How to Use Customer Credit Management in Dynamics 365 Finance and Operations

Utilizing customer credit management in Dynamics 365 Finance and Operations is crucial to your financial management process and can significantly impact your business’s cash flow, risk mitigation, and overall profitability.

In this blog post, we’ll dive into the strategic ways credit management can bolster your company’s financial health and operational efficiency.

Why Customer Credit Management in Dynamics 365 Finance and Operations is Significant

The credit management feature in Dynamics 365 Finance and Operations is more than just ensuring your payments to vendors and customers payments to you are on time. It’s an expansive strategy that influences your company’s profitability. It helps you:

- Prevent late payments.

- Strategically manage credit limits.

- Maintain a healthy cash flow.

- Mitigate the risk of shipping goods to customers who may pose financial challenges.

In many situations, you might have to hire a specific person to manage this or outsource it to a third party. With credit management, you can manage it internally.

How to Track and Rate Customers with Credit Management in Dynamics 365 Finance and Operations

To fully understand how credit management can help your business, it’s important to look at some of the core functionalities. By doing so, we hope to show you how the system can empower you to proactively manage credit risk and optimize your financial performance.

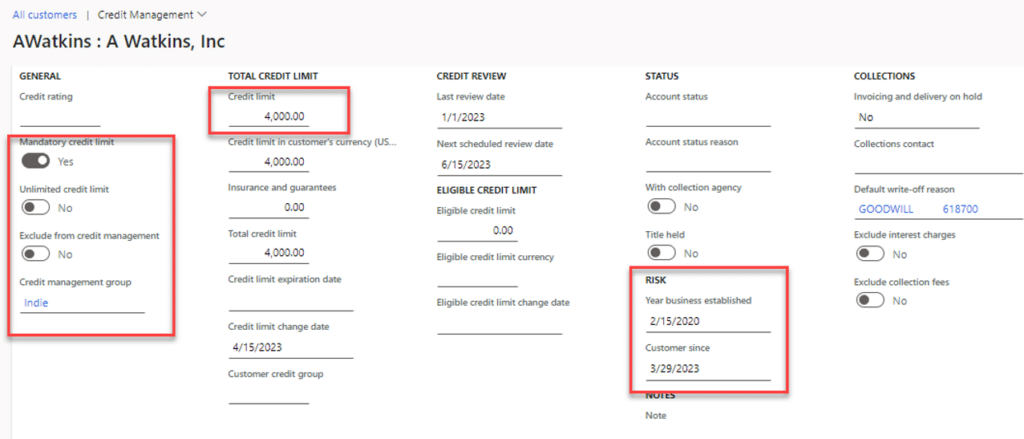

Credit Management Groups

Organizing customers into credit management groups based on shared properties eliminates the need to set up each customer individually. This streamlines credit limit tracking and risk assessment, saving you time, and maximizing your team's efficiency by freeing them up to focus on other areas.

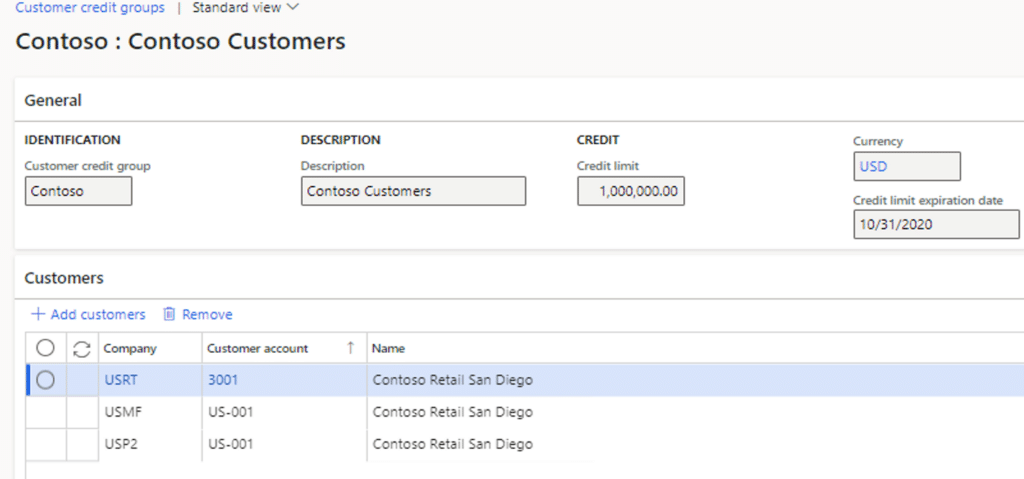

Customer Credit Groups

These function similarly to credit management groups but allow you to apply credit rules to a company and all possible subsidiaries.

