Allocation Rules vs. Ledger Allocation Rules in AX 2012 – Part 2

In my first post discussing Allocation Rules vs. Ledger Allocation Rules in AX 2012 - Part 1, I went over setting up allocation rules, resources and destinations as well as providing some practical information on the subject. Below you'll find a refresher on the high level information comparing the two features, and then I'll get into setting up ledger allocation rules.

Allocation Rules in AX 2012

Allocation rules are defined on the set up of individual Main accounts, and result in the immediate allocation of transaction amounts during the posting process. Allocation rules are defined only in terms of fixed percentages, and are defined on a company-by-company basis. It is not possible to view the calculated allocation prior to posting entries to accounts with associated Allocation rules.

Ledger Allocation Rules in AX 2012

Ledger allocation rules are used to automatically calculate and generate journal entries for the allocation of account or account/dimension combination balances. Calculation of allocations can be based on fixed percentages, fixed weights, equal distribution, or basis as defined in the associated Ledger allocation basis. Ledger allocation rules are user-triggered, and can be processed at any time. The ‘Process allocation request’ process allows a user to process the Ledger allocation rule and preview the resulting journal entry before either posting or deleting the calculated allocation. A separate Ledger allocation rule must be set up and processed for each defined source. There isn’t a process to allocate multiple sources at once.

SETTING UP LEDGER ALLOCATION RULES

Setting up Ledger Allocation Bases

Ledger allocation bases are used to calculate distributions proportionately, based on a user-defined formula.

A practical example: Company ABC allocates general expenses to departments based on each department’s labor costs in comparison to total labor costs. If Company ABC incurs $100,000 in total labor costs, and the marketing department accounts for $7,500 of those costs, the marketing department will be allocated 7.5% of all other general expenses (7,500/100,000). AX uses Ledger allocation bases to define these formulas.

Dynamics AX supports an unlimited number of Ledger allocation bases, meaning different Ledger allocation rules can be calculated using different bases. For example, some allocations could be based upon total labor costs while other allocations could be based upon total sales. Ledger allocation bases and Ledger allocation rules have a one-to-many relationship, meaning a single Ledger allocation basis can be used by multiple Ledger allocation rules.

Each Ledger allocation basis can be based upon a different time period. For example, a company may choose to allocate general expenses each month based upon that month’s total sales , but allocate annual expenses such as income taxes based upon yearly sales.

To maintain Ledger allocation bases, navigate to General ledger > Setup > Posting > Ledger allocation basis to open the Ledger allocation basis form, which contains a list of all existing Ledger allocation bases.

To add a new Ledger allocation basis, click the New button. The Basis ID may autocomplete, depending on the settings of the Number sequence assigned to Basis rules in the General ledger parameters. Add a description, effective date, expiration date (if applicable), select the checkbox for Active, and select a date interval. Please note, this date interval is used only to calculate the basis and proportionate shares. You could choose rolling 12 month date interval here to base the allocation share on 12 months activity, and later choose a current month date interval in the Ledger allocation rule setup – this would result in allocation of the current month’s expenses based upon totals over the last 12 months.

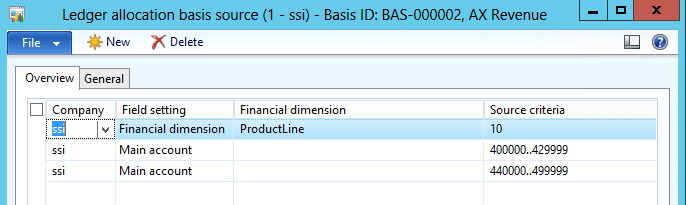

To review the account/dimension combinations that make up the total against which proportionate shares are calculated, highlight the appropriate Basis ID and click the Basis button to open the Ledger allocation basis source form.

In the example above, BAS-000002, AX Revenue is calculated as the total of all account balances from 400000 to 429999 and from 440000 to 499999, where the ProductLine is equal to 10.

