Using Sales and Purchase Journals in Microsoft Dynamics NAV 2017

In cases where you simply need to adjust a vendor or customer’s balance, the sales and purchase journals in Microsoft Dynamics NAV 2017 can be a big time saver.

Consider a case where we have an open sales invoice that needs to be written off to bad debt expense. In situations like this, no nicely formatted document is needed to be sent off to the customer, thus a full credit memo becomes overkill. Instead, the sales journal can be utilized to quickly adjust the customer’s balance.

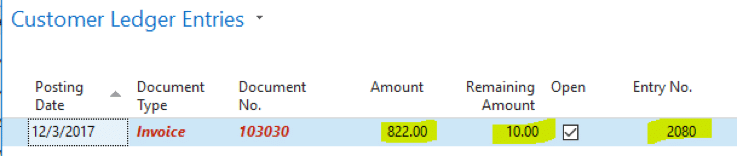

Take for example a case where your customer short-paid us by $10. If we never expect this customer to pay the remaining balance of this invoice and we’d like to get the invoice to just “go away” and stop showing up on the customer’s statement, we can use the sales journal as shown below to close the invoice.

Here we see that the customer has short-paid us by $10.

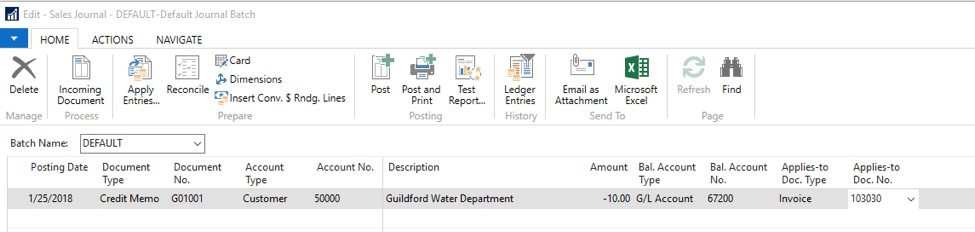

By filling in the columns of the sales journal in the order defined below, we’ll create a single line entry that will close out this open invoice when posted.

Posting Date - The date you’d like to post the corrective entry to.

Document Type - In general, if you are trying to close an invoice, your document type will be “Credit Memo” and if you are trying to close a credit memo, your document type will be “Invoice”.

Document No. - NAV may auto-populate this field given your batch’s setup. If not, you’ll need to provide a document number for this posting.

Account Type - “Customer”

Account No. - The customer’s number that we are adjusting.

Bal. Account Type - “G/L Account”

Bal Account No. - The G/L account number that we want to use as the offset to the AR posting. In my example, I’m using account 67200 which is a “bad debt expense” account.

Applies-to Doc. Type - Enter the document type of the document you are attempting to close/apply against.

Applies-to Doc. No. - Drill into this field to be taken to a listing of open documents for this customer. Select the entry that you are trying to close/apply against and click “OK.” In my example, I’m trying to close customer ledger entry 2080 (see screen clip above).

Amount - The amount field will auto-populate with the remaining amount of the document you are applying against. If you’d like to only make a partial application, the field can be edited.

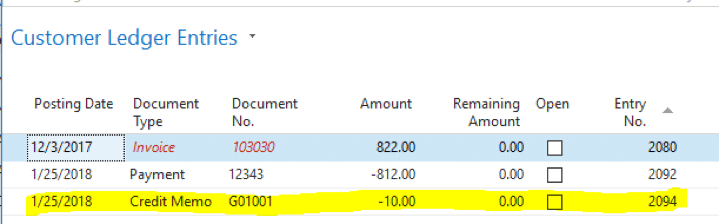

Posting the journal line above will result in a posted $10 credit memo that will apply against (and close) the invoice. Below you can see the original $822.00 invoice, the short payment of $812.00 and the $10 credit memo that we just posted from the sales journal. Note that the credit memo and invoice are no longer open.

In the above example, we’ve adjusted a customer’s balance via the “Sales Journal,” but keep in mind that the same functionality exists on the Accounts Payable (AP) side by using the “Purchase Journal.”

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.