Partial Disposal of an Asset in Dynamics AX 2012

I sometimes get asked how to dispose of part of an asset within Dynamics AX 2012. A scenario might be “We want to dispose of part of our corporate headquarters, say the garage, which is run down & needs to be scrapped. At the time of it’s construction, it made up about 5% of the value of the corporate headquarters.”

The short answer is: You can’t directly, partially dispose of a single asset.

The long answer is: There does exist a method that will allow you to dispose of part of an asset. The trick is that first you need to split the asset into two separate assets and then dispose of one of those parts.

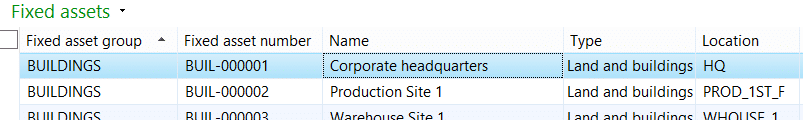

In Contoso data, Asset BUIL-000001 is the Corporate headquarters.

Step 1 –

For partial disposal you must first create a new asset for the Garage portion of the Asset, in our case, it’s asset BUIL-000018 – Garage.

Step 2 –

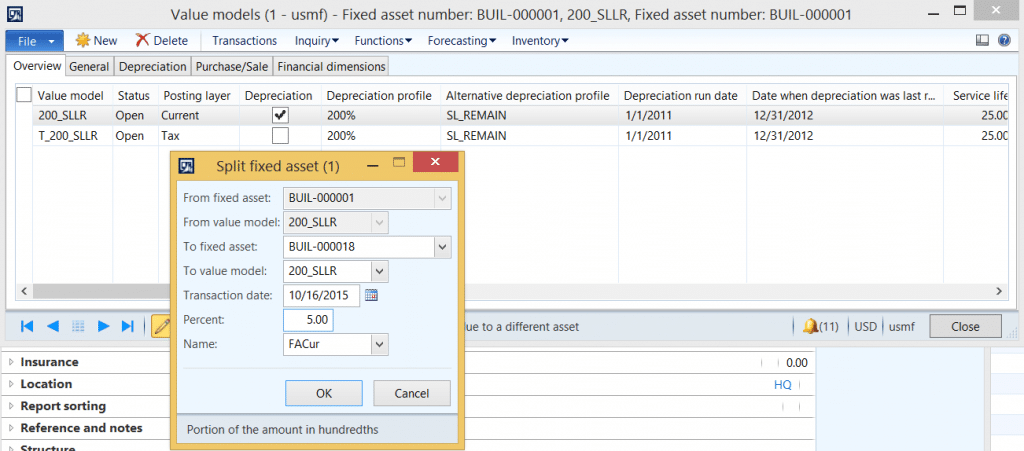

Then you must split the asset by going to the Value Models for the Corporate headquarters asset BUIL-000001 & choosing Functions > Split asset

Step 3 –

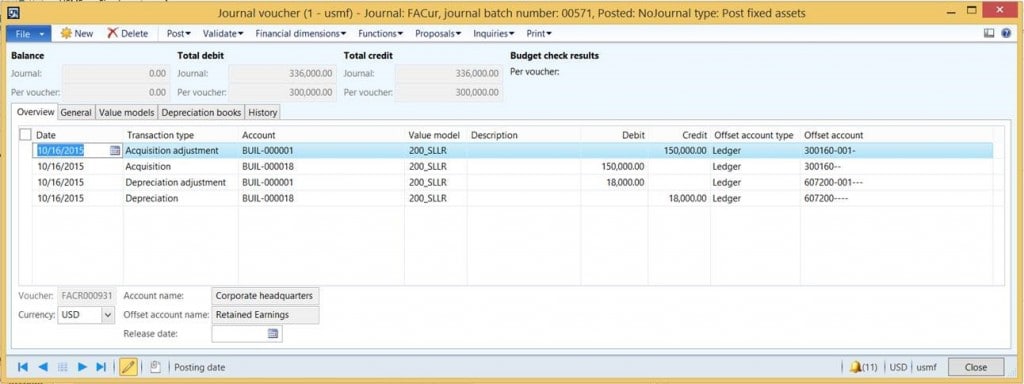

Next, post the newly created journal that is created in the Journal name you specified in the above dialog. Note that it backs out the 5% from the Corporate headquarters asset & creates a new Acquisition of the Garage asset, as well as moving the Depreciation between assets.

Step 4 –

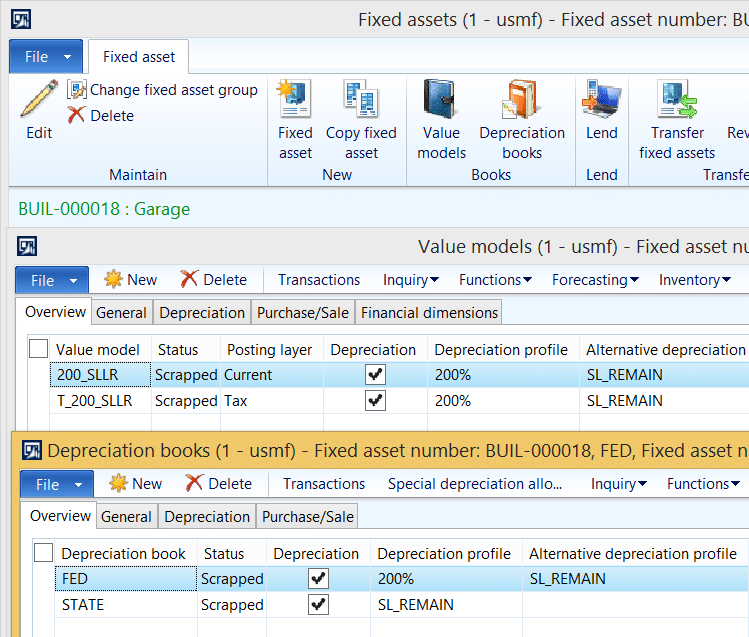

Repeat the process until you have Split each of the Value models & Depreciation Books & posted the corresponding journals.

Step 5 –

Scrap the Garage Asset in a Fixed Assets Journal using a Transaction type of Disposal-Scrap, or Sell the Garage Asset using a Free Text Invoice. Either method will mark the Asset as Scrapped.

You have now partially disposed of your asset.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.