Setting up Ledger Allocation Rules

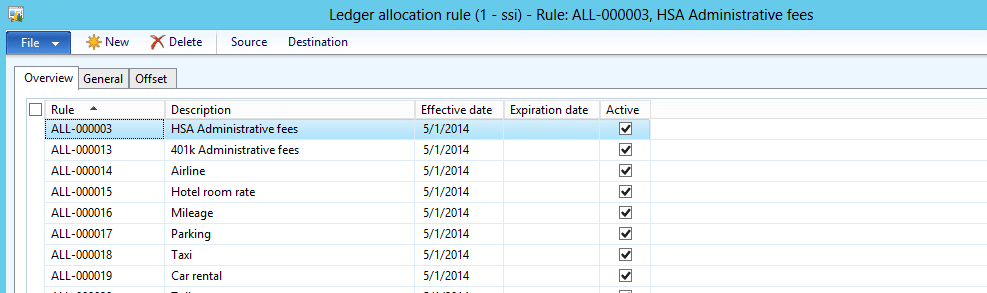

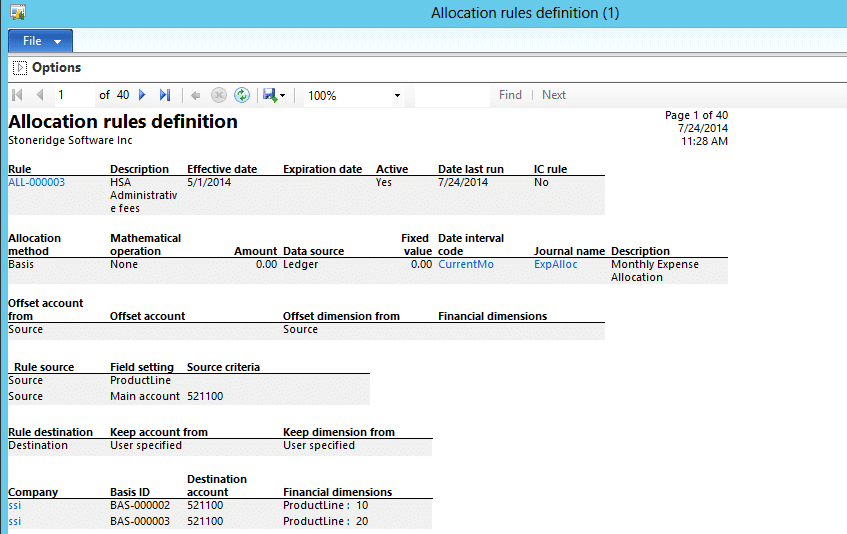

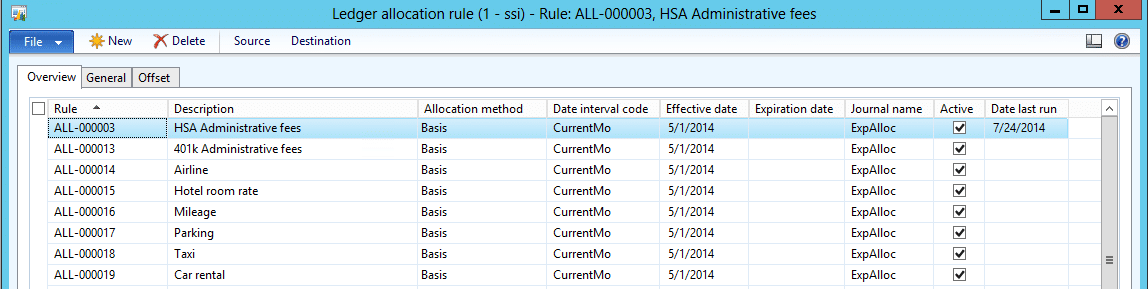

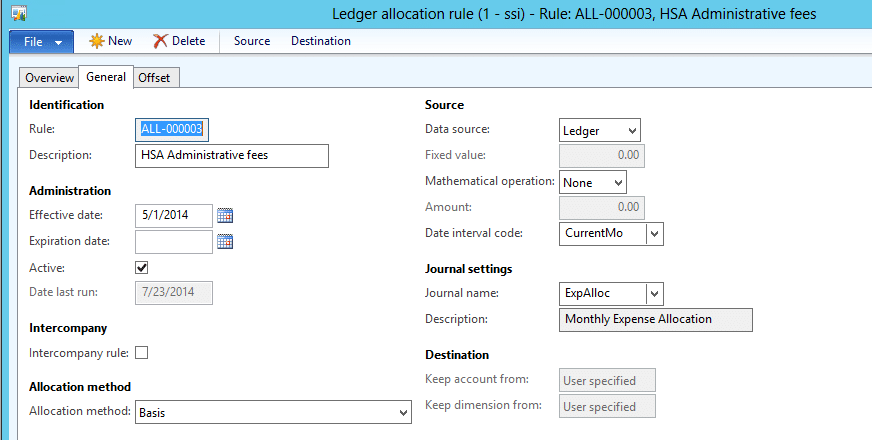

To maintain Ledger allocation rules, navigate to General ledger > Setup > Posting > Ledger allocation rules to open the Ledger allocation rule form, which opens to the Overview tab, containing a list of all existing Ledger allocation rules.

