Allocation Rules vs. Ledger Allocation Rules in AX 2012 – Part 1

Many businesses need the ability to allocate transaction or account amounts across multiple accounts or account/dimension combinations. AX delivers functionality to automatically calculate and allocate transaction amounts prior to posting, and to automatically calculate and post allocation of account balances on a periodic basis. In this series of posts we’ll walk through setting up both scenarios. Let’s begin by reviewing the high-level information necessary to compare the two features.

Allocation Rules in Dynamics AX 2012

Allocation rules are defined on the set up of individual Main accounts, and result in the immediate allocation of transaction amounts during the posting process. Allocation rules are defined only in terms of fixed percentages, and are defined on a company-by-company basis. It is not possible to view the calculated allocation prior to posting entries to accounts with associated Allocation rules.

Ledger Allocation Rules in Dynamics AX 2012

Ledger allocation rules are used to automatically calculate and generate journal entries for the allocation of account or account/dimension combination balances. Calculation of allocations can be based on fixed percentages, fixed weights, equal distribution, or basis as defined in the associated Ledger allocation basis. Ledger allocation rules are user-triggered, and can be processed at any time. The ‘Process allocation request’ process allows a user to process the Ledger allocation rule and preview the resulting journal entry before either posting or deleting the calculated allocation. A separate Ledger allocation rule must be set up and processed for each defined source. There isn’t a process to allocate multiple sources at once.

SETTING UP ALLOCATION RULES

Setting up Allocation Rules Sources

To define Allocation terms on a main account, navigate to General ledger > Common > Main accounts and add (or edit) the account which is to be used to generate automatic allocations during the posting of day-to-day transactions. From the company drop-down, select the company for which you want to define Allocation terms. Select the Allocation: checkbox on the General FastTab to enable the Allocation terms button on the General FastTab. Click the Allocation terms button to open the Allocation rule form.

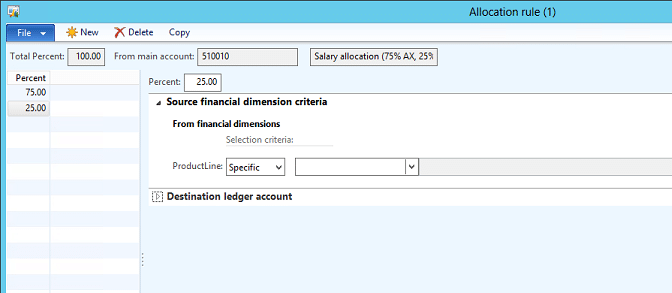

Within this form, specify first the percent that you want to allocate to a specific destination in the Percent field. Expand the Source financial dimension criteria FastTab and specify the financial dimension combination from which the specified percentage is to be allocated by choosing first Specific from the ProductLine (or whatever your dimension names are) and then the specific financial dimension value from the second drop down.

Important information about the Source financial dimension criteria FastTab: if you want to allocate all transactions posted to this main account, regardless of the financial dimensions, then choose Unspecific. If you want to allocate only transactions posted to this main account without a financial dimension, then choose Specific, and leave the value dropdown field blank. In the above example, the company needs for some transactions to be posted to a specific product line and not allocated, so they set up the allocation rule for only transactions in which a financial dimension is not specified. The result of this configuration is that a transaction posted to account combination 510010-10 will result in no allocation, but a transaction posted to main account combination 510010- will result in allocation of 75% of the transaction total to the main account combination defined on the Destination ledger account FastTab.

Please note that when this window is closed, validation occurs to ensure that no more than 100% is allocated from any one financial dimension combination. For example, if you specified Unspecific for account 510010 (meaning any transaction to this account should be allocated per the rules, regardless of the financial dimension value) and then used Specific to define a rule for account combination 510010-10, AX would try to allocate transactions posted to 510010-10 using both sets of rules, in essence, trying to allocate 200% of the transaction line. Validation occurs to prevent this type of definition. If you need to specify that specific dimension values for this account to post via one set of rules but that all transactions without a dimension assigned need to post via a different set of rules, then set up multiple allocations – one for each necessary specific account information, and one for Specific with no dimension assigned.

Setting Up Destinations

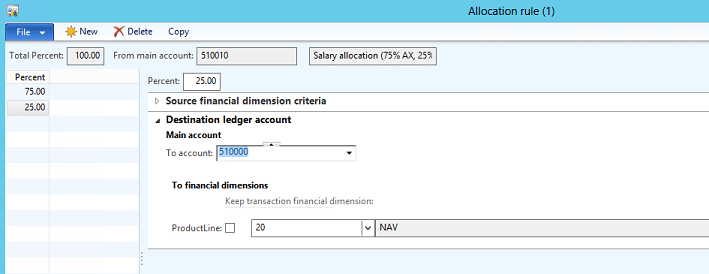

From within the Allocation rule form, expand the Destination ledger account FastTab.

From the To account dropdown, select the Main account to which the specified percentage should be posted. In the To financial dimension section, select the financial dimension values to which the amount should post for each of the financial dimensions presented.

To keep the financial dimension the same as the original transaction, select the checkbox next to each financial dimension name. For example, if you want to split all amounts posted for trade show booths between Marketing Expenses and Sales Expenses while keeping the same financial dimensions as the original transaction, you would set up a Main account ‘Trade Show Booths’ and specify two different percentages (50% each) with the same source financial dimension (Unspecified) but different destination ledger accounts, (one to Main account ‘Marketing Expenses’ and one to Main account ‘Sales Expenses), and the checkbox for Keep transaction financial dimensions selected for each destination ledger account.

Practical Information

To keep things user-friendly, when adding accounts which will be used to allocate transactions to other accounts, I like to specify the breakdown in the account description. Reviewing an account’s allocation requires navigating the chart of accounts to drill back to the Allocation rules form, as allocation percentages are not presented or reported anywhere else. Specifying allocation percentages in the account description can save time.

Calculation of allocations occur during the posting of the transaction automatically, without user intervention. Allocation cannot be inactivated from the transactional windows – the only way to stop transaction amounts from being allocated is to change the Allocation rules on the Main account.

Account combinations which are set up to be 100% allocated will never carry a balance, nor present transactional history, as transactions never post to these account combinations. They are merely holding buckets on unposted transactions that will be used to perform automatic calculations for the resulting posted transaction. However, you can drill back on the original document (for example, the vendor invoice) to verify that an account with automatic allocation was specified on the document.

Changes made to Allocation rules are not retroactive, and will only affect unposted transactions.

Continue reading more on this subject and setting up Ledger Allocation Rules here: Allocation Rules vs. Ledger Allocation Rules - Part 2.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.