Manage U.S. Use Tax on Purchase Orders in Dynamics 365 Finance and Operations

Managing sales tax requirements on your business purchase can be complicated, but Dynamics 365 Finance and Operations can help make it easier!

Your vendors are generally responsible for charging the correct amount of tax to you, however, if the vendor does not charge your business correctly, it is your responsibility to pay the tax. This is called Use Tax or assessing use tax.

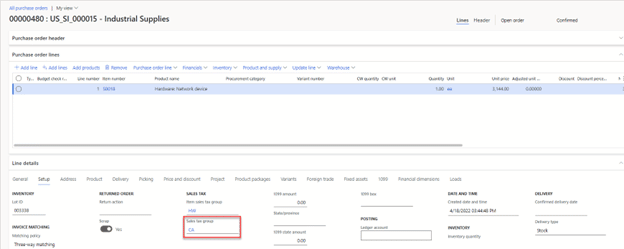

We encourage all businesses to include sales tax expectations within the purchase order. This is accomplished by adding the proper item sales tax group to each line of the purchase order and the sales tax group to the purchase order header/line. The item sales tax group can be set up as a default on the item or procurement category. The sales tax group can be set up as a default on the vendor.

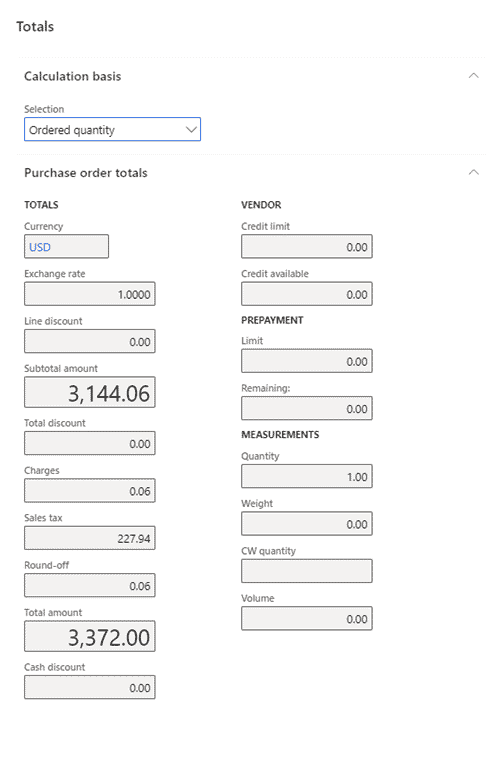

During the confirmation process, the purchase order will include an amount for expected sales tax:

Once the vendor invoice is received, the sales tax is expected to be included. If the vendor does not charge tax, consider the following approach:

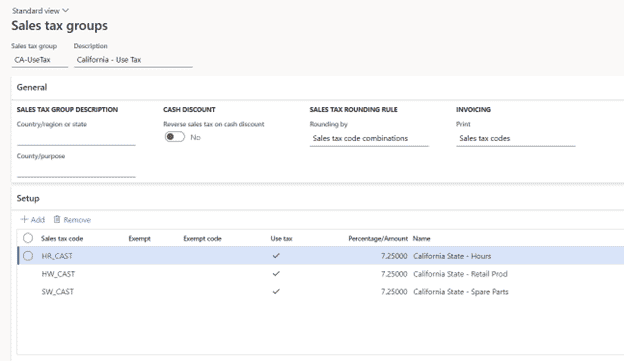

- Create a second sales tax group for the jurisdiction where use tax is being assessed (based on the delivery address, this is most likely the corporate office locations only). Indicate the group is used for use tax by checking the use tax box below

Note that this looks like a duplicate of an existing sales tax group.

The purchase order will be expecting sales tax to be included.

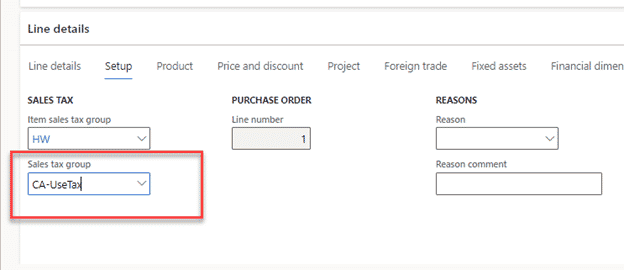

In this event, the vendor invoice does not include sales tax, the accounts payable clerk can adjust the sales tax group to the Use Tax group within the invoice posting process.