To add a new Ledger allocation rule, click the New button. The Rule ID may autocomplete, depending on the settings of the Number sequence assigned to Allocation rules in the General ledger parameters. Add a description, effective date, expiration date and select the Active checkbox. The Allocation method, found on the General page, must be selected to enable the Source and Destination buttons. Click on the General tab to move to the General page.

Rule, Description, Effective date, Expiration date and the Active checkbox will autocomplete with the values entered on the Overview page. These values can be edited on either page.

Select the Allocation method from the dropdown menu. Select the Data source from the dropdown menu. There are two choices here – Ledger will allocate amounts from account balances, Fixed amount will allocate the same amount each time the allocation rule is processed. For example, a company could choose to allocate $100,000 to select departments each month, regardless of the source account balances. Select the Date interval code from the dropdown. This is the date range of the amounts to be allocated, not the date range of the amounts to be used to determine basis. Select the Journal name from the dropdown.

Click the Offset tab to specify the Offset account. The default setting is Source, meaning entries will be posted to reduce the balances of the Source accounts. If you choose User Defined, the Source account amounts will not be reduced – instead, the Source accounts amounts will stay the same, and amounts will post to the offset account rather than reducing the Source account balance(s).

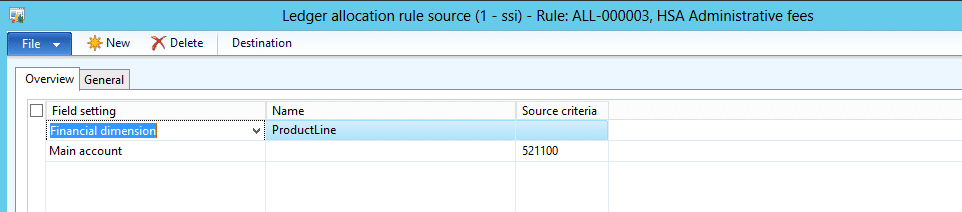

Click the Source button to define the accounts from which amounts will be allocated to destinations.

To add to the existing sources, click the New button. In the Field setting dropdown, select to base the new filter on either the Main account or a financial dimension. If Financial dimension is selected, select the appropriate financial dimension in the Name field. In the Source criteria field, select the account(s) or financial dimension value(s) to include for allocation. In the above example, the account combination 521100- has been selected for allocation. Please note, to allocate only the amounts in the main account that do not have a value for a specific financial dimension, you must add a line with that financial dimension specified to have a blank value, as above. If you specify only the main account on the source without a Financial dimension filter, all account combinations for that main account will get allocated.

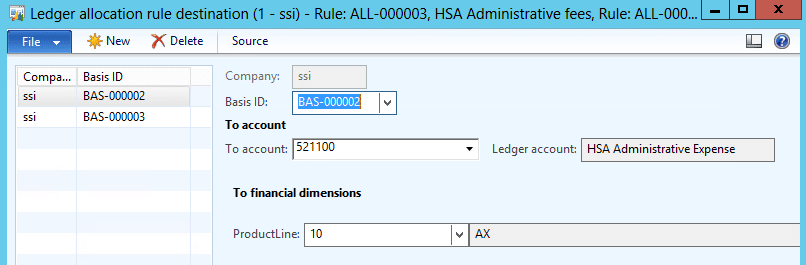

Click the Destination button to define which basis rules will comprise the total basis and the accounts to which the allocated amounts will be posted.

Total basis to be used for allocation is calculated as the sum of the bases assigned to all destinations. In the window above, total basis is the sum of Basis IDs-000002 and -000003. The percentage which will be allocated to account combination 521100-10, as pictured above, is the calculated as BAS-000002/(BAS-000002+BAS-000003). If only one destination is designated in this window, the whole source amount will be allocated to the account specified on the destination.

Reviewing Ledger Allocation Rules

Ledger allocation rules can be reviewed from within the maintenance forms, or by printing the Allocation rules definition report. To print this report, navigate to General ledger > Reports > Base data > Various > Allocation rules definition.

