Previewing Ledger Postings in Dynamics AX

Whether testing posting profiles, validating the sub-ledger or confirming journal entries, I often print the journal entries to my screen before I decide to post them. I was surprised to learn that not everyone knows how to do this! Read on learn about previewing ledger postings in Dynamics AX.

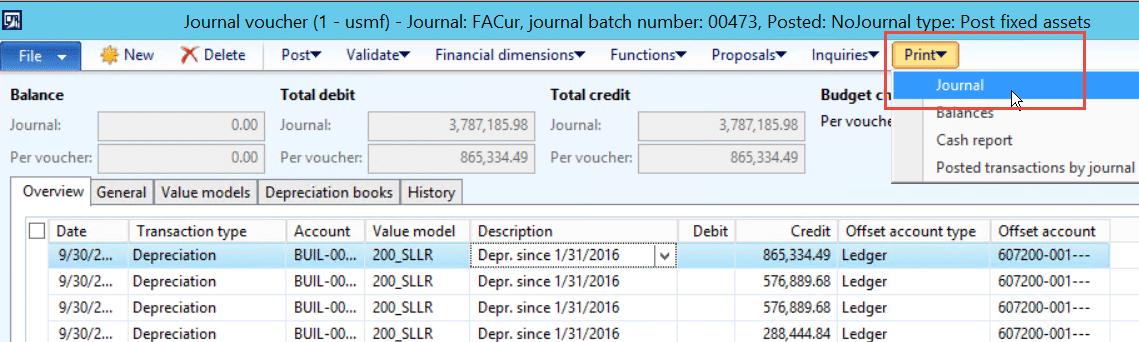

From any journal form, go to line view. Then select Print/Journal.

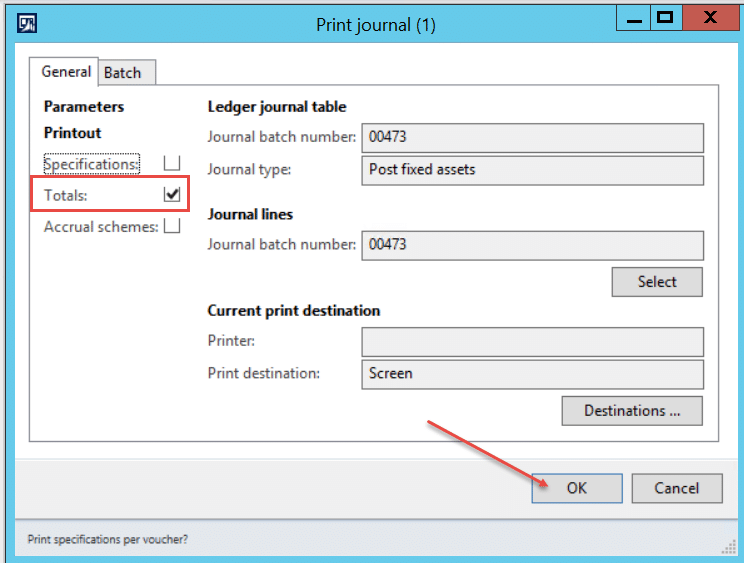

I like to see the totals, so I mark that setting as shown below.