Changing the sales tax group to include sales tax allows you to post the vendor invoice at the amount owed to the vendor (excluding sales tax) and use tax liability assessed for the purchase.

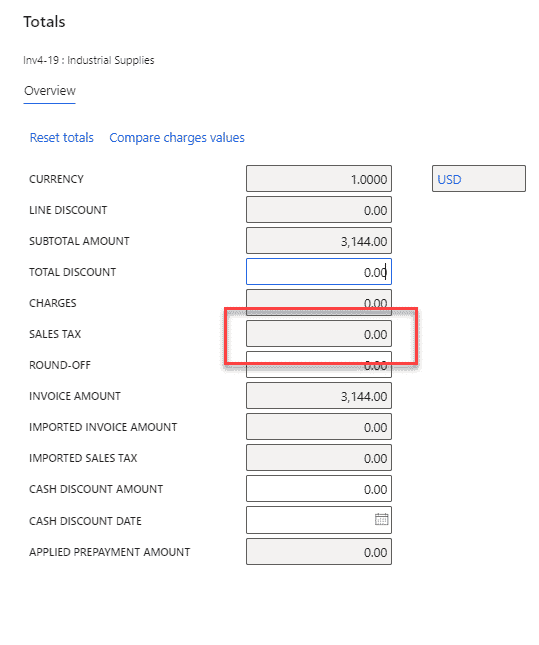

You can then fill out your invoice totals.

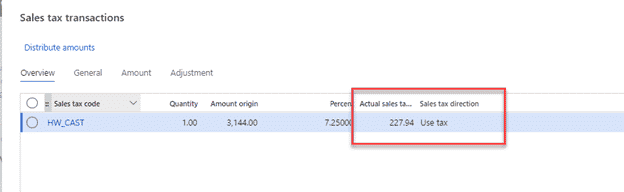

Then add your posted sales tax.

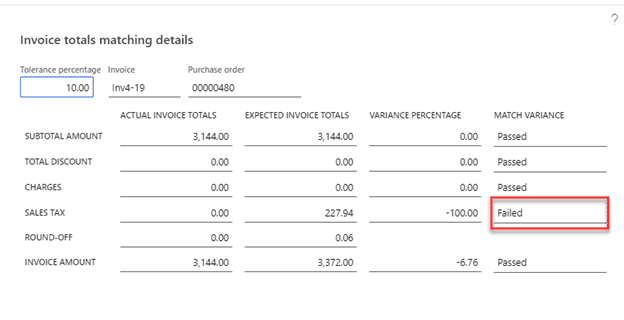

Note if invoice total matching details are activated, the exclusion of sales tax from the invoice will result in a matching variance.

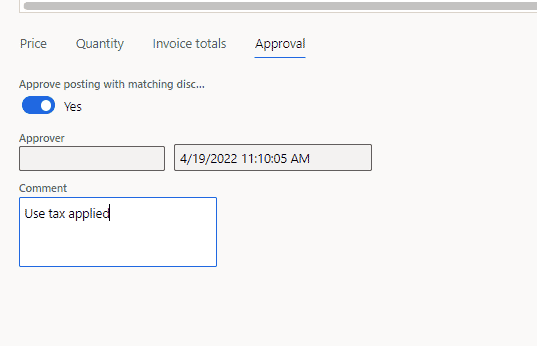

Your invoice can then still be posted by approving the variance.

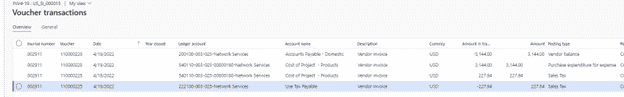

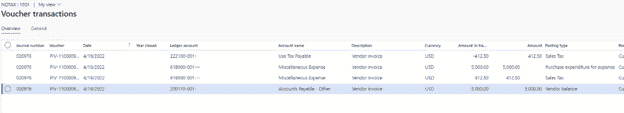

Then your Voucher is now posted with use tax.

The example above has demonstrated an item purchase for a project, the approach is the same if using a procurement category and non-project purchase – see the Voucher example below.

Questions?

Reach out to us for help optimizing your software solutions!

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.