The Lost Art of Reconciling by Posting Type in Dynamics AX

I was recently training some controllers on month-end reconciliations in Dynamics AX – how to reconcile the sub-ledger to general ledger. We had a small discrepancy in Accounts Payable and I wanted to show them how to track it down.

I’ve always taken a three-step approach to reconciliations:

- Review the relevant Ledger reconciliation report.

- Analyze the postings to the GL account(s) in question to find any postings that don’t belong.

- Analyze the postings in other GL account(s) to find any stray postings that should’ve gone into the account we’re reconciling.

We executed step 1 and it didn’t give us the answer. I’ve found step one to be fairly hit or miss in my career depending on how Dynamics AX postings are configured.

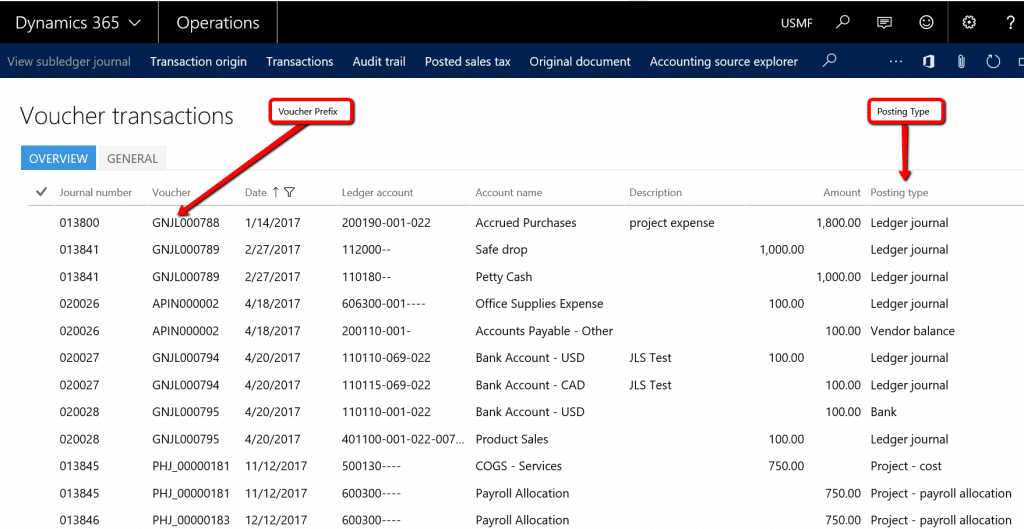

We moved on to step 2 and popped open the good old Ledger Transactions Inquiry form. I was struck by how intensely the controllers latched on to voucher prefixes as a primary means of analyzing these transactions. Voucher prefixes are alphanumeric codes embedded in number sequences that are intended to provide a hint as to where the GL transaction originated from. Some common examples of vouchers might be GJ00001 where GJ means General Journal or APP00001 where APP means AP Payment. It occurred to me that just about every accountant I’ve ever worked with in Dynamics AX has done the same thing – use the voucher prefix to analyze transactions. But that’s not the only way to get it done. A special and important field called Posting Type is the other half of the reconciliation recipe.

