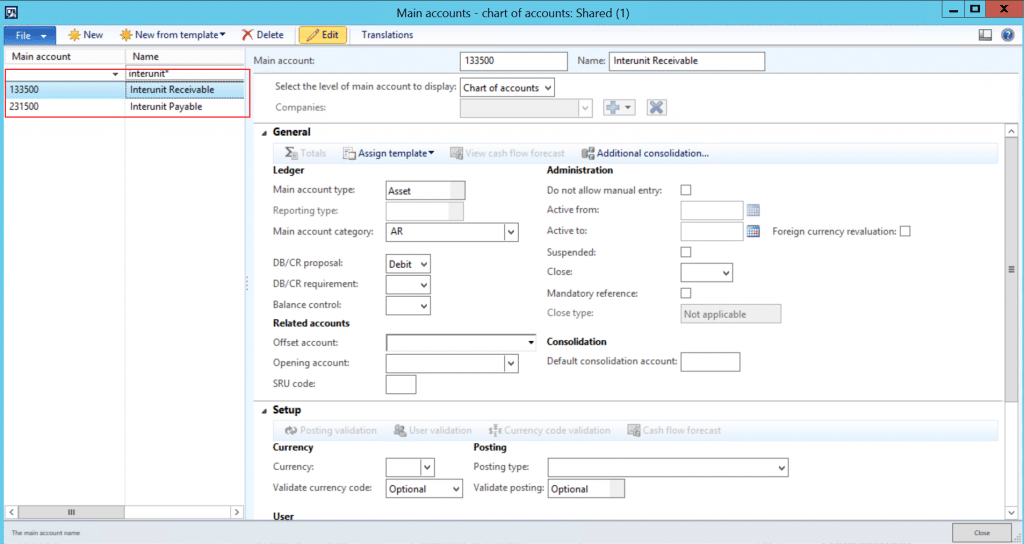

1. Create interunit debit and interunit credit balance sheet main accounts:

General ledger>Common>Main accounts

*When you enter the balancing financial dimension in the system and the entry does not balance at the level of the financial dimension values, additional entries are created automatically and are posted to the main accounts created above.

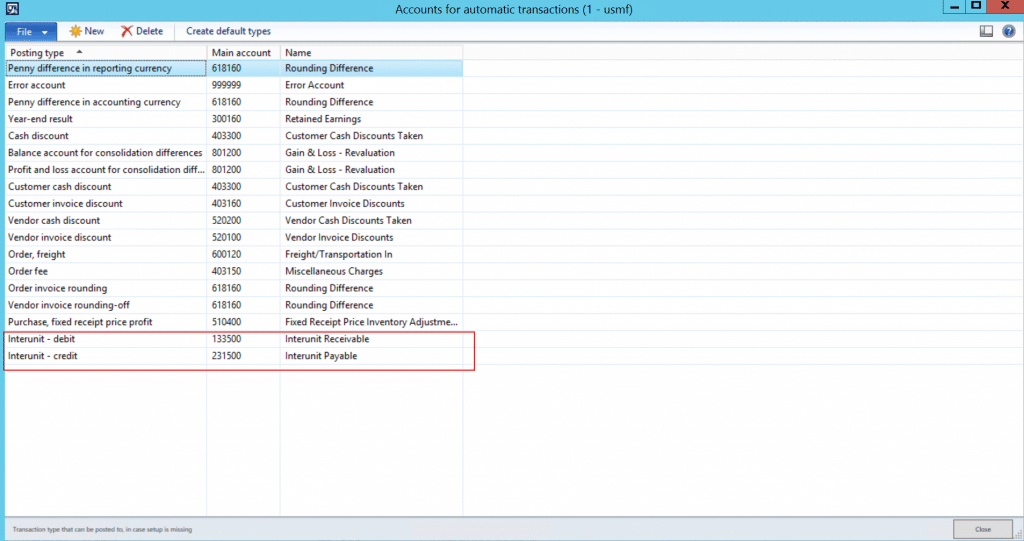

2. Setup accounts for automatic transactions for interunit accounting:

General ledger>Setup>Posting>Accounts for automatic transactions

*When you enter the balancing financial dimension in the system and the entry does not balance at the level of the financial dimension values, additional entries are created automatically and are posted to the main accounts created above.