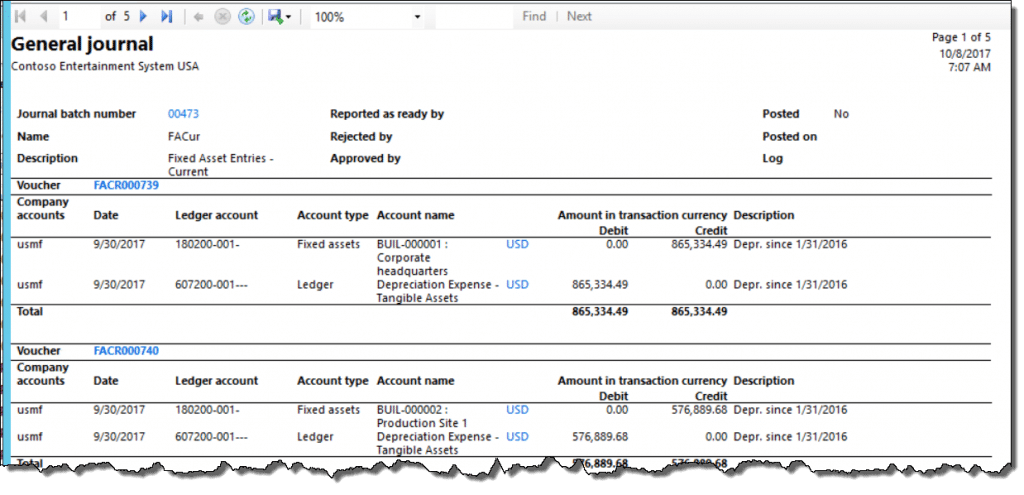

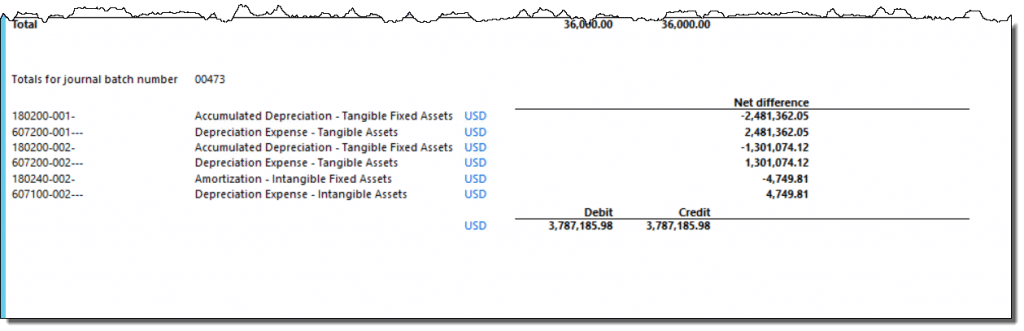

The output will display the ledger and offset accounts for each transaction, along with the financial dimensions. At the bottom of the last page, the net entry for each combination of the ledger account and dimensions is shown, as well as the total debit and credit.

There is a setting at the top of the report that allows for zooming in or out. I also will use the “Find” feature to search for specific values.

If there are dozens of entries to review, it may be practical to send the report to the printer rather than to review on screen.

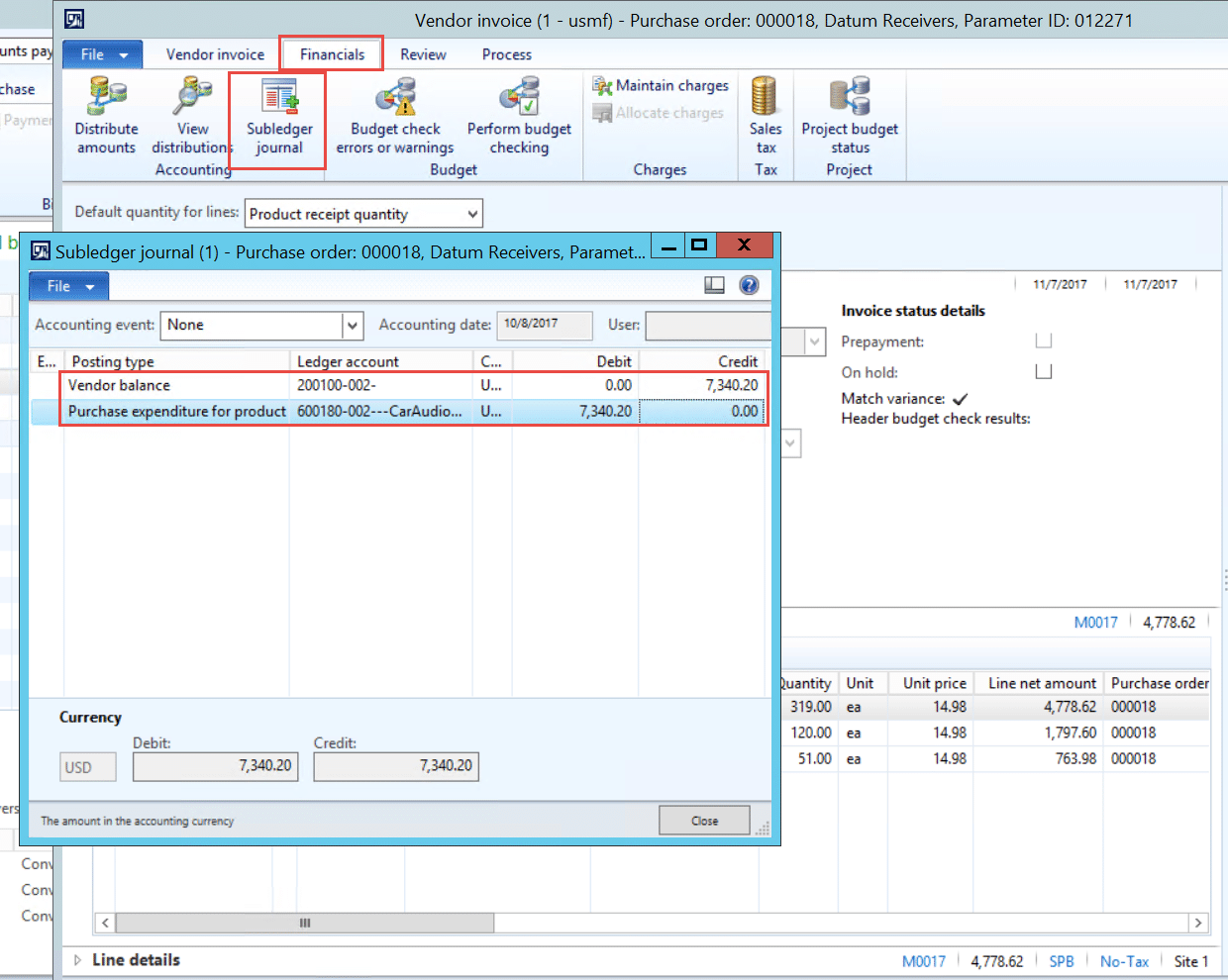

Another place that I often review sub-ledger entries is during vendor invoice processing. When processing an invoice from a purchase order, on the Financial tab, there is a Subledger journal button.

This displays the posting type, ledger, and financial dimensions, as well as debit and credit amounts.

Just keep in mind that this entry is to post the invoice only. When the invoice is processed for payment, another entry is posted to the ledger. These entries may be viewed from the payment journal using the print/journal method.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.