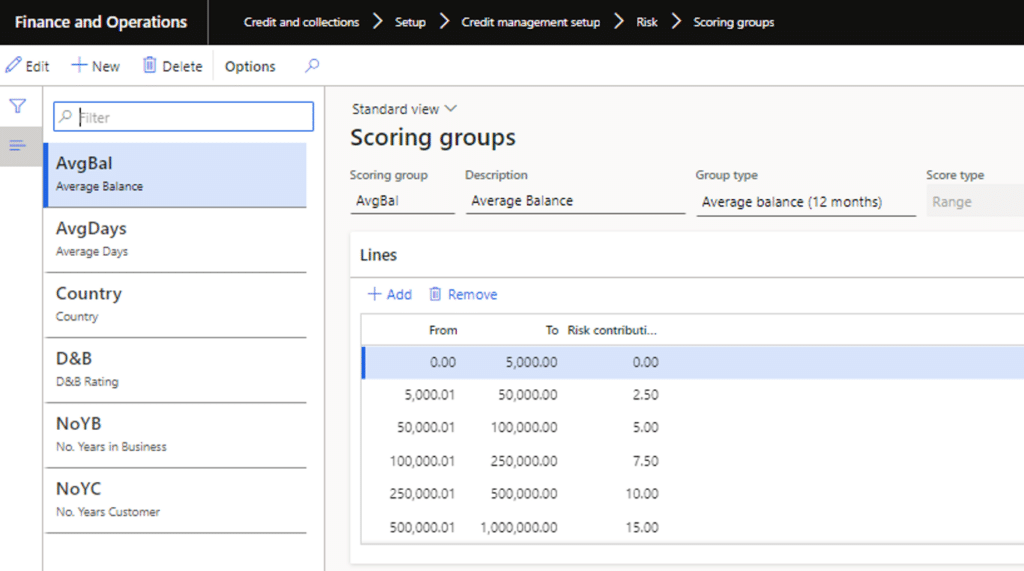

Scoring Groups

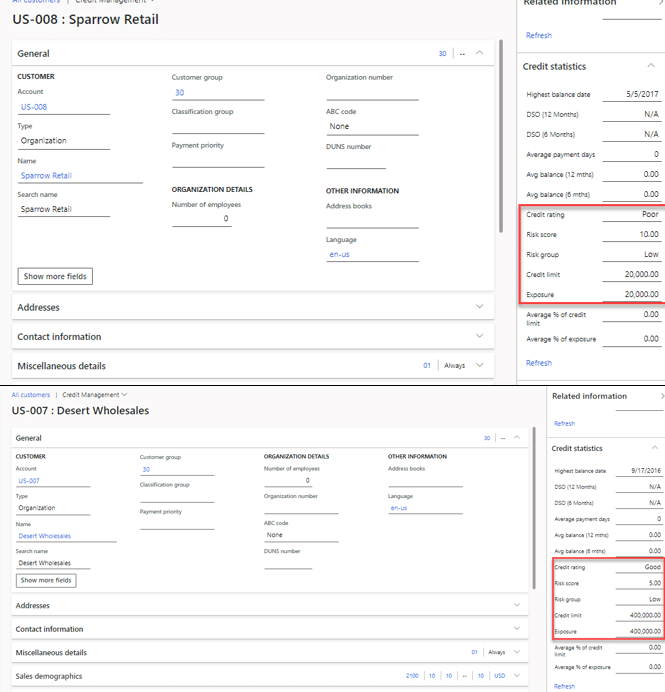

Scoring groups help you evaluate risk factors associated with certain customers. This can be defined either by you or by eight out-of-the-box definitions programmed into the system. Scoring groups help you categorize customers by risk factors such as transaction history and financial data.

All of the criteria set in the rules above this section categorize different clients into various scoring groups. Dynamics 365 Finance and Operations also automates the calculation of these scores and lets you check a customer's credit statistics right on the Credit Management screen. If you want to take a deeper dive, you can also go into specific customer records and view their stats.

How to Manage Customers Based on Credit in Dynamics 365 Finance and Operations

Blocking Rules and Exclusions

You will want to set blocking rules to prevent orders from being automatically processed for customers with high credit risks. The nice thing about these rules is they are flexible, which lets you tailor your approach based on internal risk scores and other metrics you might use to measure customer risk. For example, you might have a customer with great credit and if their score is good enough they can bypass all of the blocking rules. Inversely, a customer with a bad credit score or with outstanding debts will be flagged to prevent unnecessary averaging.