Processing Ledger Allocation Rules

To generate general ledger entries to allocate account balances from sources to destinations, Ledger allocation rules must be processed by navigating to General ledger > Periodic > Process allocation request.

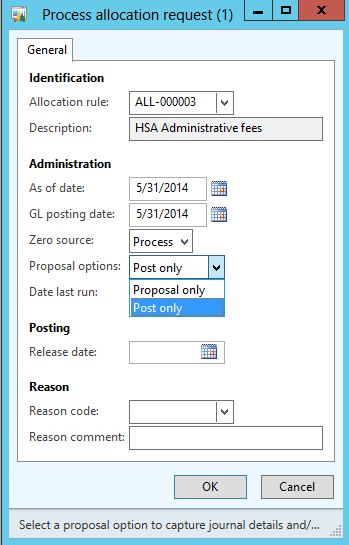

Select from the dropdown the Allocation rule to process. Select the As of date, which is the date at which the balance to be allocated is calculated, and is the date used in the date interval calculations. Select the GL posting date, which is the date to post the allocation entry in the general ledger. From the Zero source dropdown, select whether to process or stop the request if the source amounts are zero.

From the proposal options dropdown, select whether to process as a Proposal only, which can be reviewed and then either posted or deleted, or to process as Post only, resulting in immediate posting to the general ledger with no review.

In the Release date field, specify, if applicable, the date at which the transaction can be posted. For example, if this entry is to be posted to the general ledger dated 5/31/14, and the allocation request is to be processed 6/10/14 but should not be posted until 6/15/14, then enter 6/15/14.

Enter Reason codes and comments if applicable.

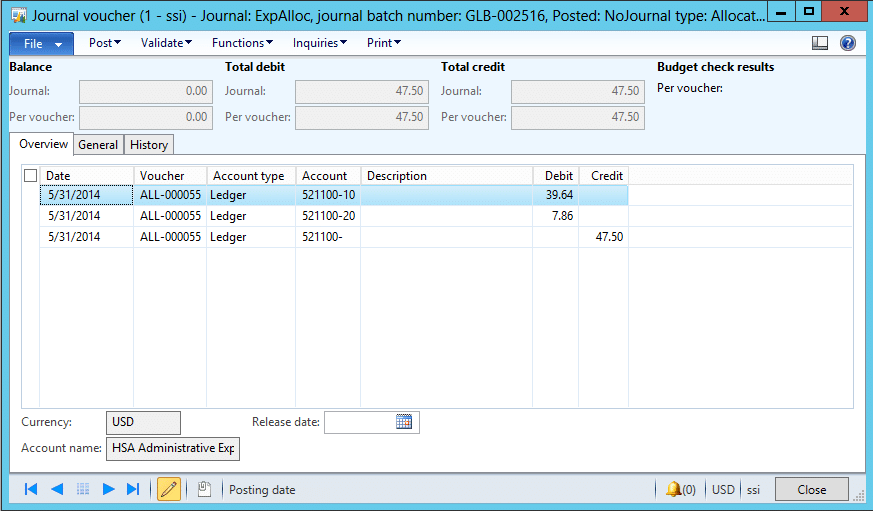

Reviewing Allocation Entries

To review and either post or delete the resulting entry, navigate to General ledger > Journals > Allocation. Select the appropriate Allocation journal, and click the Lines button to review the journal entry detail.

Practical Information

To keep things user-friendly, when setting up Ledger allocation rules, I try to be specific in the description regarding the source, as that is the only field in the Process allocation request window which provides insight into the account balances to be allocated.

I also like to personalize the grid on the Ledger allocation rule form (Overview tab). I include additional fields in the grid, providing a one-form view of all important information for all Ledger allocation rules. Below is an example where I’ve include the Allocation method, Date interval code, Journal name, and Date last run. For instructions on personalizing grids, please see the blog post ‘Reconciling Payroll Earnings in Dynamics AX 2012 R2’.

Processing allocation requests generate journal entries. Account history for source accounts remains intact, with the addition of the allocation general ledger entry, reducing the account balance.

Allocation requests can be processed as a proposal only and then deleted an unlimited number of times. Allocation rules allocate the balance at the time the request is processed. If a transaction is posted to a source account for a period that has already been allocated, the allocation rule must be processed again. Subsequent allocation requests will allocate only the balance at the time of the request, which will be made up of only new transactions since the last time the allocation rule was processed.

If you have any questions regarding allocation functionality within Microsoft Dynamics AX 2012, contact Stoneridge Software today.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.