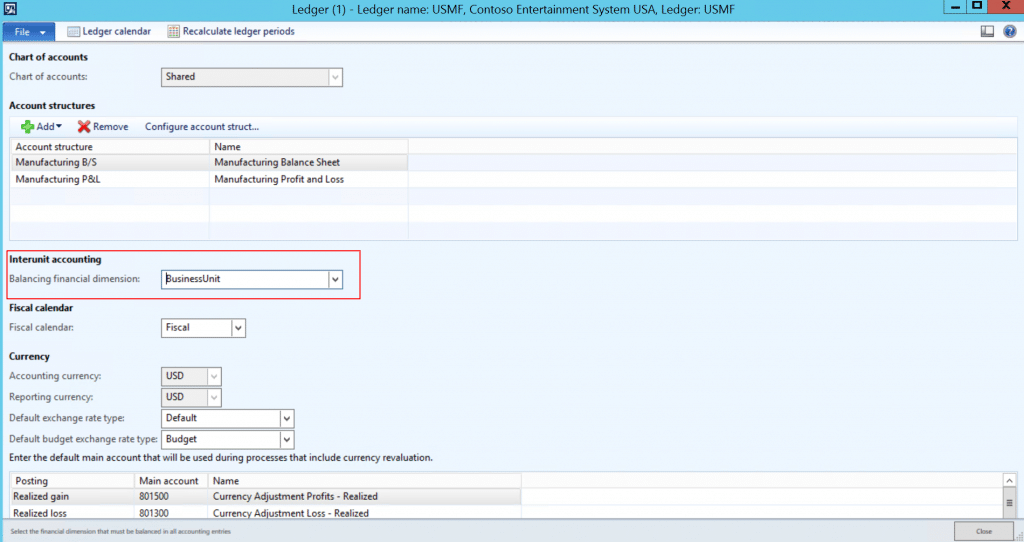

3. Select the balancing financial dimension for interunit accounting:

General ledger>Setup>Ledger

*You must select a financial dimension that is included in all account structures that are assigned to the ledger and the balancing financial dimension must not allow for blank spaces as dimension values.

Let’s see how this all works!

Scenario:

Company USMF has an Administrative department in which all salary expenses are allocated to two different Business Units.

Allocation %:

Business Unit 1 = 75%

Business Unit 2 = 25%

Account Structure 1 (Expenses):

Main Account + Business Unit + Department

Account Structure 2 (Balance Sheet):

Main Account + Business Unit

Salary Expenses of $100,000 are originally booked to the following main account and financial dimension combinations:

Debit - Salary Expense + Business Unit 1 + Admin Department $100,000

Credit – Cash + Business Unit 1 $100,000

At the end of the month the Salary Expense needs to be allocated 75% to Business Unit 1 and 25% to Business Unit 2, which is illustrated in the following entry:

Debit - Salary Expense + Business Unit 2 + Admin Department $25,000

Credit - Salary Expense + Business Unit 1 + Admin Department $25,000

If we did not select the balancing financial dimension of Business Unit in the Ledger form (Step 3. Above) your balance sheet would not balance for the financial dimension of Business Unit in this scenario. Luckily we did, so AX generates the following entry when you post the allocation entry above to ensure that the balancing financial dimension of Business Unit is balanced.

Debit – Interunit Receivable + Business Unit 1 + Admin Department $25,000

Credit – Interunit Payable + Business Unit 2 + Admin Department $25,000

-------------------------------------------------------------------------------------------------------------------------------

Balance Sheet Business Unit 1:

Assets

Cash ($100,000)

Interunit Receivable $25,000

Total Assets ($75,000)

Liabilities

Owner’s Equity

Retained Earnings ($75,000)

Total Liabilities + Owner’s Equity ($75,000)

-------------------------------------------------------------------------------------------------------------------------------

Balance Sheet Business Unit 2:

Assets

Total Assets ($0)

Liabilities

Interunit – Payable $25,000

Owner’s Equity

Retained Earnings ($25,000)

------------

Total Liabilities + Owner’s Equity ($0)

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.