Dynamics AX Error: Field Tax Code Must Be Filled In

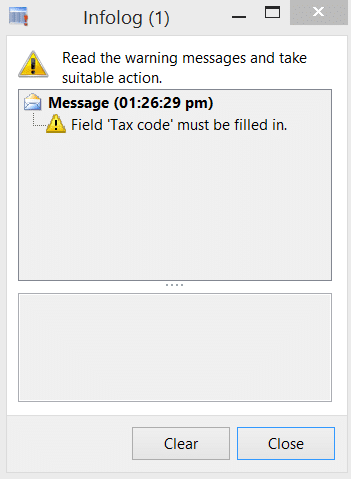

I recently came across an issue in Dynamics AX when creating a new payroll tax transition from the Tax transaction history detail inquiry. The Dynamics AX error stated: Field Tax Code must be filled in.

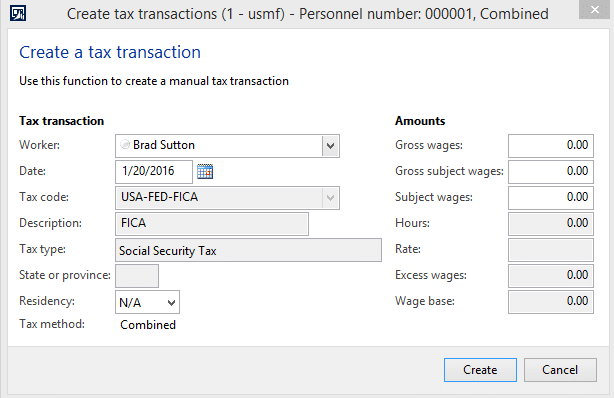

This error seems disingenuous because when you review the Create tax transaction form, the Tax code field is clearly populated (it is, after all, a required field).

As it turns out, there is another tax code field that we aren’t seeing in the form that is causing the issue.

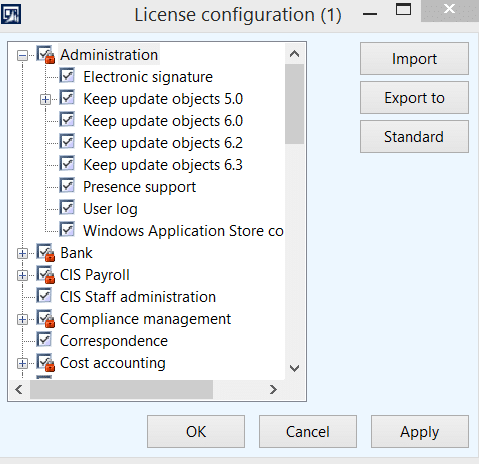

When your Microsoft Dynamics AX License Configuration has the options for Keep update objects marked, AX will crate and store fields and tables that begin with the extension DEL_.

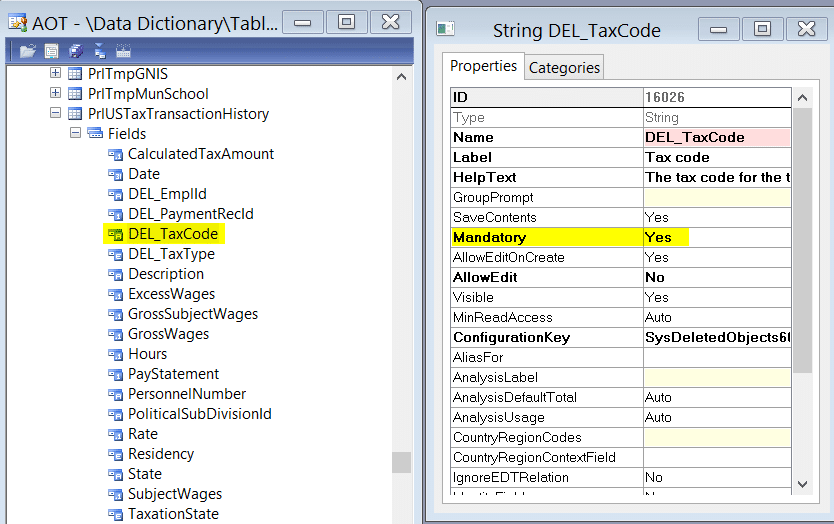

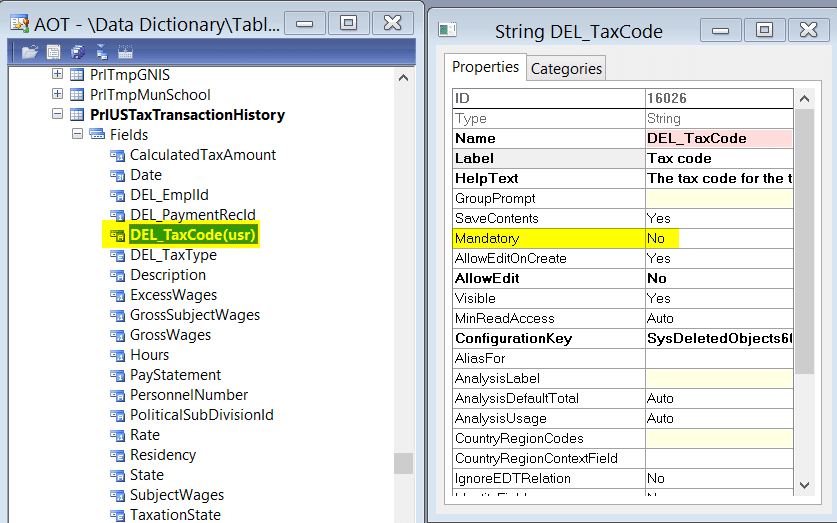

The field that is causing this specific issue is the Del_TaxCode field in the PRLUSTaxTransactionHistory table. When you take a peek at this table in your AOT, you will find that this pesky field is set as Mandatory.

Now, we can’t access the DEL_TaxCode field from the user interface therefore, we cannot resolve the error message and create the tax transaction line which means the payroll processing team is not going to be pleased.

To resolve this error issue, update the Mandatory setting for this field in the AOT to No. Save and compile the change to the PRLUSTaxTransactionHistory table and the payroll team will be forever in your debt.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.