Dynamics GP Year-End Close 2023 Guide for Canada

It's the time of year to start thinking about Dynamics GP year-end close and what you need to do to get your system and team prepared!

Throughout November and December, Microsoft will release a series of blogs to break down the individual aspects of your year-end close. The first blog will be released on Nov. 14, 2023. View Microsoft Dynamics GP Year-End close blogs here.

The Dynamics GP Year-End release is scheduled for November 17, 203. The Canadian payroll release is scheduled for December 22, 2023.

Let Stoneridge Help You with Your Dynamics GP Year-End

Over 100 Dynamics GP clients schedule their year-end close with Stoneridge Software every year. We can assist your team in navigating all of the aspects of your close and help you complete it.

What You Need to Know About Your Dynamics GP Year-End Close

As part of your year-end process, you want to post all transactions and complete month and quarter-end procedures for all modules except your General Ledger (G/L).

Then you'll have to complete your year-end closing procedures in the order below:

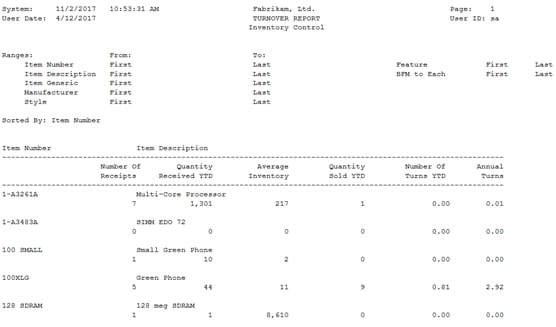

Inventory

Closing Inventory is optional.

Fields updated by the year-end close are mainly used for reports and quantity summaries. If these fields are unimportant you do not have to close inventory. Things to consider:

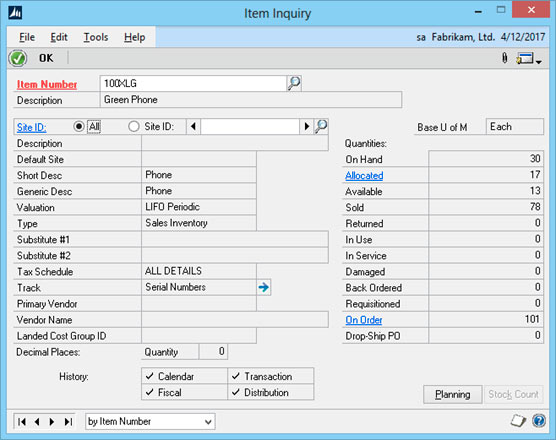

- The Sales Quantity in the Item Inquiry or history window - This is reset to zero by the year-end close process.

- The Inventory Report - Without a year-end close, the item beginning quantities for the year will be inaccurate.

If you use Average Perpetual to value your inventory, the average cost is determined by all the receipts received. The year-end close will remove purchase receipts that have been completely sold.

The next receipt will then cause the average cost to be revalued with the receipts that remain.

Receivables

1) Calendar Close

There are two year-end close processes in Receivables. The first is Calendar Close, which clears your calendar year-to-date finance changes to last year and affects:

- Finance Charges CYTD

- Finance Charges LYR Calendar

- Total # FC LYR

- Total # FC YTD

- Total Finance Charges LYR

- Total Finance Charges YTD

- Total Waived FC LYR

- Total Waived FC YTD

- Unpaid Finance Charges YTD

Note if you print customer statements and show year-to-date finance charges on them, this will not print on a December or January statement. If you run into this issue, you can contact us and our GP Support team will assist you.

2) Fiscal Year Close

The second process for Receivables is the Fiscal Year Close. This moves all amounts, other than the calendar year-to-date finance charges, to last year. Objects affected by the year-end close:

- Average Days to Pay – Year

- High Balance LYR

- High Balance YTD

- Number of ADTP Documents – LYR

- Number of ADTP Documents – Year

- Number of NSF Checks YTD

- Total # Invoices LYR

- Total # Invoices YTD

- Total Amount of NSF Check YTD

- Total Bad Debt LYR

- Total Bad Debt YTD

- Total Cash Received LYR

- Total Cash Received YTD

- Total Discounts Available YTD

- Total Discounts Taken LYR

- Total Discounts Taken YTD

- Total Returns LYR

- Total Returns YTD

- Total Sales LYD

- Total Sales YTD

- Total Writeoffs LYR

- Total Writeoffs YTD

- Write Offs LYR

- Write Offs YTD

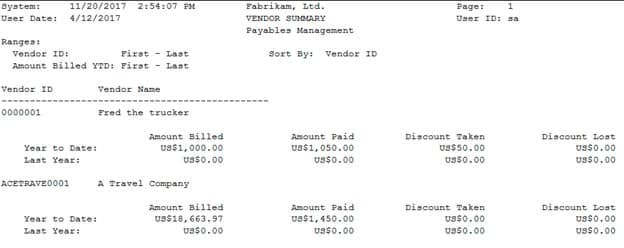

Payables

Similarly, there are two year-end close processes in Payables. The first is Calendar, which transfers 1099 (a US Tax form) from this year to last year. The second is fiscal, and has two functions:

- Adds last year amounts to life to date

- Transfers year-to-date amounts to last year's columns in the amounts since the last close views

As you can see, your vendor summary report will be updated:

Fixed Assets

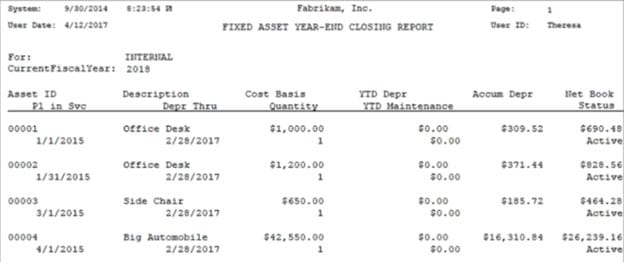

Dynamics GP 2015 and more recent versions have a new option for Fixed Asset Year-End Closing Report. It shows:

When to close Fixed Assets:

Close ALL books after you close payables but before you close General Ledger.

All assets MUST be depreciated through to the last day of the current fixed assets year. Additionally, all books must e closed before you run depreciation in the new year.

There are three main areas to consider when closing Fixed Assets:

Asset General:

- YTD Maintenance is cleared from the expanded last maintenance window

- Quantity is copied to the begin quantity field in the expand quantity window

Asset Book:

- YTD Depreciation Amount is cleared

- Costs basis is copied to the beginning year cost field

- Life-to-date depreciation is copied to the beginning reserve fields

- The salvage value is copied to begin the salvage field

Book set up:

- The current fiscal year is incremented to the next year

- Note it is important to not change the current fiscal year in the book setup window.

Do not manually change the year in the book set-up window to allow you to run depreciation in the next year and then change it back to the current year. It will affect your depreciation in the last periods of the year. In GP 2013 and beyond the current fiscal year field is locked down to avoid this.

Canadian Payroll

To close your Canadian Payroll, you must:

- Complete all pay runs for the current year

- Complete any necessary 2023 payroll reports

- Have Stoneridge install your 2023 Payroll tax update

- Complete the year-end file reset process

- Create Edit and Print your T reports

- Verify your pay periods for 2024 are set up as needed

The year-end close process moves all your current data into the last year's tables. There is no consideration for a date. You must complete all 2022 payrolls and run the file reset process before processing any 2023 pay runs.

Analytical Accounting

There are no separate steps to close Analytical Accounting (AA), as the year-end close process is automatically integrated with the year-end close process for General Ledger. However, it is important to always verify AA data is accurate before closing the year.

General Ledger

The last thing you'll need to do to finish your year-end close is wrap up your General Ledger.

It's important to ensure you have a backup of your company database before doing this, while also making sure all other users are logged out of the company at the time of closing.

If closing to retained earnings using divisional retained earnings ensure that a retained earning account exists for each unique value in the divisional segment.

Ensure unit accounts that need to roll forward or reset to zero are marked accordingly in unit account maintenance.

Let the close process run to completion, even if the process bar appears to stop. There are 7 steps in the year-end close process:

1 - Make sure all accounts marked as Profit and Loss will have their balances moved to retained earnings

2 - The accounts marked as Balance Sheet must have their balances roll forward to the next accounting year

3 - Ensure that all accounts are set with the correct Posting Type

4 - If you do not check the Maintain Inactive Accounts box in the year-end close window, then Inactive accounts with no balance and no historical transactions are removed

5 - Check to ensure the year you just closed is marked as historical

- Dynamics GP allows you to post entries one historical year back. If you need to post something from two years ago, consider waiting to close the year

- Reverse Year-End functionality alieves the need to not close as you can reopen years as needed

6 - If you have Analytical Accounting installed, close it

7 - If you are using currency translation as part of a multicurrency consolidation, enter any new values required for the newly closed year

When in doubt, reach out to Stoneridge Software! We are happy to assist you.

Questions?

Getting your Year-End close process right is important! Please reach out to us if you need any assistance.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.