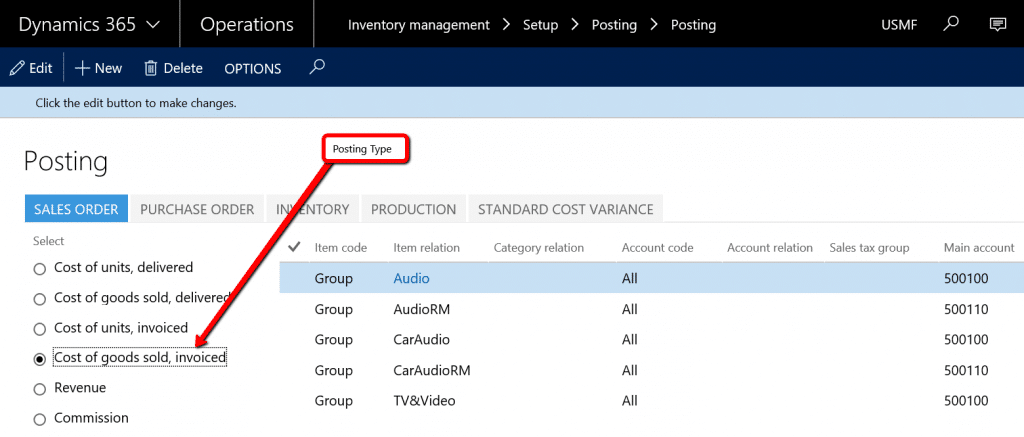

Posting types are what tell a transaction in Dynamics AX which main accounts to use. For example, when you setup Inventory Posting, you configure the account to use for Cost of Sales postings when you invoice a Sales Order. The posting type for Cost of Sales is called “Cost of Goods Sold - Invoiced”. So you’d associate your Cost of Sales main account of 5000 to the Cost of Goods Sold - Invoiced posting type in setup, as shown below.

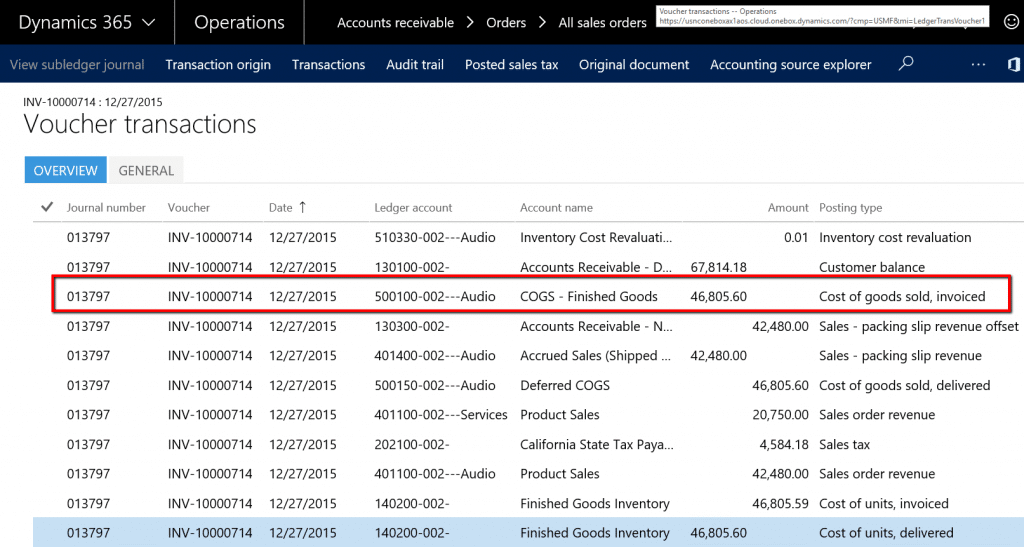

Then, whenever any sort of transaction that posts a Cost of Goods Sold - Invoiced line as a part of its voucher posting, it will know to use account 5000. Here’s an example of the voucher posting from a sales order invoice:

You can see why posting type is such a powerful tool in reconciliation because it links you back to how Dynamics AX determined which account to use when posting.

So in Step 2, reviewing for BOTH voucher prefixes that don’t belong and posting types that don’t belong is a very effective way to identify reconciliation discrepancies.

Step 3 is the inverse of Step 2. Basically, you search for voucher prefixes or posting types that you expect to post to the account in question but that landed elsewhere. So for example, if you wanted to confirm that all your cost of goods sold postings correctly ended up in account 5000, you’d search the voucher transaction inquiry window where account is not equal to 5000 (!5000) and where posting type is “Cost of goods sold, invoiced.” If you find entries with those posting types somewhere else, start investigating why!

Closing tip on posting type in Dynamics AX

When searching and filtering by just about any “type” field (like posting type, project type, etc) you can’t use wildcard characters, you have to enter the text exactly. You can still use all other search syntax like ! for “not” and a comma to separate multiple values you’re searching for.

Happy reconciling!

Under the terms of this license, you are authorized to share and redistribute the content across various mediums, subject to adherence to the specified conditions: you must provide proper attribution to Stoneridge as the original creator in a manner that does not imply their endorsement of your use, the material is to be utilized solely for non-commercial purposes, and alterations, modifications, or derivative works based on the original material are strictly prohibited.

Responsibility rests with the licensee to ensure that their use of the material does not violate any other rights.