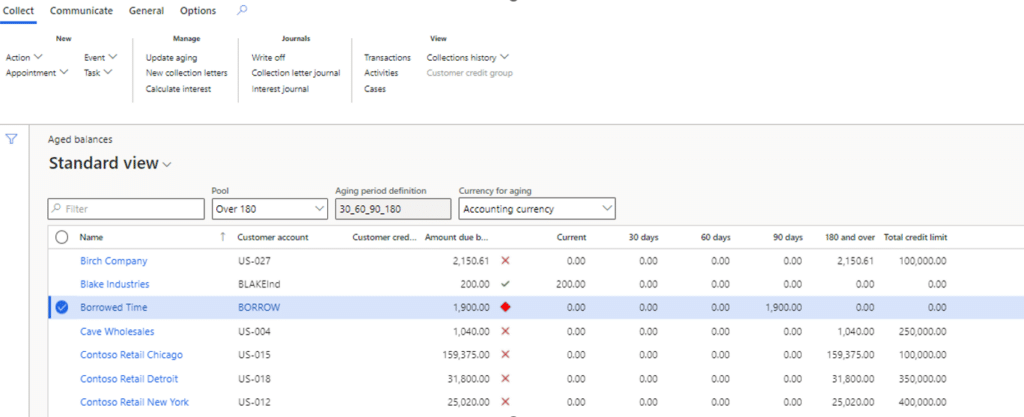

You can track all customers as a whole, as groups, or as individuals. Some criteria you might look at include:

Number of days a payment is overdue

- Account status

- Terms of payment

- Credit limit expired

- Overdue amount

- Sales Order amount

- Credit limit used

If a customer is blocked, credit management will alert you and you can determine why that customer is blocked and how it can be resolved.

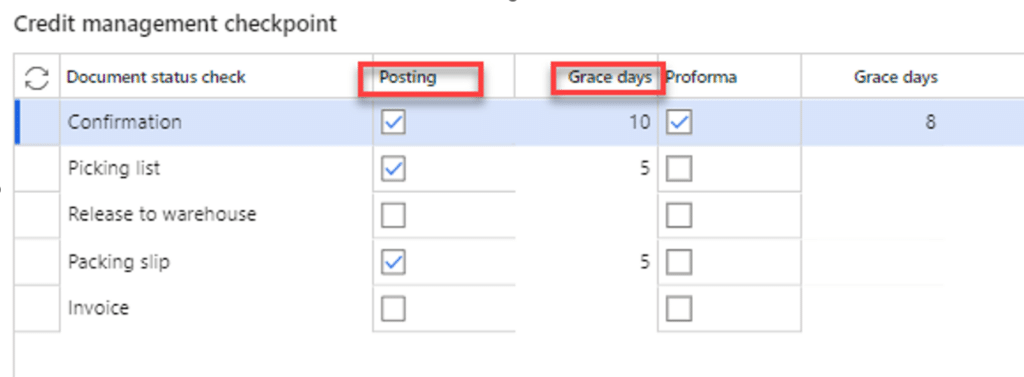

Grace Periods and Credit Limit Expiry

The system offers control over when blocking rules take effect, including grace periods for adjusting credit limits and preventing immediate disruptions in business transactions. Here you can also set checkpoints for certain customers based on their credit standing to your organization, including blocking customers whose credit limits have expired.

There might be some cases where you want to exclude certain customers whose credit limit expires. The system allows you to customize that so you can allow certain clients to bypass that in order to keep your sales process flowing smoothly.

Deduction Tracking and Management

This feature allows you to manage short pay, deductions, and discounts within your system. You can record, evaluate, and address deductions with the option to approve or deny them based on predetermined criteria you and your team establish.

Deduction management is a particularly useful feature as it can be very difficult to track something like that manually. The system makes it easy for you to spot these instances and correct them efficiently.

