Save Time on Fixed Asset Transactions with Duplication List in Dynamics NAV

If your company uses and manages a plethora of fixed assets, filling out journal lines for acquisition costs and disposals can be cumbersome. The problem only amplifies when your company also uses multiple depreciation books. One way to help lighten your load is to utilize the Duplication List in Dynamics NAV.

With duplication lists, you are able to populate one journal line in the FA G/L Journal for the depreciation book you have tied to the general ledger, and upon posting you will find journal lines populated for the remaining depreciation books of your choice in the Fixed Asset Journal. This prevents the need to populate four lines for four depreciation books for one fixed asset. I will walk you through the necessary setup and steps to utilize this feature for a fixed asset.

First, create the depreciation book(s) you will be using. In NAV, start by simply going to the Depreciation Books list. I am using CRONUS, and so the COMPANY book already exists. Add a new book called EXTERNAL and click Edit. Make sure that none of the G/L Integration toggles are checked in the Integration fast tab. This will cause the automatically created journal lines to appear in the FA Journal. Next, go to the Duplication fast tab and check the box for “Part of Duplication List.”

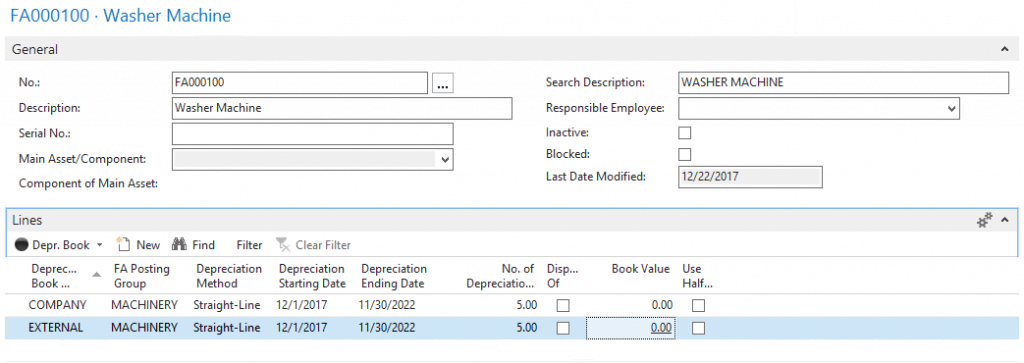

Now that your Depreciation Books are ready, go to the Fixed Assets list to create or modify a fixed asset to include both Depreciation Books.

Making use of the Duplication list will look the same whether you are using the FA G/L Journal for the Acquisition Cost or Disposal. For instance, to acquire the fixed asset, go to the FA G/L Journal and add a line with the relevant information:

|

Posting Date |

12/1/2017 |

| Document No. |

G05002 |

| Account Type |

Fixed Asset |

| Account No. |

FA000100 |

| Depreciation Book Code |

COMPANY |

| FA Posting Type |

Acquisition Cost |

| Description |

Washer Machine |

| Amount |

2,000.00 |

| Bal. Account Type |

G/L Account |

| Bal. Account No. |

22400 |

| Use Duplication List |

Yes |

This last field is the focus of our exercise. After posting the journal, two things will happen. You will see a new ledger entry for your fixed asset for the COMPANY book with a net book value matching the acquisition cost, and you will see lines populated in the FA Journal for the EXTERNAL book, ready for you to post. This is because the Depreciation Book Setup included the EXTERNAL book in the Duplication List, and the lines populated in the FA Journal instead of the FA G/L Journal because the book setup did not have a checked box indicating that acquisition costs for this book would affect the G/L. After reviewing the FA Journal and posting, you will see the book value change to the acquisition cost on the fixed asset page for the EXTERNAL book.

It is worth noting that this is not as beneficial of a feature for depreciation cost calculation since the Calculate Depreciation will already allow you to calculate book by book and will place the correct lines in the correct Journal, based on whether it has a G/L impact indicated for depreciation cost in the book setup. However, if you wish, you could fill the COMPANY lines in the FA G/L Journal via Calculate Depreciation and then manually check every line to use duplication list. Like with Acquisition Cost, the lines would appear in the correct journals after posting, based on the setup. Running the Calculate Depreciation for each book appears to be less time consuming, but it would depend on the number of fixed assets and books you have.

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.