GP Dynamics Payables Module: Importance of Dates

Even those who are seasoned in the functionality of the Payables Module within GP Dynamics can use a refresher from time to time on the different attributes of date functionality. There are four date fields that come into play when creating a payables transaction.

1. Document Date – This date is usually the invoice date or the check date. It affects the payables summary data and aging records. You can run reports and use the date as a restriction or sorting field. It also will serve as the default date. It defaults from your GP user date.

2. GL Posting Date – This date determines when the transaction will affect the General Ledger. It can be the same as the document date (or you can make them different, you can maintain the proper invoice date for aging and discount purposes but post to the GL on a different date, like in an example where a period has already been closed).

3. Posted Date – This date tells you when the transaction was actually posted in the system. You can see this date in a SmartList for payables transactions. It is determined by your computer’s system date.

4. The apply date is used to determine the period for which the payment or credit document applies to the invoice. You usually would think of this as the date of the payment, but the apply date can be different.

You see this date in four transaction windows in Payables:

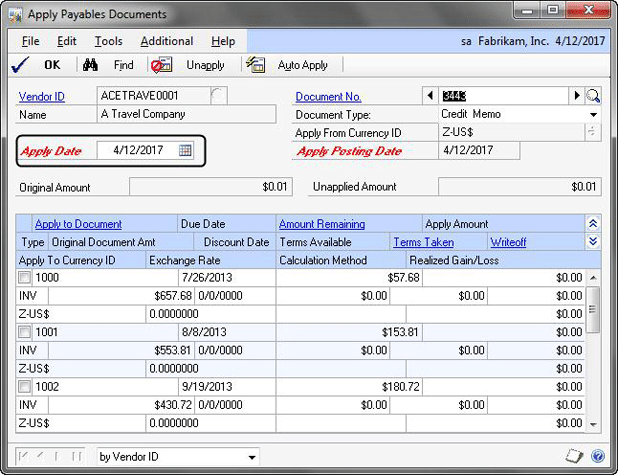

Apply Payables Documents

This window is accessed from various windows, such as the Manual Payments window, and the Payables Transactions menu. You can see on the above window the Apply Date field as April 12, 2017. However, you also see the date can be changed. On this window, the apply date comes from the document date if the window is accessed from the Manual Payments window. If you use the Payables Transaction Entry window or the menu to access the window, the apply date comes from the GP user date.

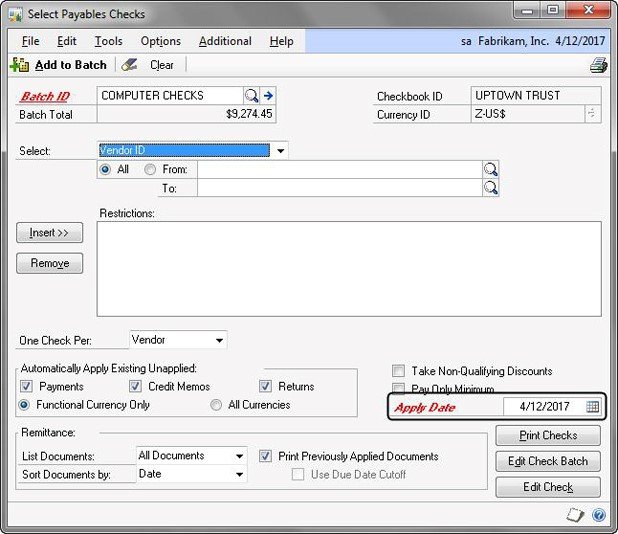

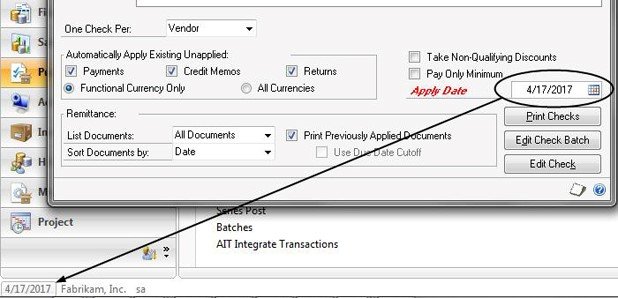

Select Checks

Most GP users use this window to create a batch of payables checks. By default, the apply date matches the GP user date.

Therefore, if you are processing checks in January but dating them in December, the default apply date will be in January unless you change it.

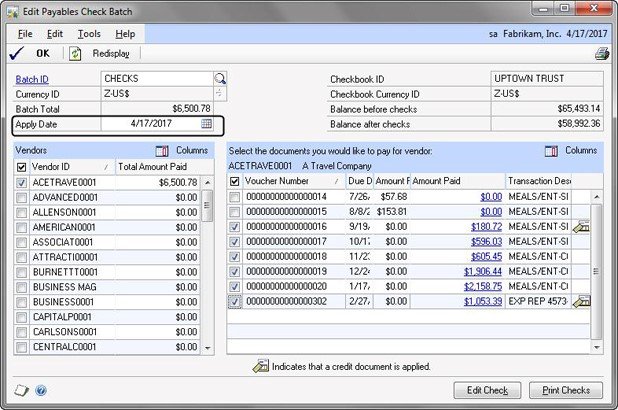

Edit Payables Check Batch

If this window is opened from the Select Checks window, the apply date defaults from the apply date on the Select Checks window. If you use the menu to access the window, the apply date defaults from the GP user date.

Edit Payables Checks

The date defaults from the Select Checks window or the GP user date, depending on whether you open the window from the Select Checks window or the menu.

Apply Date’s Effect on 1099 Amounts

You typically think of the check date as the determining factor for when the voucher is paid. However, GP uses the Apply Date field to determine in which period the 1099 amount should apply. Thus, if you have a payment dated in December but an apply date in January, the payment will not be in your December 1099 amount; it will be in your January amount. Unfortunately, the Payables Transaction SmartList does not have a column to display the apply date, nor does the apply date appear on reports or inquiry windows. You can find out when the invoice was paid—the key for 1099 amounts—by adding a “Date Invoice Paid Off” column to your Payables Transactions SmartList. The Apply Date field can make a difference on reports and 1099 processing. Make sure you pay attention to the field when processing payments or credit memo transactions and applying them to invoices. By utilizing this information, you will be able to better understand how the system works and reconcile your 1099 amounts in GP.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.