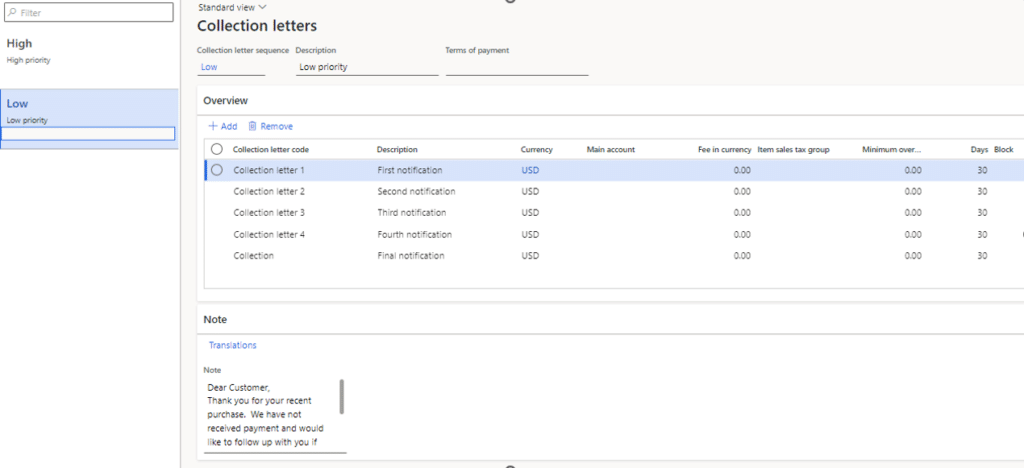

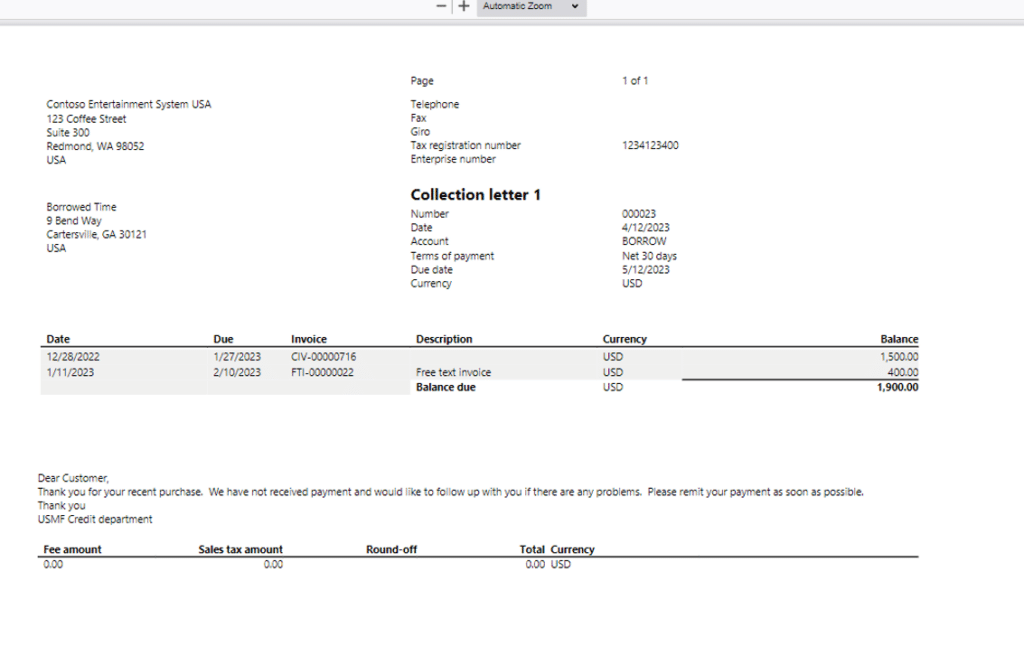

Collection Letters

This streamlines communication with customers regarding overdue payments. You can automate these letters to go out at predetermined times and customize them to follow a more critical trajectory the more overdue the payment is.

For example:

- The first letter might be a polite warning that a balance is owing

- The second letter will warn them that action will be taken if the balance isn't paid off

- The third letter will notify them that interest will start being charged against their balance

- The fourth letter will tell them that the balance has been sent to a collection agency

Case Management

Case management capabilities let you track customer interactions, collection activities, and follow-up actions. You can create cases based on aged balances and get a holistic view of what a customer is doing, what they owe, and what can be done to resolve the issue.

Stoneridge Can Help You Maximize Efficient Credit Management and Achieve Financial Stability

Hopefully, this blog post showed you the positive benefits of harnessing the capabilities of credit management in Dynamics 365 Finance and Operations. At Stoneridge, we want to give you practical insights and actionable strategies to help your organization operate as efficiently as possible.

Please get in touch with our team to learn more about how we can help!

Prefer video? Head to our YouTube page to view a recording of a webinar on this topic.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.